Financial Statement Analysis: Include relevant key financial ratios with a brief interpretation for each ratio as they apply to the company and/or industry. Is the company financially sound?

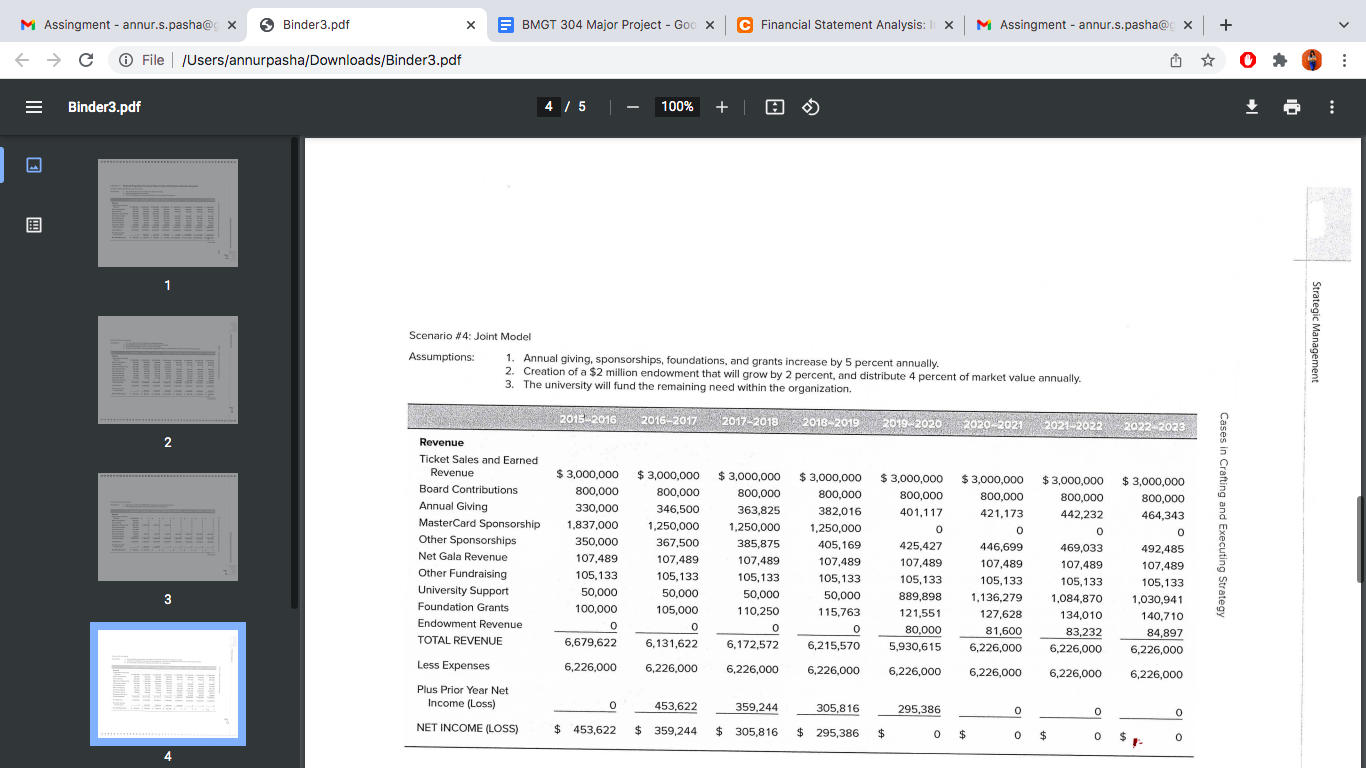

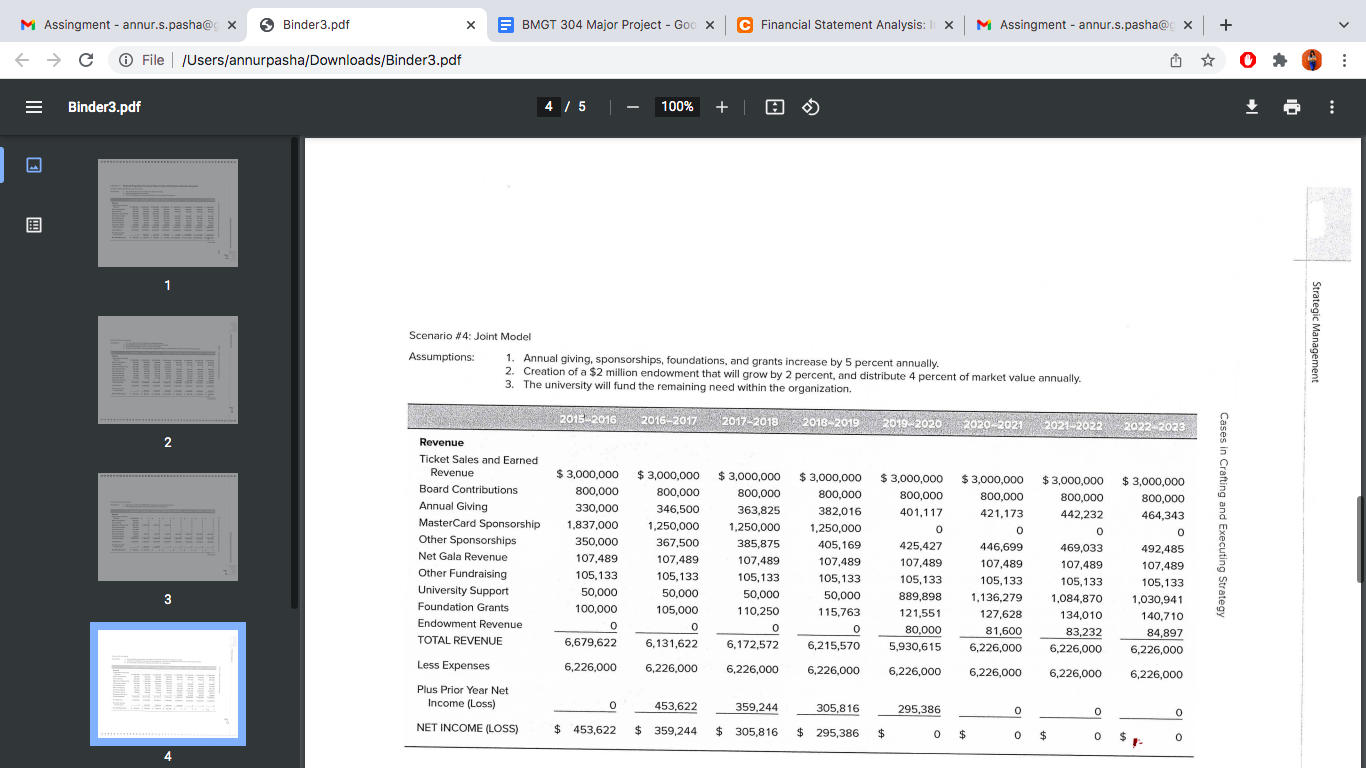

M Assingment - annur.s.pasha@cx Binder3.pdf E BMGT 304 Major Project - Goo X C Financial Statement Analysis: X M Assingment - annur.s.pasha@cx + + c File /Users/annurpasha/Downloads/Binder3.pdf : III E Binder3.pdf 4 / 5 100% + | 1 Scenario #4: Joint Model Assumptions: 1. Annual giving, sponsorships, foundations, and grants increase by 5 percent annually. 2. Creation of a $2 million endowment that will grow by 2 percent, and distribute 4 percent of market value annually. 3. The university will fund the remaining need within the organization. Strategic Management 2015-2016 2016-2017 2017-2018 2018-2019 2019-2020 2020-2021 2020-2021 2021-2022 -2022-2023 2 Revenue Ticket Sales and Earned Revenue Board Contributions Annual Giving MasterCard Sponsorship Other Sponsorships Net Gala Revenue Other Fundraising University Support Foundation Grants Endowment Revenue TOTAL REVENUE $ 3.000.000 800.000 330,000 1,837,000 350,000 107,489 105,133 50,000 100,000 $ 3,000,000 800,000 346,500 1,250,000 367,500 107.489 105,133 50,000 105,000 0 6,131,622 $ 3,000,000 800,000 363,825 1,250,000 385,875 107,489 105,133 50,000 110.250 0 0 6,172,572 $ 3,000,000 800,000 382,016 1,250,000 405,169 107,489 105,133 50,000 115.763 0 6,215,570 $ 3,000,000 800,000 401,117 o 425,427 107.489 105,133 889,898 121,551 80,000 5,930,615 $ 3,000,000 800,000 421,173 0 446,699 107,489 105,133 1,136,279 127,628 81,600 6,226,000 $ 3,000,000 800,000 442,232 0 469,033 107,489 105,133 1,084,870 134,010 83,232 6,226,000 $ 3,000,000 800,000 464.343 0 492,485 107,489 105,133 1.030,941 140,710 84.897 6,226,000 Cases in Crafting and Executing Strategy 3 0 6,679,622 Less Expenses 6,226,000 6,226,000 6,226,000 6,226,000 6,226,000 6,226,000 6,226,000 6,226,000 Plus Prior Year Net Income (Loss) 0 453,622 359,244 305,816 295,386 o 0 0 NET INCOME (LOSS) $ 453,622 $ 359,244 $ 305,816 $ 295,386 $ 0 0 $ 0 $ 0 0 M Assingment - annur.s.pasha@cx Binder3.pdf E BMGT 304 Major Project - Goo X C Financial Statement Analysis: X M Assingment - annur.s.pasha@cx + + c File /Users/annurpasha/Downloads/Binder3.pdf : III E Binder3.pdf 4 / 5 100% + | 1 Scenario #4: Joint Model Assumptions: 1. Annual giving, sponsorships, foundations, and grants increase by 5 percent annually. 2. Creation of a $2 million endowment that will grow by 2 percent, and distribute 4 percent of market value annually. 3. The university will fund the remaining need within the organization. Strategic Management 2015-2016 2016-2017 2017-2018 2018-2019 2019-2020 2020-2021 2020-2021 2021-2022 -2022-2023 2 Revenue Ticket Sales and Earned Revenue Board Contributions Annual Giving MasterCard Sponsorship Other Sponsorships Net Gala Revenue Other Fundraising University Support Foundation Grants Endowment Revenue TOTAL REVENUE $ 3.000.000 800.000 330,000 1,837,000 350,000 107,489 105,133 50,000 100,000 $ 3,000,000 800,000 346,500 1,250,000 367,500 107.489 105,133 50,000 105,000 0 6,131,622 $ 3,000,000 800,000 363,825 1,250,000 385,875 107,489 105,133 50,000 110.250 0 0 6,172,572 $ 3,000,000 800,000 382,016 1,250,000 405,169 107,489 105,133 50,000 115.763 0 6,215,570 $ 3,000,000 800,000 401,117 o 425,427 107.489 105,133 889,898 121,551 80,000 5,930,615 $ 3,000,000 800,000 421,173 0 446,699 107,489 105,133 1,136,279 127,628 81,600 6,226,000 $ 3,000,000 800,000 442,232 0 469,033 107,489 105,133 1,084,870 134,010 83,232 6,226,000 $ 3,000,000 800,000 464.343 0 492,485 107,489 105,133 1.030,941 140,710 84.897 6,226,000 Cases in Crafting and Executing Strategy 3 0 6,679,622 Less Expenses 6,226,000 6,226,000 6,226,000 6,226,000 6,226,000 6,226,000 6,226,000 6,226,000 Plus Prior Year Net Income (Loss) 0 453,622 359,244 305,816 295,386 o 0 0 NET INCOME (LOSS) $ 453,622 $ 359,244 $ 305,816 $ 295,386 $ 0 0 $ 0 $ 0 0