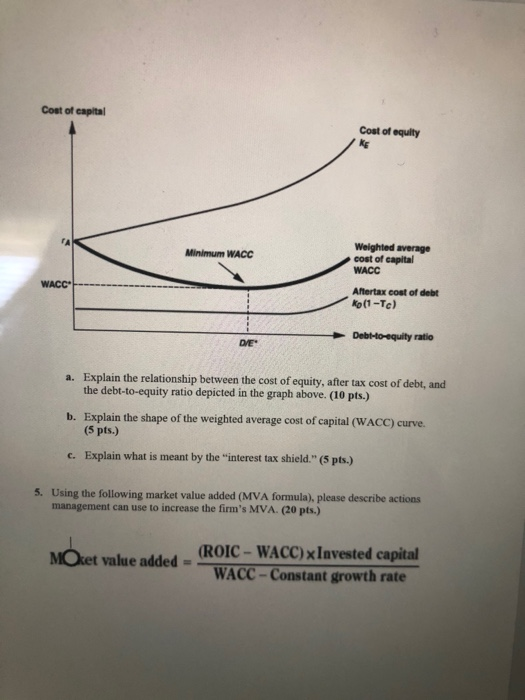

Financial Performance Control and Measurement 1. The Covid-19 pandemic has had global implications for financial markets. As a result, there has been significant volatility in equity returns for the past two months. Your 401(k) investments happen to be more concentrated on low beta stocks. What type of risk has been prevalent in the equity markets the past two months? What are the key attributes of that risk? (10 pts.) b. How would you expect your 401(k) investments to react relative to changes in the S&P 500 index over the past two months? (5 pts.) c. Believing there will be an economic recovery that will commence later this year, what type of stocks would you select for your 401(k) portfolio? (5 pts.) 2. The Capital Asset Pricing Model (CAPM) is expressed as the following: Ri = [Rf + ((Rm - Rf) x Bi)] a. Please define and explain the following components: (10 pts.) Ri RE (Rm -RE) Bi b. What does the CAPM tell us about the required return on a risky investment? (10 pts.) 3. Market Enterprises, Inc. has 1.0 million shares of stock outstanding. The stock currently sells for $25 per share. The firm's debt is publicly traded and its market value was recently quoted at 102% of face value. It has a total face value of 57 million, and it is currently priced to yield 7 percent. The risk-free rate is 6%, and the market risk premium is 7%. You've estimated that Market Enterprises has a beta of 95. If the corporate tax rate is 34%, what is the weighted average cost of capital of Market Enterprises, Inc. (20 pts.) 4. The following graph depicts the cost of capital as a function of the debt-to-equity ratio in the presence of corporate taxes and financial distress costs. Cost of capital Cost of equity Minimum WACC Weighted average cost of capital WACC Aftertax cost of debt Kp (1 -Tc) Debt-to-equity ratio a. Explain the relationship between the cost of equity, after tax cost of debt, and the debt-to-equity ratio depicted in the graph above. (10 pts.) b. Explain the shape of the weighted average cost of capital (WACC) curve. (5 pts.) c. Explain what is meant by the interest tax shield." (5 pts.) 5. Using the following market value added (MVA formula), please describe actions management can use to increase the firm's MVA. (20 pts.) MOket value added (ROIC - WACC)xInvested capital WACC - Constant growth rate