Answered step by step

Verified Expert Solution

Question

1 Approved Answer

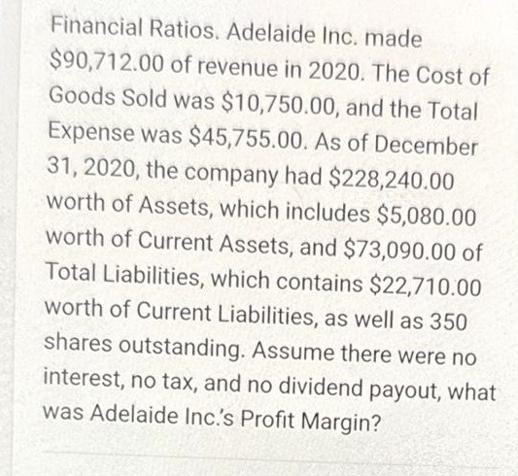

Financial Ratios. Adelaide Inc. made $90,712.00 of revenue in 2020. The Cost of Goods Sold was $10,750.00, and the Total Expense was $45,755.00. As

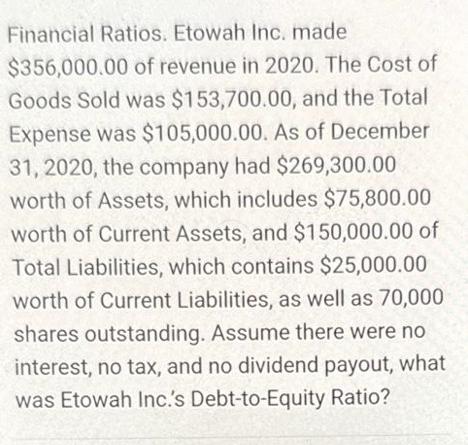

Financial Ratios. Adelaide Inc. made $90,712.00 of revenue in 2020. The Cost of Goods Sold was $10,750.00, and the Total Expense was $45,755.00. As of December 31, 2020, the company had $228,240.00 worth of Assets, which includes $5,080.00 worth of Current Assets, and $73,090.00 of Total Liabilities, which contains $22,710.00 worth of Current Liabilities, as well as 350 shares outstanding. Assume there were no interest, no tax, and no dividend payout, what was Adelaide Inc.'s Profit Margin? Financial Ratios. Etowah Inc. made $356,000.00 of revenue in 2020. The Cost of Goods Sold was $153,700.00, and the Total Expense was $105,000.00. As of December 31, 2020, the company had $269,300.00 worth of Assets, which includes $75,800.00 worth of Current Assets, and $150,000.00 of Total Liabilities, which contains $25,000.00 worth of Current Liabilities, as well as 70,000 shares outstanding. Assume there were no interest, no tax, and no dividend payout, what was Etowah Inc.'s Debt-to-Equity Ratio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Adelaide Incs Profit Margin we need to use the formula Profit Margin Net Income Reven...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started