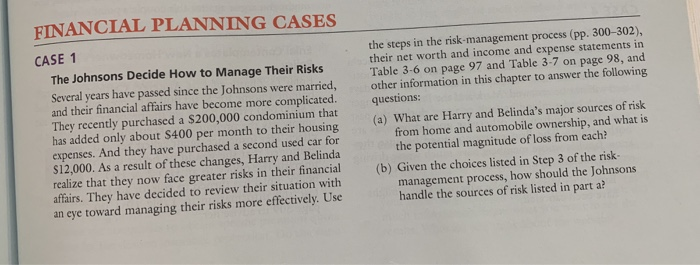

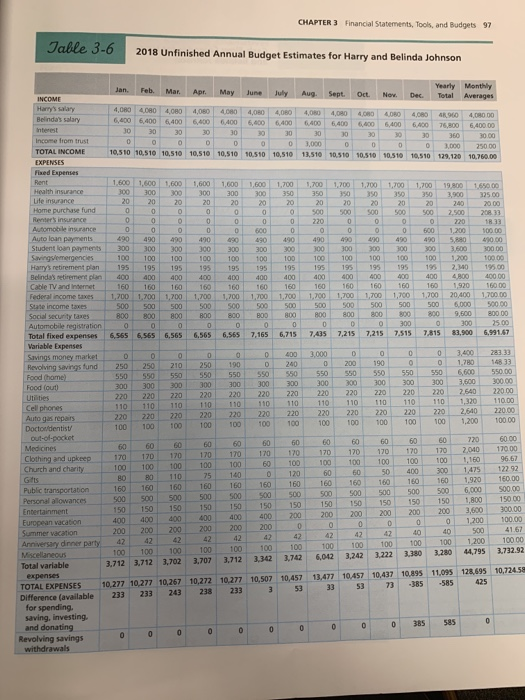

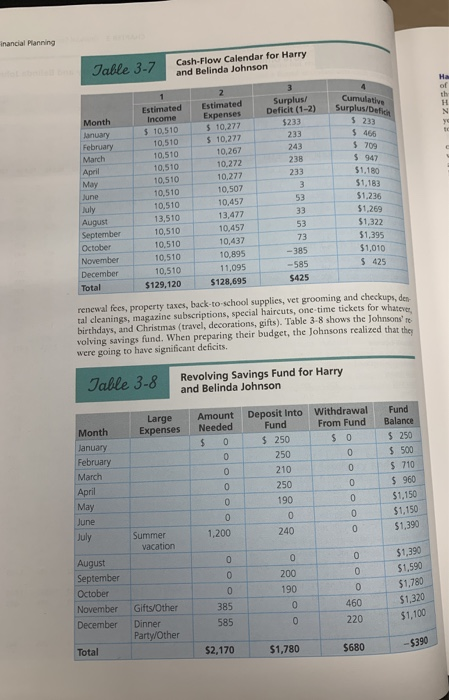

FINANCIAL PLANNING CASES CASE 1 The Johnsons Decide How to Manage Their Risks Several years have passed since the Johnsons were married, and their financial affairs have become more complicated. They recently purchased a $200,000 condominium that has added only about $400 per month to their housing expenses. And they have purchased a second used car for $12,000. As a result of these changes, Harry and Belinda realize that they now face greater risks in their financial affairs. They have decided to review their situation with an eye toward managing their risks more effectively. Use the steps in the risk management process (pp. 300-302), their net worth and income and expense statements in Table 3-6 on page 97 and Table 3-7 on page 98, and other information in this chapter to answer the following questions: (a) What are Harry and Belinda's major sources of risk from home and automobile ownership, and what is the potential magnitude of loss from each? (b) Given the choices listed in Step 3 of the risk- management process, how should the Johnsons handle the sources of risk listed in part a? CHAPTER 3 Financial Statements, Tools, and Budgets 97 Table 3-6 2018 Unfinished Annual Budget Estimates for Harry and Belinda Johnson Jan Feb Mar Apr May Yearly Monthly June July Aug. Sept. Oct Nov Dec. Total Averages Harry's salary 4,080 4CRO 4. 00 4,00 4,00 4,00 4,00 4,00 4,00 4,00 400 4,080 RO 4,00 DO Belinda's salary 6,400 6400 6,400 6400 6.400 6,000 6400 6400 6.400 6.000 30 6.400 6400 30 30 30 DO 6,400 00 30 30 30 30 Income from trust 30 30 0 30 30 0 0 0 30 30.00 0 0 0 3,000 TOTAL INCOME 0 0 0 10,510 10,510 10,510 10,510 0 3.000 25000 10,510 10,510 10,510 13.510 10.510 10.510 10.510 EXPENSES 10,510 129,120 10,760.00 Fixed Expenses 1.600 1.600 1,600 1,600 1,600 1,600 1,700 1,700 1,700 1,700 1,700 1,700 9800 1.650.00 300 300 300 300 300 Life insurance 300 350 350 350 350 350 350 3,900 125.00 20 20 20 20 20 Home purchase fund 20 20 20 0 0 0 0 0 0 0 900 900 900 900 Renter's insurance 900 2.500 208 33 0 0 0 0 0 0 0 220 0 0 0 Automobile insurance 0 220 0 0 0 0 0 600 0 0 0 0 0 Auto loan payments 600 1,200 100.00 490 490 490 400 400 400 410 4900 0 490 490 500 40.00 Student loan payments 300 300 300 300 300 300 300 300 300 100 100 200 3.600 300.00 Saving emergencies Harry's retirement plan 195 195 195 196 195 195 196 195 196 195 195 195 2,140 195.00 Belindas retirement plan 400 400 400 400 400 400 400 400 400 400 400 400 4800 400.00 Cable TV and internet 160 160 160 160 160 160 160 160 160 160 160 160 1,920 16000 Federal income taxes 1,700 1,700 1,700 1,700 1,700 1,700 1,700 1,700 1,700 1,700 1,700 1,700 20,400 1,700.00 Suate income taxes 500 500 500 500 500 500 500 500 500 500 500 500 6,000 500.00 Social security taxes 800 800 800 800 800 00 00 00 800 800 800 800 9,500 Automobile registration 0 0 0 0 0 0 0 0 0 0 300 0 3 00 2500 Total fixed expenses 6,565 6,565 6,565 6,565 6,565 7,165 6,715 7,495 7,215 7,215 7.515 7.815 83,900 6,991,67 Variable Expenses Savings money market 0 0 0 0 0 0 400 3,000 0 0 0 0 3.400 28333 Revolving Savings fund 250 250 210 250 190 0 240 0 200 190 0 0 1,70 148 33 Food (home) 550 550 550 550 550 550 550 550 550 550 550 550 6,600 550.00 Food (out) 300 300 300 300 300 300 300 300 300 300.00 Utilities 220 220 220 220 220 220 220 220 220 220 220 220 2640 220.00 Cell phones 110 110 110 110 110 110 110110 110110 110 110.00 Auto gas repairs 220 220 220 220 220 220 220 220 220 220 220 2,640 220.00 Doctondentist 100 100 100 100 100 100 100 100 100 100 100 100 1.200 100.00 Out-of-pocket 60 60 Medicines 60 60 60 60 60 60 60 60 60 720 60 170 Clothing and upkeep 170 170 170 170 170 170 170 170 170 170 2,040 170 100 100 100 100 100 Church and charity 60 100 100 100 100 96.67 100 100 1,150 | B 127 75 110 B 0 120 60 60 122.92 50 400 1,475 300 Gifts 160 160 160 160 160 160 160 160 Public transportation 160 160 1.920 160 160 500 500 500 500 500 500 500 500 500 Personal alowances 500.00 500 500 500 6,000 150 150 150 150 150 150 150 150 1,800 150 Entertainment 150 150 150.00 150 400 400 400 200 400 400 200 200 400 200 200 European vacation 200 300.00 3,600 0 0 0 1.200 100.00 Summer vacation 0 0 0 200 200 200 200 200 200 42 41.67 42 10 500 42 42 40 42 42 42 42 42 42 Anniversary drner party 100 1200 100.00 100 100 100 100 100 100 Miscellaneous 100 100 100 100 100 3.712 3.742 3.712 3.707 3.712 3.222 6,042 3.732.92 3,342 3.242 3.380 44,795 3,702 Total variable 3.280 expenses 10,272 10.277 10,507 10,457 13.477 128,695 10,724.53 10.457 10,437 10,895 11.095 10,277 10,277 10,267 TOTAL EXPENSES 238 233 3 233 53 33 73 233 243 53 -385 -585 Difference (available for spending. Saving. Investing, and donating 0 0 0 0 0 0 0 0 0 0 385 0 585 Revolving savings withdrawals 60.00 170.00 160.00 inancial Planning Table 3-7 Cash-Flow Calendar for Harry and Belinda Johnson Cumulaths Surplus/Dati Month January February March April Surplus/ Deficit (1-2) $233 233 243 238 233 May Estimated Income $ 10,510 10,510 10,510 10,510 10,510 10,510 10,510 13.510 10,510 10,510 10,510 10.510 $129,120 June July August September October November December Total Estimated Expenses $ 10,277 $ 10,277 10,267 10,272 10,277 10,507 10,457 13,477 10,457 10,437 10,895 11,095 $128,695 53 $ 466 $709 $ 947 $1,180 $1,183 51.236 $1,269 $1,322 $1,395 $1,010 $ 425 73 -385 -585 $425 renewal fees, property taxes, back-to-school supplies, vet grooming and checkups, des tal cleanings, magazine subscriptions, special haircuts, one-time tickets for whatever birthdays, and Christmas (travel, decorations, gifts). Table 3-8 shows the Johnson's volving savings fund. When preparing their budget, the Johnsons realized that the were going to have significant deficits. Table 3-8 Revolving Savings Fund for Harry and Belinda Johnson Large Expenses Month January Amount Deposit Into Withdrawal Needed Fund From Fund $ 0 $ 250 $ 0 0 250 210 250 February Fund Balance $250 $ 500 $ 710 $ 960 $1,150 $1,150 $1,390 March April May June July 1,200 Summer vacation 0 0 August September October November December $1,390 $1,590 $1,780 $1,320 $1,100 385 Gifts/Other Dinner Party/Other 585 $2,170 $1,780 $680 Total -5390 FINANCIAL PLANNING CASES CASE 1 The Johnsons Decide How to Manage Their Risks Several years have passed since the Johnsons were married, and their financial affairs have become more complicated. They recently purchased a $200,000 condominium that has added only about $400 per month to their housing expenses. And they have purchased a second used car for $12,000. As a result of these changes, Harry and Belinda realize that they now face greater risks in their financial affairs. They have decided to review their situation with an eye toward managing their risks more effectively. Use the steps in the risk management process (pp. 300-302), their net worth and income and expense statements in Table 3-6 on page 97 and Table 3-7 on page 98, and other information in this chapter to answer the following questions: (a) What are Harry and Belinda's major sources of risk from home and automobile ownership, and what is the potential magnitude of loss from each? (b) Given the choices listed in Step 3 of the risk- management process, how should the Johnsons handle the sources of risk listed in part a? CHAPTER 3 Financial Statements, Tools, and Budgets 97 Table 3-6 2018 Unfinished Annual Budget Estimates for Harry and Belinda Johnson Jan Feb Mar Apr May Yearly Monthly June July Aug. Sept. Oct Nov Dec. Total Averages Harry's salary 4,080 4CRO 4. 00 4,00 4,00 4,00 4,00 4,00 4,00 4,00 400 4,080 RO 4,00 DO Belinda's salary 6,400 6400 6,400 6400 6.400 6,000 6400 6400 6.400 6.000 30 6.400 6400 30 30 30 DO 6,400 00 30 30 30 30 Income from trust 30 30 0 30 30 0 0 0 30 30.00 0 0 0 3,000 TOTAL INCOME 0 0 0 10,510 10,510 10,510 10,510 0 3.000 25000 10,510 10,510 10,510 13.510 10.510 10.510 10.510 EXPENSES 10,510 129,120 10,760.00 Fixed Expenses 1.600 1.600 1,600 1,600 1,600 1,600 1,700 1,700 1,700 1,700 1,700 1,700 9800 1.650.00 300 300 300 300 300 Life insurance 300 350 350 350 350 350 350 3,900 125.00 20 20 20 20 20 Home purchase fund 20 20 20 0 0 0 0 0 0 0 900 900 900 900 Renter's insurance 900 2.500 208 33 0 0 0 0 0 0 0 220 0 0 0 Automobile insurance 0 220 0 0 0 0 0 600 0 0 0 0 0 Auto loan payments 600 1,200 100.00 490 490 490 400 400 400 410 4900 0 490 490 500 40.00 Student loan payments 300 300 300 300 300 300 300 300 300 100 100 200 3.600 300.00 Saving emergencies Harry's retirement plan 195 195 195 196 195 195 196 195 196 195 195 195 2,140 195.00 Belindas retirement plan 400 400 400 400 400 400 400 400 400 400 400 400 4800 400.00 Cable TV and internet 160 160 160 160 160 160 160 160 160 160 160 160 1,920 16000 Federal income taxes 1,700 1,700 1,700 1,700 1,700 1,700 1,700 1,700 1,700 1,700 1,700 1,700 20,400 1,700.00 Suate income taxes 500 500 500 500 500 500 500 500 500 500 500 500 6,000 500.00 Social security taxes 800 800 800 800 800 00 00 00 800 800 800 800 9,500 Automobile registration 0 0 0 0 0 0 0 0 0 0 300 0 3 00 2500 Total fixed expenses 6,565 6,565 6,565 6,565 6,565 7,165 6,715 7,495 7,215 7,215 7.515 7.815 83,900 6,991,67 Variable Expenses Savings money market 0 0 0 0 0 0 400 3,000 0 0 0 0 3.400 28333 Revolving Savings fund 250 250 210 250 190 0 240 0 200 190 0 0 1,70 148 33 Food (home) 550 550 550 550 550 550 550 550 550 550 550 550 6,600 550.00 Food (out) 300 300 300 300 300 300 300 300 300 300.00 Utilities 220 220 220 220 220 220 220 220 220 220 220 220 2640 220.00 Cell phones 110 110 110 110 110 110 110110 110110 110 110.00 Auto gas repairs 220 220 220 220 220 220 220 220 220 220 220 2,640 220.00 Doctondentist 100 100 100 100 100 100 100 100 100 100 100 100 1.200 100.00 Out-of-pocket 60 60 Medicines 60 60 60 60 60 60 60 60 60 720 60 170 Clothing and upkeep 170 170 170 170 170 170 170 170 170 170 2,040 170 100 100 100 100 100 Church and charity 60 100 100 100 100 96.67 100 100 1,150 | B 127 75 110 B 0 120 60 60 122.92 50 400 1,475 300 Gifts 160 160 160 160 160 160 160 160 Public transportation 160 160 1.920 160 160 500 500 500 500 500 500 500 500 500 Personal alowances 500.00 500 500 500 6,000 150 150 150 150 150 150 150 150 1,800 150 Entertainment 150 150 150.00 150 400 400 400 200 400 400 200 200 400 200 200 European vacation 200 300.00 3,600 0 0 0 1.200 100.00 Summer vacation 0 0 0 200 200 200 200 200 200 42 41.67 42 10 500 42 42 40 42 42 42 42 42 42 Anniversary drner party 100 1200 100.00 100 100 100 100 100 100 Miscellaneous 100 100 100 100 100 3.712 3.742 3.712 3.707 3.712 3.222 6,042 3.732.92 3,342 3.242 3.380 44,795 3,702 Total variable 3.280 expenses 10,272 10.277 10,507 10,457 13.477 128,695 10,724.53 10.457 10,437 10,895 11.095 10,277 10,277 10,267 TOTAL EXPENSES 238 233 3 233 53 33 73 233 243 53 -385 -585 Difference (available for spending. Saving. Investing, and donating 0 0 0 0 0 0 0 0 0 0 385 0 585 Revolving savings withdrawals 60.00 170.00 160.00 inancial Planning Table 3-7 Cash-Flow Calendar for Harry and Belinda Johnson Cumulaths Surplus/Dati Month January February March April Surplus/ Deficit (1-2) $233 233 243 238 233 May Estimated Income $ 10,510 10,510 10,510 10,510 10,510 10,510 10,510 13.510 10,510 10,510 10,510 10.510 $129,120 June July August September October November December Total Estimated Expenses $ 10,277 $ 10,277 10,267 10,272 10,277 10,507 10,457 13,477 10,457 10,437 10,895 11,095 $128,695 53 $ 466 $709 $ 947 $1,180 $1,183 51.236 $1,269 $1,322 $1,395 $1,010 $ 425 73 -385 -585 $425 renewal fees, property taxes, back-to-school supplies, vet grooming and checkups, des tal cleanings, magazine subscriptions, special haircuts, one-time tickets for whatever birthdays, and Christmas (travel, decorations, gifts). Table 3-8 shows the Johnson's volving savings fund. When preparing their budget, the Johnsons realized that the were going to have significant deficits. Table 3-8 Revolving Savings Fund for Harry and Belinda Johnson Large Expenses Month January Amount Deposit Into Withdrawal Needed Fund From Fund $ 0 $ 250 $ 0 0 250 210 250 February Fund Balance $250 $ 500 $ 710 $ 960 $1,150 $1,150 $1,390 March April May June July 1,200 Summer vacation 0 0 August September October November December $1,390 $1,590 $1,780 $1,320 $1,100 385 Gifts/Other Dinner Party/Other 585 $2,170 $1,780 $680 Total -5390