Question

Financial Statement Analysis Cases: Case 1: Merck and Johnson & Johnson Merck & Co., Inc. (USA) and Johnson & Johnson (USA) are two leading producers

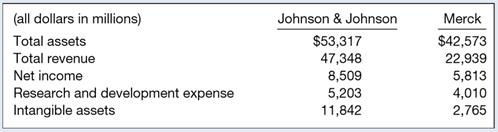

Case 1: Merck and Johnson & Johnson Merck & Co., Inc. (USA) and Johnson & Johnson (USA) are two leading producers of healthcare products. Each has considerable assets and each expends considerable funds each year toward the development of new products. The development of a new healthcare product is often very expensive and risky. New products frequently must undergo considerable testing before approval for distribution to the public. For example, it took Johnson & Johnson 4 years and $200 million to develop its 1-DAY ACUVUE contact lenses. The following are some basic data compiled from the financial statements of these two companies.

Instructions:

(a) What kinds of intangible assets might a healthcare products company have? Does the composition of these intangibles matter to investors—that is, would it be perceived differently if all of Merck’s intangibles were goodwill, than if all of its intangibles were patents?

(b) Suppose the president of Merck has come to you for advice. He has noted that by eliminating all research and development expenditures the company could have reported $1.3 billion more in net income. He is frustrated because much of the research never results in a product, or the products take years to develop. He says shareholders are eager for higher returns, so he is considering eliminating research and development expenditures for at least a couple of years. What would you advise?

(c) The notes to Merck’s financial statements state that Merck has goodwill of $1.1 billion. Where does recorded goodwill come from? Is it necessarily a good thing to have a lot of goodwill on your books?

(all dollars in millions) Total assets Total revenue Net income Research and development expense Intangible assets Johnson & Johnson $53,317 47,348 8,509 5,203 11,842 Merck $42,573 22,939 5,813 4,010 2,765

Step by Step Solution

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Because the company offers health products its intangible assets are likely trademarks patents and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started