Answered step by step

Verified Expert Solution

Question

1 Approved Answer

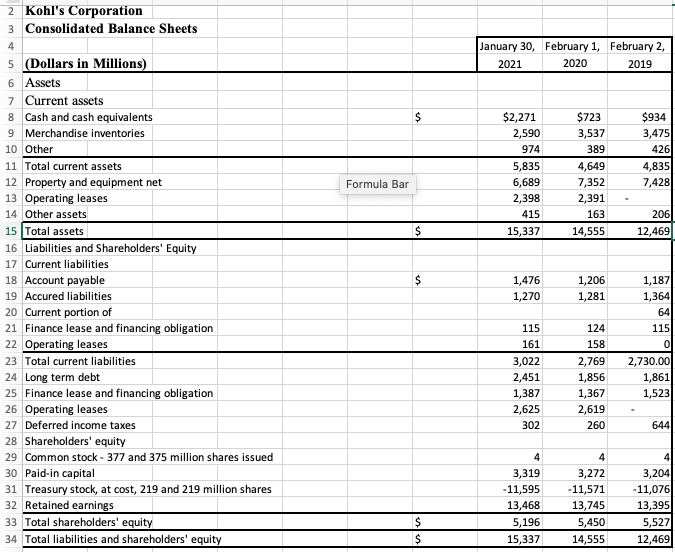

Financial Statement Analysis Predict the next years of projected balance statements, for Kohls Corporation Balance sheets starting with the most recent year after the companys

- Financial Statement Analysis

Predict the next years of projected balance statements, for Kohls Corporation Balance sheets starting with the most recent year after the companys last issued report.

-

- Projections should be based on research performed on your company and its industry. Use historical, trend, ratio data and current and future economic projections as well as information from the companys MD&A to aid in preparing projections.

- Clearly state your assumptions in a text box at the bottom of each tab. Cite sources for assumptions based on research.

- This is the information I receive and was told it is correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started