Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FINANCIAL RATIOS YEAR 2020 GROWTH RATIOS CAGR (20XX-20XX) % Growth Rate - previous year % PROFITABILITY RATIOS Gross Profit Margin % Operating Profit Margin %

| FINANCIAL RATIOS | YEAR 2020 |

| GROWTH RATIOS | |

| CAGR (20XX-20XX) | % |

| Growth Rate - previous year | % |

| PROFITABILITY RATIOS | |

| Gross Profit Margin | % |

| Operating Profit Margin | % |

| Net Profit Margin | % |

| ROA | % |

| ROE | % |

| SUSTAINABILITY RATIOS | |

| LIQUIDITY RATIOS | |

| Cash Flow from Operations | $ |

| Current Ratio | |

| Quick Ratio | |

| Inventory Turnover Rate | X |

| Days in Inventory | days |

| DEBT RATIOS | |

| Debt to Asset | |

| Debt to Equity | |

| Times Interest Earned | x |

Please solve for year 2020, then using the previous years to help find growth rates.

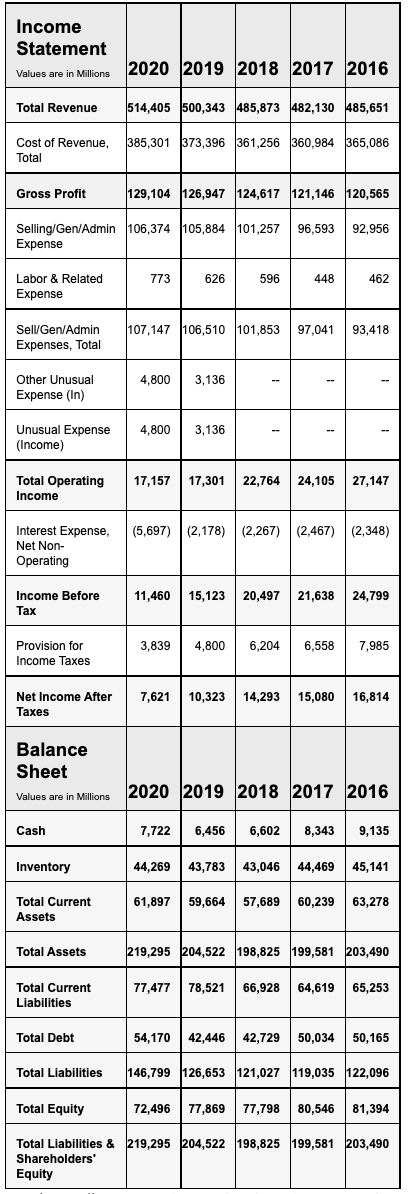

Income Statement Values are in Millions 2020 2019 2018 2017 2016 Total Revenue 514,405 500,343 485,873 482,130 485,651 Cost of Revenue, 385,301 373,396 361,256 360,984 365,086 Total Gross Profit 129,104 126,947 124,617 121,146 120,565 Selling/Gen/Admin 106,374 105,884 101,257 96,593 92,956 Expense 773 626 596 448 462 Labor & Related Expense 107,147 106,510 101,853 97,041 93,418 SellGen/Admin Expenses, Total 4,800 3,136 Other Unusual Expense (In) - -- Unusual Expense (Income) 4,800 3,136 -- Total Operating Income 17,157 17,301 22,764 24,105 27,147 (5,697) (2,178) (2,267) (2,467) (2,348) Interest Expense, Net Non- Operating Income Before Tax 11,460 15,123 20,497 21,638 24,799 3,839 4,800 Provision for Income Taxes 6,204 6,558 7,985 7,621 10,323 14,293 Net Income After Taxes 15,080 16,814 Balance Sheet Values are in Millions 2020 2019 2018 2017 2016 Cash 7,722 6,456 6,602 8,343 9,135 Inventory 44,269 43,783 43,046 44,469 45,141 61,897 Total Current Assets 59,664 57,689 60,239 63,278 Total Assets 219,295 204,522 198,825 199,581 203,490 Total Current Liabilities 77,477 78,521 66,928 64,619 65,253 Total Debt 54,170 42,446 42,729 50,034 50,165 Total Liabilities 146,799 126,653 121,027 119,035 122,096 Total Equity 72,496 77,869 77,798 77,798 80,546 81,394 Total Liabilities & 219,295 204,522 198,825 199,581 203,490 Shareholders' EquityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started