Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial ratios of Trendz Limited given - correctly calculated for 2021: Trendz Limited trades in the retail clothing sector and is listed on the general

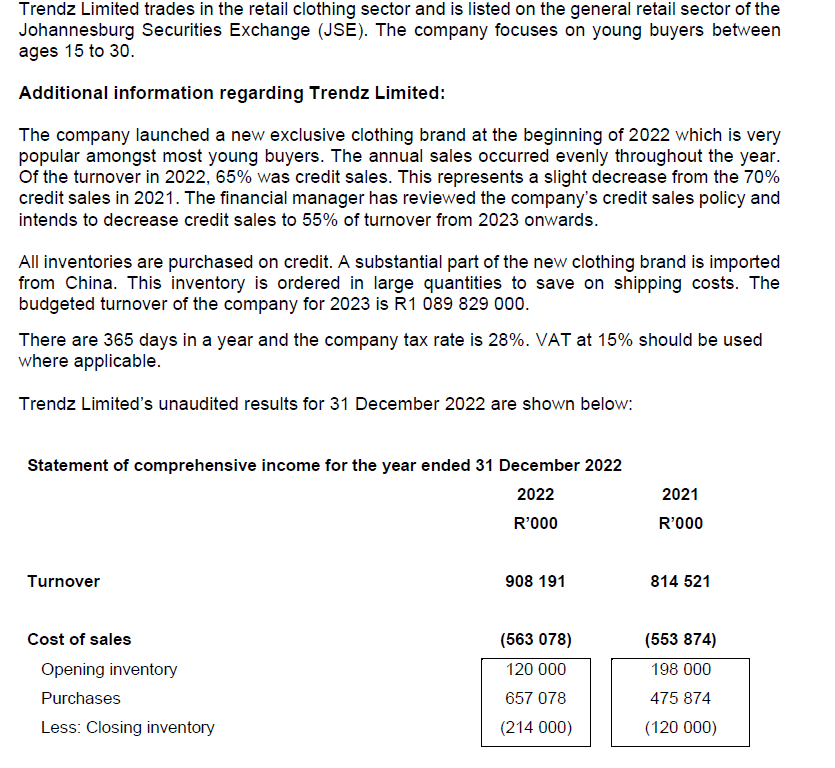

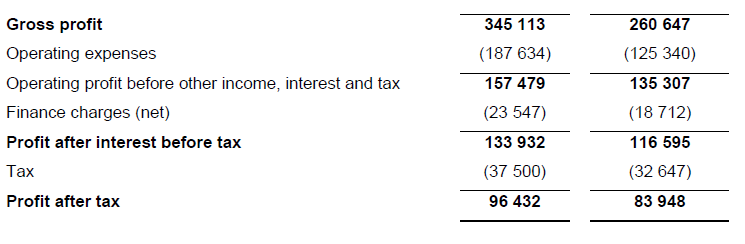

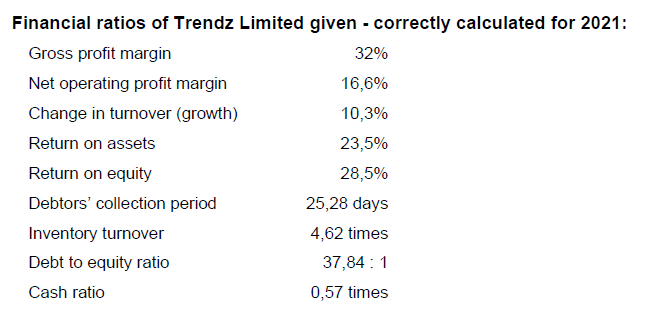

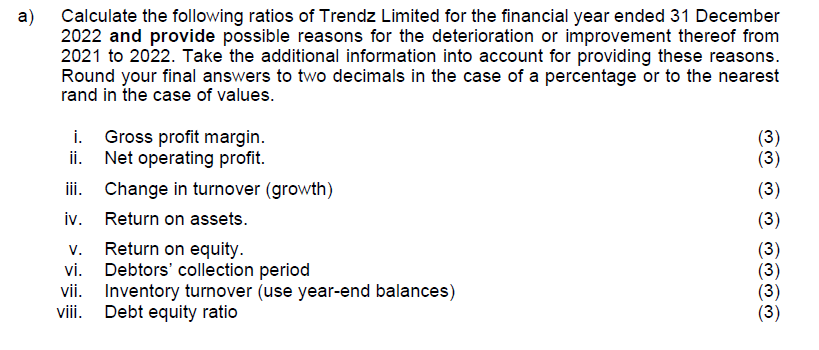

Financial ratios of Trendz Limited given - correctly calculated for 2021: Trendz Limited trades in the retail clothing sector and is listed on the general retail sector of the Johannesburg Securities Exchange (JSE). The company focuses on young buyers between ages 15 to 30 . Additional information regarding Trendz Limited: The company launched a new exclusive clothing brand at the beginning of 2022 which is very popular amongst most young buyers. The annual sales occurred evenly throughout the year. Of the turnover in 2022,65% was credit sales. This represents a slight decrease from the 70% credit sales in 2021. The financial manager has reviewed the company's credit sales policy and intends to decrease credit sales to 55% of turnover from 2023 onwards. All inventories are purchased on credit. A substantial part of the new clothing brand is imported from China. This inventory is ordered in large quantities to save on shipping costs. The budgeted turnover of the company for 2023 is R1 089829000 . There are 365 days in a year and the company tax rate is 28%. VAT at 15% should be used where applicable. Trendz Limited's unaudited results for 31 December 2022 are shown below: Calculate the following ratios of Trendz Limited for the financial year ended 31 December 2022 and provide possible reasons for the deterioration or improvement thereof from 2021 to 2022. Take the additional information into account for providing these reasons. Round your final answers to two decimals in the case of a percentage or to the nearest rand in the case of values. i. Gross profit margin. (3) ii. Net operating profit. (3) iii. Change in turnover (growth) iv. Return on assets. (3) v. Return on equity. (3) vi. Debtors' collection period (3) vii. Inventory turnover (use year-end balances) (3) viii. Debt equity ratio (3) Financial ratios of Trendz Limited given - correctly calculated for 2021: Trendz Limited trades in the retail clothing sector and is listed on the general retail sector of the Johannesburg Securities Exchange (JSE). The company focuses on young buyers between ages 15 to 30 . Additional information regarding Trendz Limited: The company launched a new exclusive clothing brand at the beginning of 2022 which is very popular amongst most young buyers. The annual sales occurred evenly throughout the year. Of the turnover in 2022,65% was credit sales. This represents a slight decrease from the 70% credit sales in 2021. The financial manager has reviewed the company's credit sales policy and intends to decrease credit sales to 55% of turnover from 2023 onwards. All inventories are purchased on credit. A substantial part of the new clothing brand is imported from China. This inventory is ordered in large quantities to save on shipping costs. The budgeted turnover of the company for 2023 is R1 089829000 . There are 365 days in a year and the company tax rate is 28%. VAT at 15% should be used where applicable. Trendz Limited's unaudited results for 31 December 2022 are shown below: Calculate the following ratios of Trendz Limited for the financial year ended 31 December 2022 and provide possible reasons for the deterioration or improvement thereof from 2021 to 2022. Take the additional information into account for providing these reasons. Round your final answers to two decimals in the case of a percentage or to the nearest rand in the case of values. i. Gross profit margin. (3) ii. Net operating profit. (3) iii. Change in turnover (growth) iv. Return on assets. (3) v. Return on equity. (3) vi. Debtors' collection period (3) vii. Inventory turnover (use year-end balances) (3) viii. Debt equity ratio (3)

Financial ratios of Trendz Limited given - correctly calculated for 2021: Trendz Limited trades in the retail clothing sector and is listed on the general retail sector of the Johannesburg Securities Exchange (JSE). The company focuses on young buyers between ages 15 to 30 . Additional information regarding Trendz Limited: The company launched a new exclusive clothing brand at the beginning of 2022 which is very popular amongst most young buyers. The annual sales occurred evenly throughout the year. Of the turnover in 2022,65% was credit sales. This represents a slight decrease from the 70% credit sales in 2021. The financial manager has reviewed the company's credit sales policy and intends to decrease credit sales to 55% of turnover from 2023 onwards. All inventories are purchased on credit. A substantial part of the new clothing brand is imported from China. This inventory is ordered in large quantities to save on shipping costs. The budgeted turnover of the company for 2023 is R1 089829000 . There are 365 days in a year and the company tax rate is 28%. VAT at 15% should be used where applicable. Trendz Limited's unaudited results for 31 December 2022 are shown below: Calculate the following ratios of Trendz Limited for the financial year ended 31 December 2022 and provide possible reasons for the deterioration or improvement thereof from 2021 to 2022. Take the additional information into account for providing these reasons. Round your final answers to two decimals in the case of a percentage or to the nearest rand in the case of values. i. Gross profit margin. (3) ii. Net operating profit. (3) iii. Change in turnover (growth) iv. Return on assets. (3) v. Return on equity. (3) vi. Debtors' collection period (3) vii. Inventory turnover (use year-end balances) (3) viii. Debt equity ratio (3) Financial ratios of Trendz Limited given - correctly calculated for 2021: Trendz Limited trades in the retail clothing sector and is listed on the general retail sector of the Johannesburg Securities Exchange (JSE). The company focuses on young buyers between ages 15 to 30 . Additional information regarding Trendz Limited: The company launched a new exclusive clothing brand at the beginning of 2022 which is very popular amongst most young buyers. The annual sales occurred evenly throughout the year. Of the turnover in 2022,65% was credit sales. This represents a slight decrease from the 70% credit sales in 2021. The financial manager has reviewed the company's credit sales policy and intends to decrease credit sales to 55% of turnover from 2023 onwards. All inventories are purchased on credit. A substantial part of the new clothing brand is imported from China. This inventory is ordered in large quantities to save on shipping costs. The budgeted turnover of the company for 2023 is R1 089829000 . There are 365 days in a year and the company tax rate is 28%. VAT at 15% should be used where applicable. Trendz Limited's unaudited results for 31 December 2022 are shown below: Calculate the following ratios of Trendz Limited for the financial year ended 31 December 2022 and provide possible reasons for the deterioration or improvement thereof from 2021 to 2022. Take the additional information into account for providing these reasons. Round your final answers to two decimals in the case of a percentage or to the nearest rand in the case of values. i. Gross profit margin. (3) ii. Net operating profit. (3) iii. Change in turnover (growth) iv. Return on assets. (3) v. Return on equity. (3) vi. Debtors' collection period (3) vii. Inventory turnover (use year-end balances) (3) viii. Debt equity ratio (3) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started