Answered step by step

Verified Expert Solution

Question

1 Approved Answer

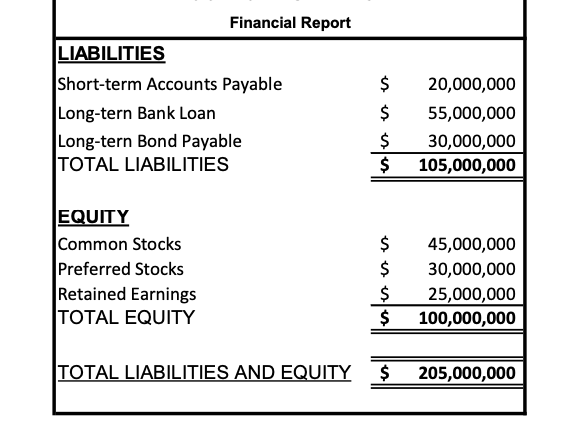

Financial Report Financial Report LIABILITIES Short-term Accounts Payable Long-tern Bank Loan Long-tern Bond Payable TOTAL LIABILITIES $ 20,000,000 55,000,000 30,000,000 105,000,000 $ $ EQUITY Common

Financial Report

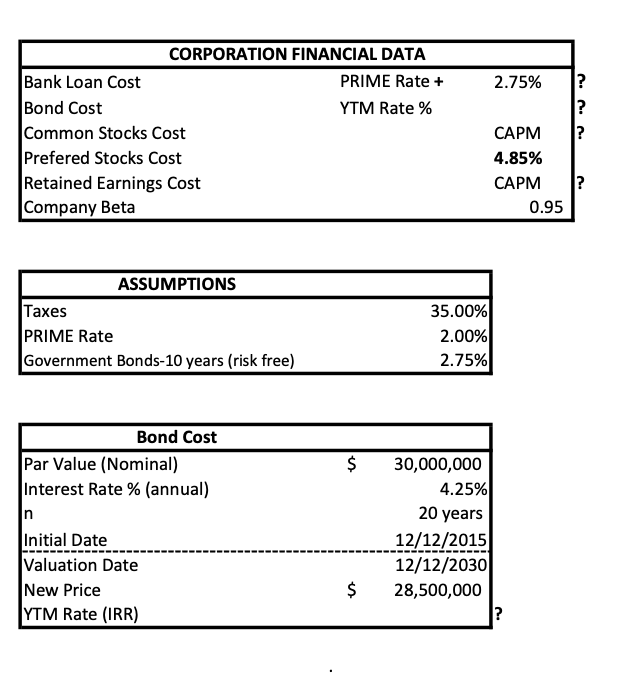

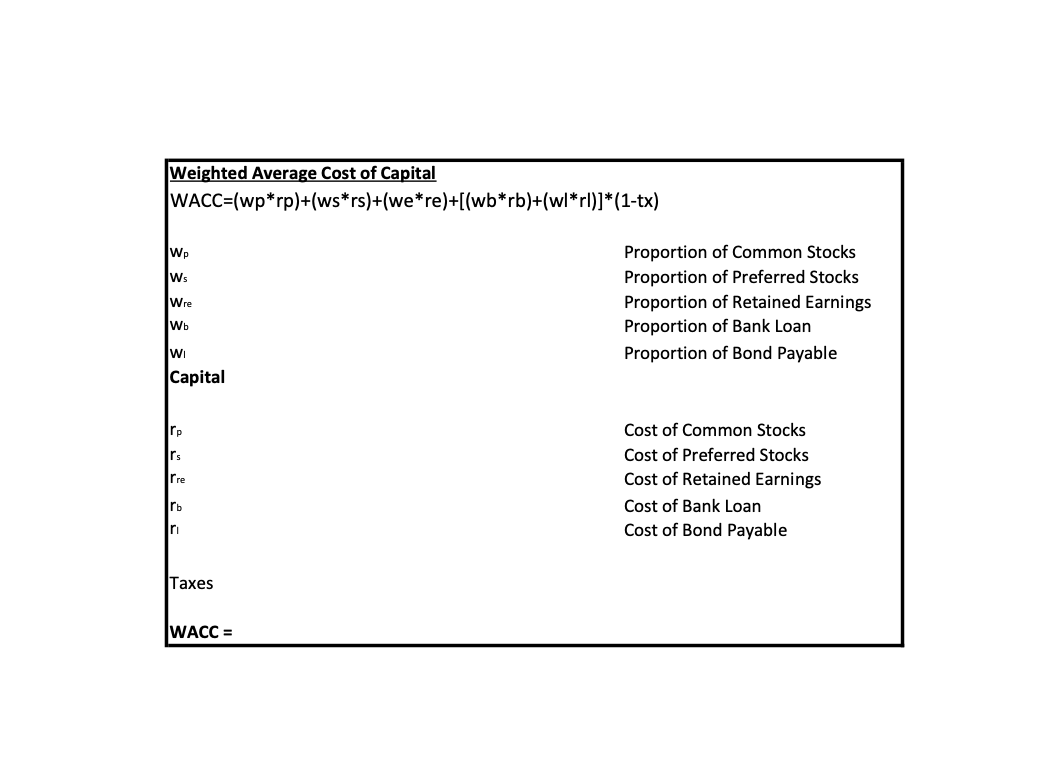

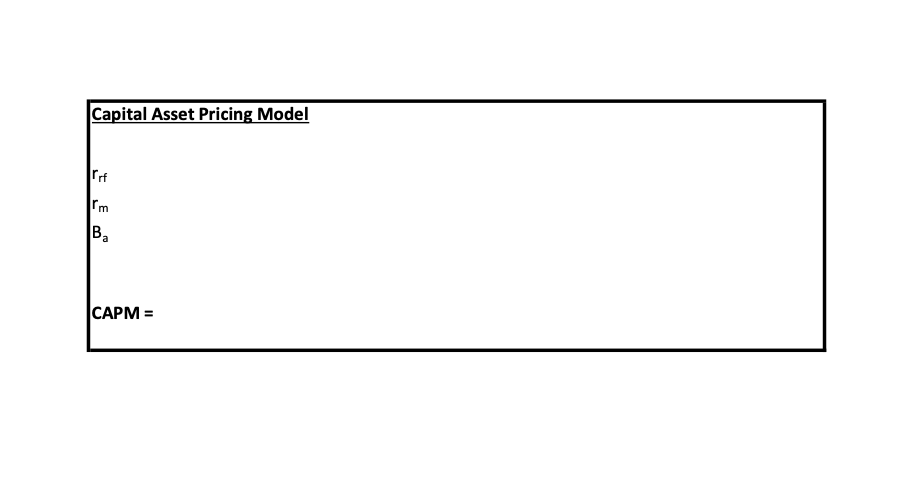

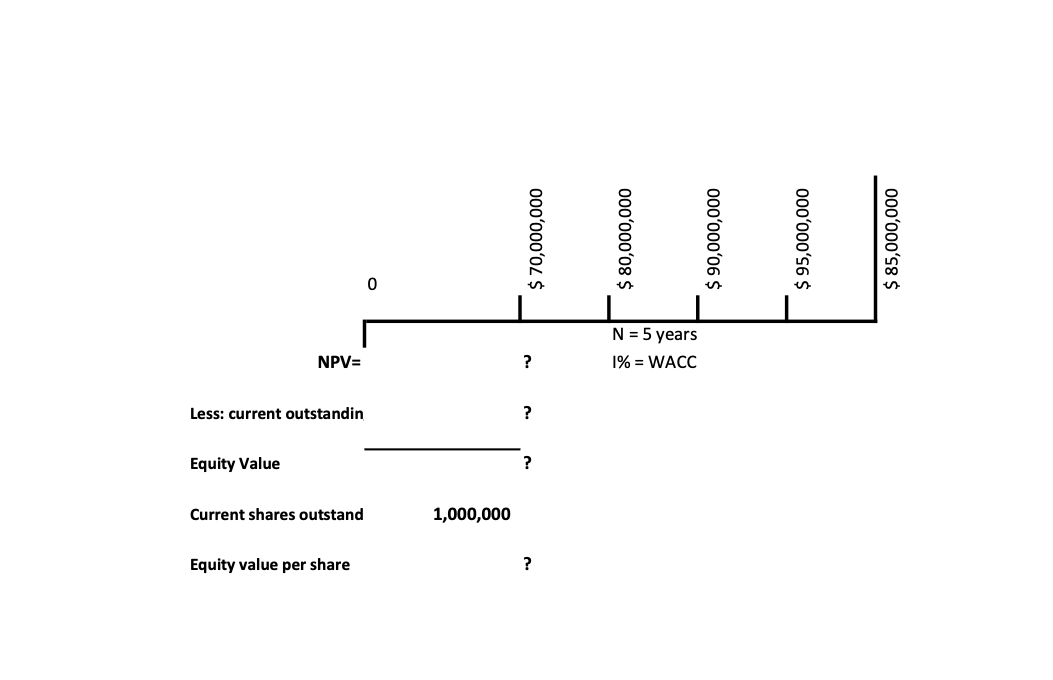

Financial Report LIABILITIES Short-term Accounts Payable Long-tern Bank Loan Long-tern Bond Payable TOTAL LIABILITIES $ 20,000,000 55,000,000 30,000,000 105,000,000 $ $ EQUITY Common Stocks Preferred Stocks Retained Earnings TOTAL EQUITY $ $ $ 45,000,000 30,000,000 25,000,000 100,000,000 TOTAL LIABILITIES AND EQUITY $ 205,000,000 2.75% CORPORATION FINANCIAL DATA Bank Loan Cost PRIME Rate + Bond Cost YTM Rate % Common Stocks Cost Prefered Stocks Cost Retained Earnings Cost Company Beta CAPM 4.85% CAPM 0.95 ASSUMPTIONS Taxes PRIME Rate Government Bonds-10 years (risk free) 35.00% 2.00% 2.75% Bond Cost Par Value (Nominal) Interest Rate % (annual) 30,000,000 4.25% 20 years 12/12/2015 12/12/2030 28,500,000 Initial Date Valuation Date New Price YTM Rate (IRR) $ Weighted Average Cost of Capital WACC=(wp*rp)+(ws*rs)+(we*re)+((wb*rb)+(wl*rl)]*(1-tx) Proportion of Common Stocks Proportion of Preferred Stocks Proportion of Retained Earnings Proportion of Bank Loan Proportion of Bond Payable Capital Cost of Common Stocks Cost of Preferred Stocks Cost of Retained Earnings Cost of Bank Loan Cost of Bond Payable Taxes WACC = Capital Asset Pricing Model CAPM = Equity value per share Current shares outstand Equity Value Less: current outstandin NPV= 1,000,000 $ 70,000,000 $ 80,000,000 1% = WACC N = 5 years $ 90,000,000 $ 95,000,000 $ 85,000,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started