Financial Mathematics, please help

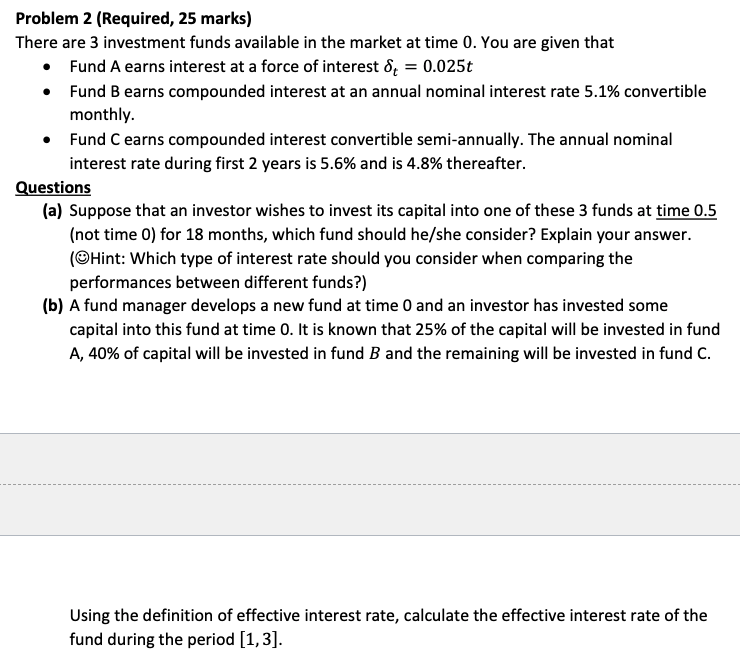

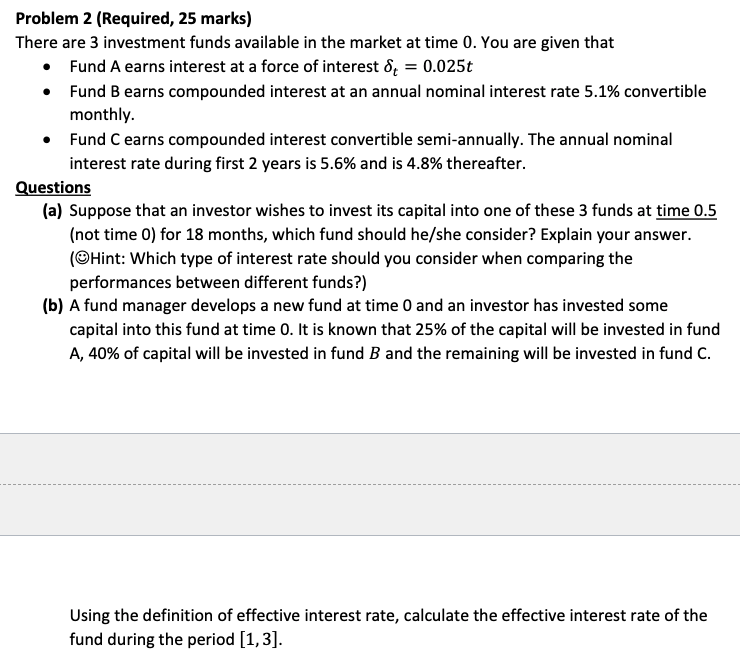

Problem 2 (Required, 25 marks) There are 3 investment funds available in the market at time 0. You are given that Fund A earns interest at a force of interest &; = 0.025t Fund B earns compounded interest at an annual nominal interest rate 5.1% convertible monthly. Fund Cearns compounded interest convertible semi-annually. The annual nominal interest rate during first 2 years is 5.6% and is 4.8% thereafter. Questions (a) Suppose that an investor wishes to invest its capital into one of these 3 funds at time 0.5 (not time 0) for 18 months, which fund should he/she consider? Explain your answer. (Hint: Which type of interest rate should you consider when comparing the performances between different funds?) (b) A fund manager develops a new fund at time 0 and an investor has invested some capital into this fund at time 0. It is known that 25% of the capital will be invested in fund A, 40% of capital will be invested in fund B and the remaining will be invested in fund C. Using the definition of effective interest rate, calculate the effective interest rate of the fund during the period (1,3]. Problem 2 (Required, 25 marks) There are 3 investment funds available in the market at time 0. You are given that Fund A earns interest at a force of interest &; = 0.025t Fund B earns compounded interest at an annual nominal interest rate 5.1% convertible monthly. Fund Cearns compounded interest convertible semi-annually. The annual nominal interest rate during first 2 years is 5.6% and is 4.8% thereafter. Questions (a) Suppose that an investor wishes to invest its capital into one of these 3 funds at time 0.5 (not time 0) for 18 months, which fund should he/she consider? Explain your answer. (Hint: Which type of interest rate should you consider when comparing the performances between different funds?) (b) A fund manager develops a new fund at time 0 and an investor has invested some capital into this fund at time 0. It is known that 25% of the capital will be invested in fund A, 40% of capital will be invested in fund B and the remaining will be invested in fund C. Using the definition of effective interest rate, calculate the effective interest rate of the fund during the period (1,3]