Answered step by step

Verified Expert Solution

Question

1 Approved Answer

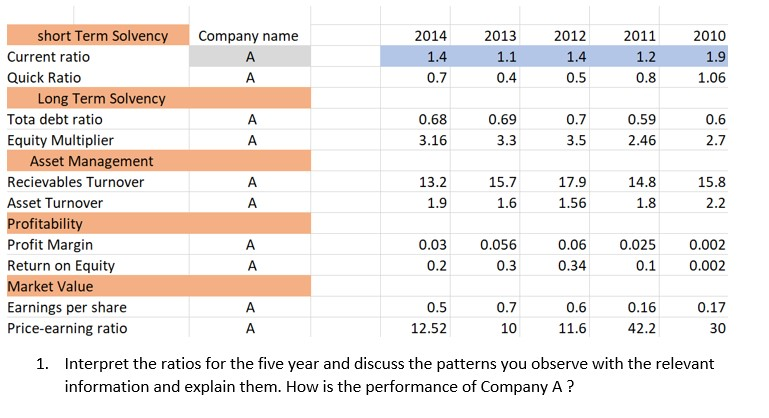

Financial statement Analysis 2011 Company name 2014 1.4 0.7 2013 1.1 0.4 2012 1.4 0.5 1.2 2010 1.9 1.06 0.8 A A 0.68 3.16 0.69

Financial statement Analysis

2011 Company name 2014 1.4 0.7 2013 1.1 0.4 2012 1.4 0.5 1.2 2010 1.9 1.06 0.8 A A 0.68 3.16 0.69 3.3 0.7 3.5 0.59 2.46 0.6 2.7 short Term Solvency Current ratio Quick Ratio Long Term Solvency Tota debt ratio Equity Multiplier Asset Management Recievables Turnover Asset Turnover Profitability Profit Margin Return on Equity Market Value Earnings per share Price-earning ratio A 13.2 1.9 15.7 1.6 17.9 1.56 14.8 1.8 15.8 2.2 A A A 0.03 0.2 0.056 0.3 0.06 0.34 0.025 0.1 0.002 0.002 A 0.5 12.52 0.7 10 0.6 11.6 0.16 42.2 0.17 30 1. Interpret the ratios for the five year and discuss the patterns you observe with the relevant information and explain them. How is the performance of Company AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started