Question

Financial results and conditions vary among companies for a number of reasons. One reason for the variation can be traced to the characteristics of the

Financial results and conditions vary among companies for a number of reasons. One reason for the variation can be traced to the characteristics of the industries in which companies operate. For example, some industries are capital intensive and require large investments in property, plant, and equipment, while others require very little. In some industries, the competitive product-pricing structure imposes a much lower profit margin. In most low-margin industries, however, companies often experience a relatively high rate of product throughput or turnover.

Another reason for variation in financial results among companies is the result of management philosophy and policy. Some companies reduce their manufacturing capacity to match more closely their immediate sales prospects, while others will carry excess capacity to be prepared for future sales growth. Also, some companies finance their assets with borrowed funds, while others avoid leverage and choose instead to finance their assets with owners’ equity and retained earnings, paying less out in dividends and reinvesting those funds in the company.

Of course, another reason for variation in reported financial results among companies is the differing competencies of management. Given the same industry characteristics and the same management policies, different companies may report different financial results simply because their management acumen differs.

Still another reason for performance variation is that some industries are more susceptible to macroeconomic conditions than others (i.e., economically sensitive or cyclical). Thus, when macroeconomic conditions (e.g., economic growth, foreign exchange rates, interest rates, etc.) are weak and/or deteriorating, top line growth and margin expansion will be weak and/or deteriorating. The reverse is also true. This can also be true when such conditions are stable versus volatile.

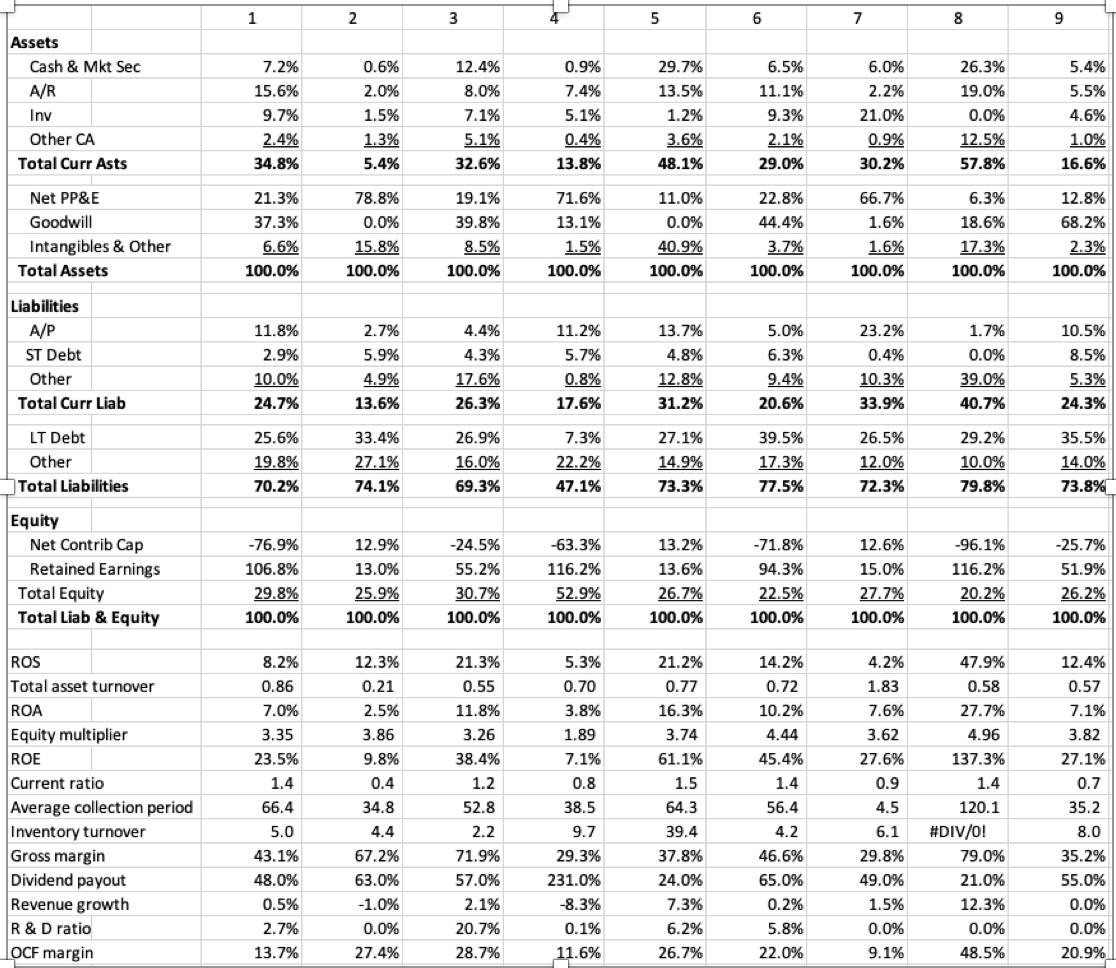

Those differences in industry characteristics, company policies, management performance, and responsiveness to the macroeconomic environment are reflected in the financial statements published by publicly held companies. And thus, they can be highlighted through the use of financial ratios. The accompanying spreadsheet presents the balance sheets, in percentage form (common sized), and selected financial ratios computed from fiscal year 2019 or 2020 balance sheets and income statements for nine companies from the following industries:

Retailer | Industrial |

Chemical | Packaged Food |

Integrated Oil | Utility |

Technology | Financial Services |

Pharmaceutical |

Study the balance sheet profiles and the financial ratios listed for each of the nine companies on the accompanying spreadsheet. All of the data is real.

Your assignment is to use your intuition, common sense, and basic understanding of the unique attributes of each industry listed above to match each column in the exhibit with one of the industries. Write out the reasons for your pairings, citing the data that seems to be consistent with the characteristics of the industry you selected. Ours is not a perfect world, however, and for our class discussion, it will be helpful if you will also identify those pieces of data that seem to contradict the pairings you have made.

Please note that using the data available here, you will find it difficult to identify those companies whose financial results differ because of management policy and competence. It will be easiest for our class discussion and for grading, if you list the industries in numerical order. In other words, start your paper by identifying the industry you believe is represented by the column labeled “1”, and give your rationale or justification. Then do the same for the industry in column “2”, and so on until you have covered all nine industries.

The company ratios on the spreadsheet were calculated via the following formulas:

- ROS (return on sales) = Net Income / Net Sales

- ATO (asset turnover ratio) = Net Sales / Average Total Assets

- ROA (return on assets) = Net Income / Average Total Assets

- Equity Multiplier (financial leverage) =

Average Total Assets / Average Total Equity

- ROE (return on equity) = Net Income / Average Total Equity

- Current ratio = Total Current Assets / Total Current Liabilities

- Inventory Turnover = Cost of Goods Sold / Ending Inventory

- Average Collection Period = Accounts Receivable / (Net Sales / 365)

- Revenue Growth = Change in Net Sales (yoy) / Last Year’s Net Sales

- Gross Margin = (Net Sales – Cost of Goods Sold) / Net Sales

- Dividend Payout = Cash Dividends Paid / Net Income

- R&D Ratio* = Research & Development Expense / Net Sales

* Not all companies report R&D expense separately. If this ratio is missing, it does not mean necessarily that the firm does not conduct research and development.

Based on a case prepared by Professor Mark E. Haskins, Darden Graduate School of Business Administration.

Assets Cash & Mkt Sec A/R Inv Other CA Total Curr Asts Net PP&E Goodwill Intangibles & Other Total Assets Liabilities A/P ST Debt Other Total Curr Liab LT Debt Other Total Liabilities Equity Net Contrib Cap Retained Earnings Total Equity Total Liab & Equity ROS Total asset turnover ROA Equity multiplier ROE Current ratio Average collection period Inventory turnover Gross margin Dividend payout Revenue growth R & D ratio OCF margin 1 7.2% 15.6% 9.7% 2.4% 34.8% 21.3% 37.3% 6.6% 100.0% 11.8% 2.9% 10.0% 24.7% 25.6% 19.8% 70.2% -76.9% 106.8% 29.8% 100.0% 8.2% 0.86 7.0% 3.35 23.5% 1.4 66.4 5.0 43.1% 48.0% 0.5% 2.7% 13.7% 2 0.6% 2.0% 1.5% 1.3% 5.4% 78.8% 0.0% 15.8% 100.0% 2.7% 5.9% 4.9% 13.6% 33.4% 27.1% 74.1% 12.9% 13.0% 25.9% 100.0% 12.3% 0.21 2.5% 3.86 9.8% 0.4 34.8 4.4 67.2% 63.0% -1.0% 0.0% 27.4% 3 12.4% 8.0% 7.1% 5.1% 32.6% 19.1% 39.8% 8.5% 100.0% 4.4% 4.3% 17.6% 26.3% 26.9% 16.0% 69.3% -24.5% 55.2% 30.7% 100.0% 21.3% 0.55 11.8% 3.26 38.4% 1.2 52.8 2.2 71.9% 57.0% 2.1% 20.7% 28.7% 4 0.9% 7.4% 5.1% 0.4% 13.8% 71.6% 13.1% 1.5% 100.0% 11.2% 5.7% 0.8% 17.6% 7.3% 22.2% 47.1% -63.3% 116.2% 52.9% 100.0% 5.3% 0.70 3.8% 1.89 7.1% 0.8 38.5 9.7 29.3% 231.0% -8.3% 0.1% 11.6% 5 29.7% 13.5% 1.2% 3.6% 48.1% 11.0% 0.0% 40.9% 100.0% 13.7% 4.8% 12.8% 31.2% 27.1% 73.3% 13.2% 13.6% 26.7% 100.0% 21.2% 0.77 16.3% 3.74 61.1% 1.5 64.3 39.4 37.8% 24.0% 7.3% 6.2% 26.7% 6 6.5% 11.1% 9.3% 2.1% 29.0% 22.8% 44.4% 3.7% 100.0% 5.0% 6.3% 9.4% 20.6% 39.5% 17.3% 77.5% -71.8% 94.3% 22.5% 100.0% 14.2% 0.72 10.2% 4.44 45.4% 1.4 56.4 4.2 46.6% 65.0% 0.2% 5.8% 22.0% 7 6.0% 2.2% 21.0% 0.9% 30.2% 66.7% 1.6% 1.6% 100.0% 23.2% 0.4% 10.3% 33.9% 26.5% 12.0% 72.3% 12.6% 15.0% 27.7% 100.0% 4.2% 1.83 7.6% 3.62 27.6% 0.9 4.5 6.1 29.8% 49.0% 1.5% 0.0% 9.1% 8 26.3% 19.0% 0.0% 12.5% 57.8% 6.3% 18.6% 17.3% 100.0% 1.7% 0.0% 39.0% 40.7% 29.2% 10.0% 79.8% -96.1% 116.2% 20.2% 100.0% 47.9% 0.58 27.7% 4.96 137.3% 1.4 120.1 #DIV/0! 79.0% 21.0% 12.3% 0.0% 48.5% 9 5.4% 5.5% 4.6% 1.0% 16.6% 12.8% 68.2% 2.3% 100.0% 10.5% 8.5% 5.3% 24.3% 35.5% 14.0% 73.8% -25.7% 51.9% 26.2% 100.0% 12.4% 0.57 7.1% 3.82 27.1% 0.7 35.2 8.0 35.2% 55.0% 0.0% 0.0% 20.9%

Step by Step Solution

3.55 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

To match each column in the exhibit with one of the industries lets analyze the characteristics of each industry and compare them with the given data Retailer This industry is characterized by high in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started