Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Results for Birmingham Wire and Cable Supply Company Year end 12/31/22 Income Statement Net Sales Cost of Goods Sold Gross Margin Payroll/Fringes All

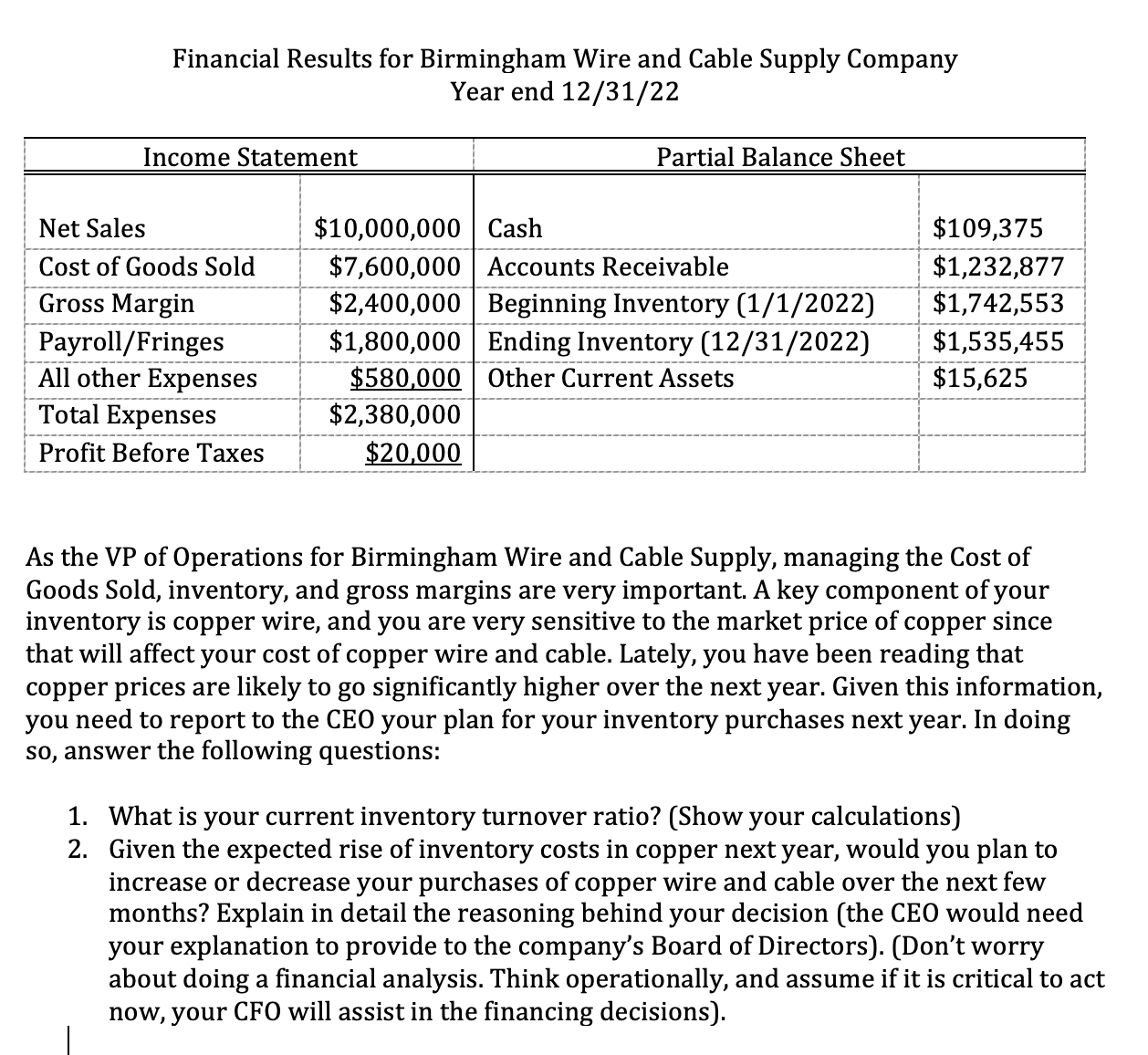

Financial Results for Birmingham Wire and Cable Supply Company Year end 12/31/22 Income Statement Net Sales Cost of Goods Sold Gross Margin Payroll/Fringes All other Expenses Total Expenses Profit Before Taxes Partial Balance Sheet $10,000,000 Cash $7,600,000 Accounts Receivable $2,400,000 Beginning Inventory (1/1/2022) $1,800,000 Ending Inventory (12/31/2022) $580,000 Other Current Assets $2,380,000 $20,000 $109,375 $1,232,877 $1,742,553 $1,535,455 $15,625 As the VP of Operations for Birmingham Wire and Cable Supply, managing the Cost of Goods Sold, inventory, and gross margins are very important. A key component of your inventory is copper wire, and you are very sensitive to the market price of copper since that will affect your cost of copper wire and cable. Lately, you have been reading that copper prices are likely to go significantly higher over the next year. Given this information, you need to report to the CEO your plan for your inventory purchases next year. In doing so, answer the following questions: 1. What is your current inventory turnover ratio? (Show your calculations) 2. Given the expected rise of inventory costs in copper next year, would you plan to increase or decrease your purchases of copper wire and cable over the next few months? Explain in detail the reasoning behind your decision (the CEO would need your explanation to provide to the company's Board of Directors). (Don't worry about doing a financial analysis. Think operationally, and assume if it is critical to act now, your CFO will assist in the financing decisions).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the current inventory turnover ratio well use the formula textInventory Turnover Ratio fracCost of Goods SoldAverage Inventory Given data ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started