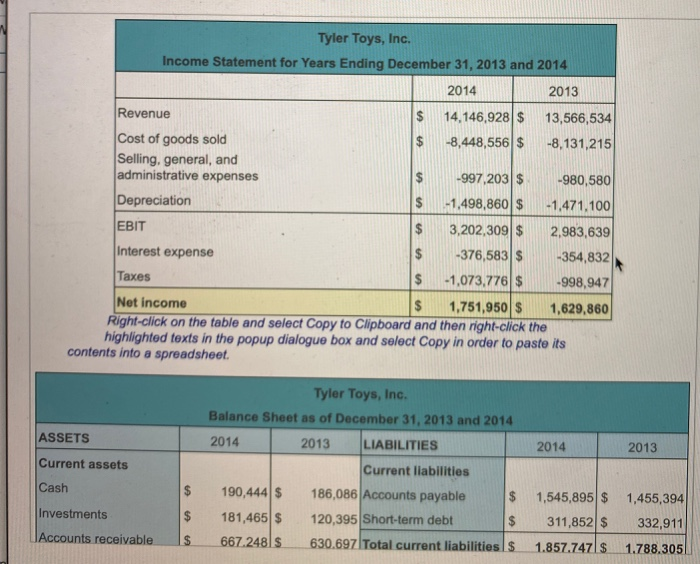

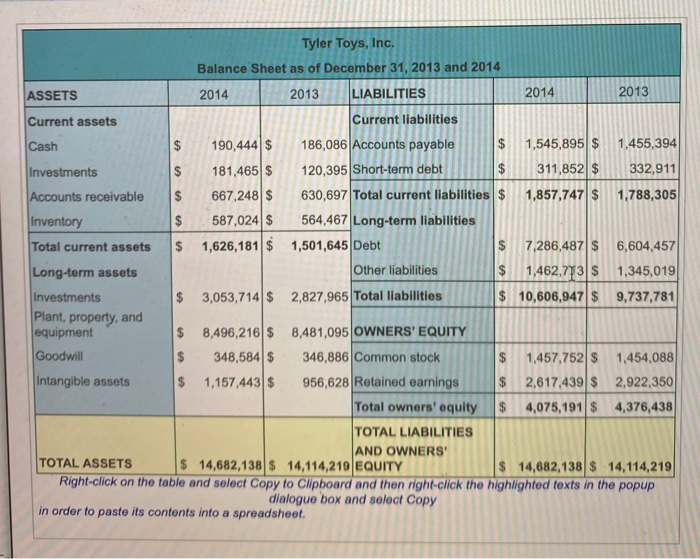

Financial ratios: Liquidity. The financial statements for Tyler Toys, Inc. are shown in the popup window: 6. Calculate the current ratio, quick ratio, and cash ratio for Tyler Toys for 2013 and 2014. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? What is the current ratio for 2014? (Round to four decimal places.) $ Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue 14,146,928 $ 13,566,534 Cost of goods sold $ -8,448,556 $ -8,131,215 Selling, general, and administrative expenses -997,203 $ -980,580 Depreciation -1,498,860 $ -1,471,100 EBIT $ 3,202,309 $ 2,983,639 Interest expense -376,583 $ -354,832 Taxes $ -1,073,776 $ -998,947 Net income $ 1,751,950 $ 1,629,860 Right-click on the table and select Copy to clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet. ASSETS 2014 2013 Current assets Tyler Toys, Inc. Balance Sheet as of December 31, 2013 and 2014 2014 2013 LIABILITIES Current liabilities 190,444 $ 186,086 Accounts payable 181,465 $ 120,395 Short-term debt $ 667.2481 $ 630.697 Total current liabilities $ Cash 1,455,394 Investments 1,545,895 $ 311,852 $ 332,911 Accounts receivable 1.857.747/ $ 1.788.305 Tyler Toys, Inc. Balance Sheet as of December 31, 2013 and 2014 2014 2013 LIABILITIES ASSETS 2014 2013 $ $ $ $ Current assets Current liabilities Cash $ 190,444$ 186,086 Accounts payable 1,545,895 $ 1,455,394 Investments $ 181,465$ 120,395 Short-term debt 311,852 $ 332,911 Accounts receivable $ 667,248 $ 630,697 Total current liabilities $ 1,857,747 $ 1,788,305 Inventory $ 587,024 $ 564,467 Long-term liabilities Total current assets $ 1,626,181 $ 1,501,645 Debt $ 7,286,487 $ 6,604,457 Long-term assets Other liabilities 1,462,773 $ 1,345,019 Investments 3,053,714 $ 2,827,965 Total liabilities $ 10,606,947 $ 9,737,781 Plant, property, and equipment $ 8,496,216 $ 8,481,095 OWNERS' EQUITY Goodwill 348,584 $ 346,886 Common stock $ 1,457,752 $ 1,454,088 Intangible assets 1,157,443 956,628 Retained earnings $ 2,617,439 $ 2,922,350 Total owners' equity $ 4,075,191 $ 4,376,438 TOTAL LIABILITIES AND OWNERS TOTAL ASSETS $ 14,682,138 $ 14,114,219 EQUITY $ 14,682,138 $ 14,114,219 Right click on the table and select Copy to clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet