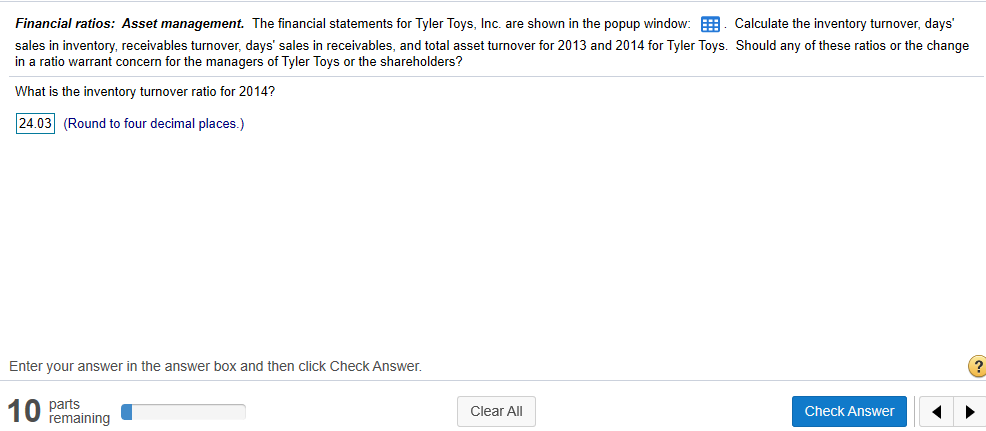

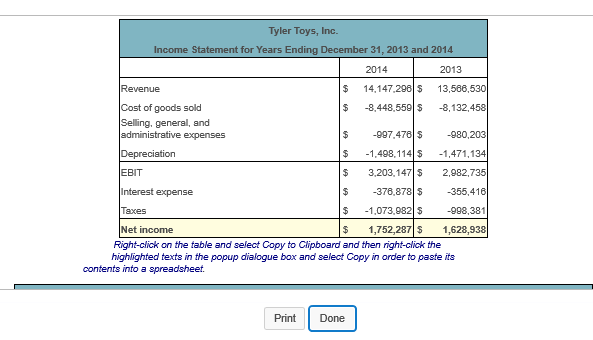

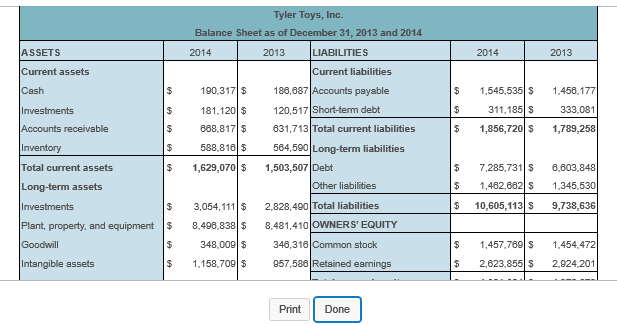

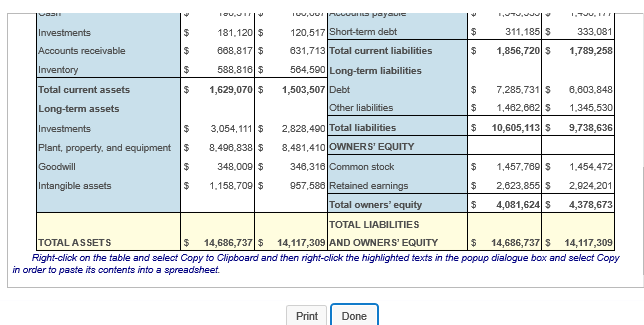

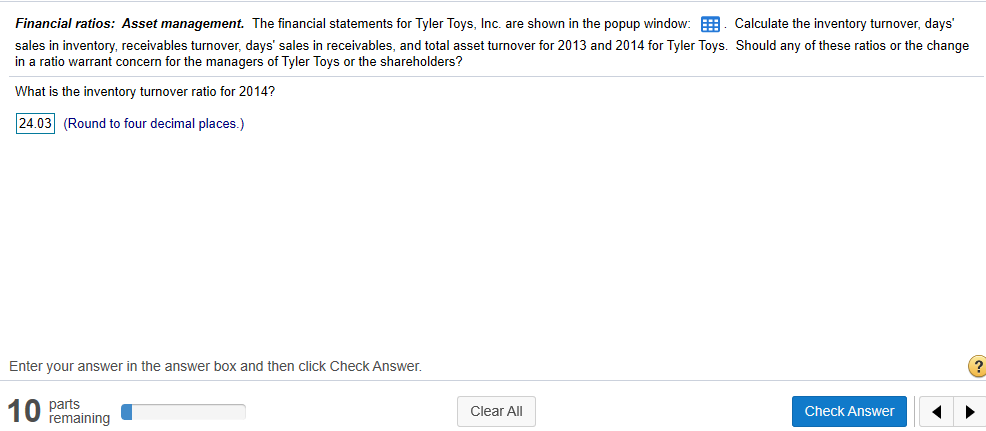

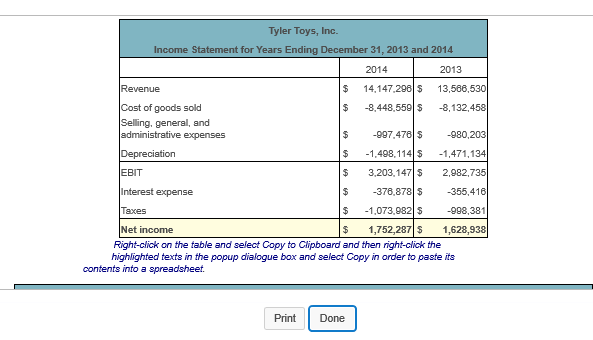

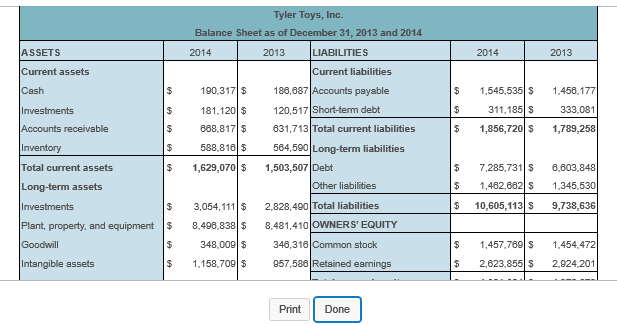

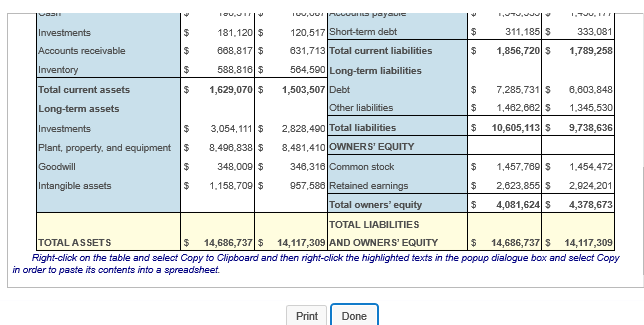

Financial ratios: Asset management. The financial statements for Tyler Toys, Inc. are shown in the popup window: Calculate the inventory turnover, days' sales in inventory, receivables turnover, days' sales in receivables, and total asset turnover for 2013 and 2014 for Tyler Toys. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? What is the inventory turnover ratio for 2014? 24.03 (Round to four decimal places.) Enter your answer in the answer box and then click Check Answer. 10 parts Clear All Check Answer remaining Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue $ 14.147.298 $ 13,568,530 Cost of goods sold $ -8.448,559 $ -8,132,458 Selling, general, and administrative expenses -997.478 $ -980,203 Depreciation $ -1,498,114 % -1,471,134 EBIT $ 3.203.147$ 2,982,735 Interest expense $ -376,878 $ - 355,416 Teoces $ -1,073.982 $ 998,381 Net income $ 1,752,287 $ 1,628,938 Right click on the table and select Copy to clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet Print Print Done Done 2014 2013 ASSETS Current assets Cash 1,545,535 $ 311,185 $ 1,856,720 S 1.458,177 333,081 1,789,258 $ Investments Accounts receivable Inventory Total current assets Tyler Toys, Inc. Balance Sheet as of December 31, 2013 and 2014 2014 2013 LIABILITIES Current liabilities 190,317$ 188,887 Accounts payable 181,120 $ 120,517 Short-term debt 888.817 $ 631,713 Total current liabilities 588,810 $ 584,500 Long-term liabilities 1,629,070 $ 1,503,507 Debt Other liabilities 3,054,111 $ 2,828,400 Total liabilities 8.498.838 $ 3.481,410 OWNERS' EQUITY 348,000$ 346,316 Common stock 1.158.709 $ 957,586 Retained earnings Long-term assets $ $ $ 7,285,731 $ 1,462,862 $ 10,605,113 8.603.848 1.345.530 9,738,636 Investments Plant, property, and equipments Goodwill Intangible assets $ $ 1,457,769 $ 2,623.855 S 1.454.472 2.924,201 Print Done TOU, UMUUS Payavic Www .TVU, Investments 181,120 $ 120,517 Short-term debt 311,185 $ 333,081 Accounts receivable 888.817 $ 631,713 Total current liabilities 1,856,720 $ 1,789,258 Inventory 588.810 $ 564,500 Long-term liabilities Total current assets 1,629,070 $ 1,503,507 Debt $ 7,285,731 $ 8.803,848 Long-term assets Other liabilities $ 1,462,662 $ 1.345.530 Investments 3,054,111 $ 2,828,490 Total liabilities $ 10,605,113 $ 9,738,636 Plant, property, and equipment 8.498,838 $ 8481,410 OWNERS' EQUITY Goodwill 348.000 $ 348,316 Common stock $ 1,457,769 $ 1.454.472 Intangible assets 1.158.709 $ 957,586 Retained earnings $ 2,623.855 $ 2.924,201 Total owners' equity $ 4,081,624 $ 4,378,673 TOTAL LIABILITIES TOTAL ASSETS $ 14,686,737$ 14,117,309 AND OWNERS' EQUITY $ 14,686,737$ 14.117,309 Right click on the table and select Copy to clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet. Print Done Financial ratios: Asset management. The financial statements for Tyler Toys, Inc. are shown in the popup window: Calculate the inventory turnover, days' sales in inventory, receivables turnover, days' sales in receivables, and total asset turnover for 2013 and 2014 for Tyler Toys. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? What is the inventory turnover ratio for 2014? 24.03 (Round to four decimal places.) Enter your answer in the answer box and then click Check Answer. 10 parts Clear All Check Answer remaining Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue $ 14.147.298 $ 13,568,530 Cost of goods sold $ -8.448,559 $ -8,132,458 Selling, general, and administrative expenses -997.478 $ -980,203 Depreciation $ -1,498,114 % -1,471,134 EBIT $ 3.203.147$ 2,982,735 Interest expense $ -376,878 $ - 355,416 Teoces $ -1,073.982 $ 998,381 Net income $ 1,752,287 $ 1,628,938 Right click on the table and select Copy to clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet Print Print Done Done 2014 2013 ASSETS Current assets Cash 1,545,535 $ 311,185 $ 1,856,720 S 1.458,177 333,081 1,789,258 $ Investments Accounts receivable Inventory Total current assets Tyler Toys, Inc. Balance Sheet as of December 31, 2013 and 2014 2014 2013 LIABILITIES Current liabilities 190,317$ 188,887 Accounts payable 181,120 $ 120,517 Short-term debt 888.817 $ 631,713 Total current liabilities 588,810 $ 584,500 Long-term liabilities 1,629,070 $ 1,503,507 Debt Other liabilities 3,054,111 $ 2,828,400 Total liabilities 8.498.838 $ 3.481,410 OWNERS' EQUITY 348,000$ 346,316 Common stock 1.158.709 $ 957,586 Retained earnings Long-term assets $ $ $ 7,285,731 $ 1,462,862 $ 10,605,113 8.603.848 1.345.530 9,738,636 Investments Plant, property, and equipments Goodwill Intangible assets $ $ 1,457,769 $ 2,623.855 S 1.454.472 2.924,201 Print Done TOU, UMUUS Payavic Www .TVU, Investments 181,120 $ 120,517 Short-term debt 311,185 $ 333,081 Accounts receivable 888.817 $ 631,713 Total current liabilities 1,856,720 $ 1,789,258 Inventory 588.810 $ 564,500 Long-term liabilities Total current assets 1,629,070 $ 1,503,507 Debt $ 7,285,731 $ 8.803,848 Long-term assets Other liabilities $ 1,462,662 $ 1.345.530 Investments 3,054,111 $ 2,828,490 Total liabilities $ 10,605,113 $ 9,738,636 Plant, property, and equipment 8.498,838 $ 8481,410 OWNERS' EQUITY Goodwill 348.000 $ 348,316 Common stock $ 1,457,769 $ 1.454.472 Intangible assets 1.158.709 $ 957,586 Retained earnings $ 2,623.855 $ 2.924,201 Total owners' equity $ 4,081,624 $ 4,378,673 TOTAL LIABILITIES TOTAL ASSETS $ 14,686,737$ 14,117,309 AND OWNERS' EQUITY $ 14,686,737$ 14.117,309 Right click on the table and select Copy to clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet. Print Done