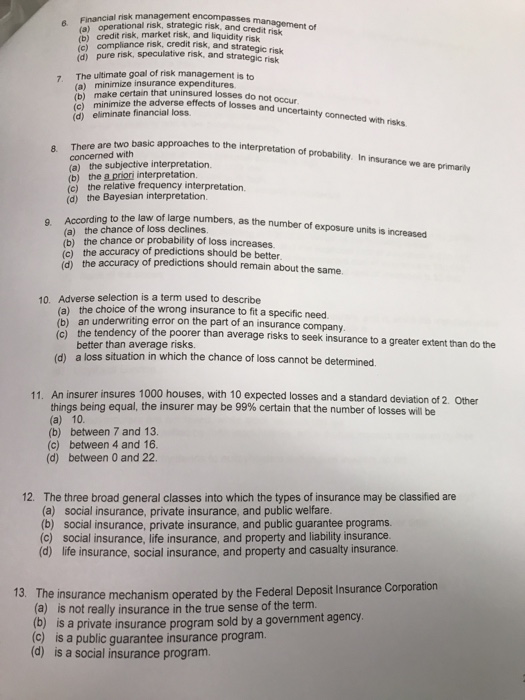

Financial risk management encompasses management of (a) operational risk strategic risk, and credit risk (b) credit risk, market risk and liquidity risk (c) compliance risk, credit risk, and strategic risk (d) pure risk, speculative risk, and strategic risk The ultimate goal of risk management is to (a) minimize insurance expenditures. (b) make certain that uninsured losses do not occur (c) minimize the adverse effects of losses and uncertainty connected with risks (d) eliminate financial loss. There are two basic approaches to the interpretation of probability. In insurance we are primarily concerned with (a) the subjective interpretation. (b) the a priori interpretation (c) the relative frequency interpretation (d) the Bayesian interpretation. According to the law of large numbers, as the number of exposure units is increased (a) the chance of loss declines (b) the chance or probability of loss increases. (c) the accuracy of predictions should be better. (d) the accuracy of predictions should remain about the same. Adverse selection is a term used to describe (a) the choice of the wrong insurance to fit a specific need. (b) an underwriting error on the part of an insurance company (c) the tendency of the poor than average risks to seek insurance to a greater extent than do the better than average risks. (d) a loss situation in which the chance of loss cannot be determined. An insurer insures 1000 houses, with 10 expected losses and a standard deviation of 2. Other things being equal, the insurer may be 99% certain that the number of losses will be (a) 10. (b) between 7 and 13 (c) between 4 and 16 (d) between 0 and 22. The three broad general classes into which the types of insurance may be classified are (a) social insurance, private insurance, and public welfare. (b) social insurance, private insurance, and public guarantee programs. (c) social insurance, life insurance, and property and liability insurance. (d) life insurance, social insurance, and property and casualty insurance. The insurance mechanism operated by the Federal Deposit Insurance Corporation (a) is not really insurance in the true sense of the them (b) is a private insurance program sold by a government agency (c) is a public guarantee insurance program. (d) is a social insurance program