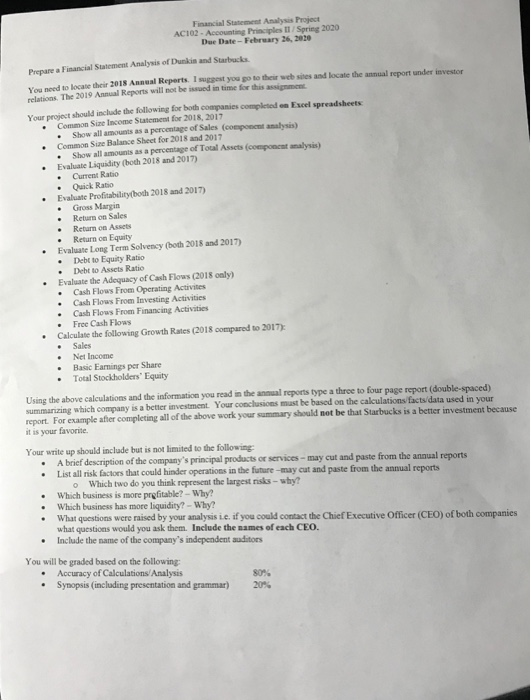

Financial Statement Analysis Project AC102 - Accounting Principles Spring 2020 Due Date - February 26, 2020 Prepare a Financial Statement Analysis of Dunkin and Starbucks d a te their 2018 Annual Reports. I suggest you go to their websites and locate the annual report under investor relations. The 2019 Annual Reports will not be issued in time for this assignment Yourist should include the following for both companies completed on Excel spreadsheets Common Size Income Statement for 2018, 2017 Show all amounts as a percentage of Sales (componentamalysis) Common Size Balance Sheet for 2018 and 2017 Show all amounts as a percentage of Total Assets component analysis) Evaluate Liquidity (both 2018 and 2017) Current Ratio Quick Ratio Evaluate Profitability both 2018 and 2017) Gross Margin Return on Sales Return on Assets Return on Equity Evaluate Long Term Solvency (both 2018 and 2017) Debt to Equity Ratio Debt to Assets Ratio Evaluate the Adequacy of Cash Flows (2018 only) Cash Flows From Operating Activites Cash Flows From Investing Activities Cash Flows From Financing Activities Free Cash Flows Calculate the following Growth Rates (2018 compared to 2017) Net Income Basic Earnings per Share Total Stockholders' Equity Using the above calculations and the information you read in the annual reports type a three to four page report (double-spaced) summarizing which company is a better investment. Your conclusions must be based on the calculations facts data used in your report. For example after completing all of the above work your summary should not be that Starbucks is a better investment because it is your favorite Your write up should include but is not limited to the following A brief description of the company's principal products or services - may cut and paste from the annual reports List all risk factors that could hinder operations in the future -may cut and paste from the annual reports Which two do you think represent the largest risks - why? Which business is more profitable? Why? Which business has more liquidity? - Why? What questions were raised by your analysis ie if you could contact the Chief Executive Officer (CEO) of both companies what questions would you ask them. Include the names of each CEO. Include the name of the company's independent auditors You will be graded based on the following: Accuracy of Calculations Analysis Synopsis (including presentation and grammar) 30. 20% Financial Statement Analysis Project AC102 - Accounting Principles Spring 2020 Due Date - February 26, 2020 Prepare a Financial Statement Analysis of Dunkin and Starbucks d a te their 2018 Annual Reports. I suggest you go to their websites and locate the annual report under investor relations. The 2019 Annual Reports will not be issued in time for this assignment Yourist should include the following for both companies completed on Excel spreadsheets Common Size Income Statement for 2018, 2017 Show all amounts as a percentage of Sales (componentamalysis) Common Size Balance Sheet for 2018 and 2017 Show all amounts as a percentage of Total Assets component analysis) Evaluate Liquidity (both 2018 and 2017) Current Ratio Quick Ratio Evaluate Profitability both 2018 and 2017) Gross Margin Return on Sales Return on Assets Return on Equity Evaluate Long Term Solvency (both 2018 and 2017) Debt to Equity Ratio Debt to Assets Ratio Evaluate the Adequacy of Cash Flows (2018 only) Cash Flows From Operating Activites Cash Flows From Investing Activities Cash Flows From Financing Activities Free Cash Flows Calculate the following Growth Rates (2018 compared to 2017) Net Income Basic Earnings per Share Total Stockholders' Equity Using the above calculations and the information you read in the annual reports type a three to four page report (double-spaced) summarizing which company is a better investment. Your conclusions must be based on the calculations facts data used in your report. For example after completing all of the above work your summary should not be that Starbucks is a better investment because it is your favorite Your write up should include but is not limited to the following A brief description of the company's principal products or services - may cut and paste from the annual reports List all risk factors that could hinder operations in the future -may cut and paste from the annual reports Which two do you think represent the largest risks - why? Which business is more profitable? Why? Which business has more liquidity? - Why? What questions were raised by your analysis ie if you could contact the Chief Executive Officer (CEO) of both companies what questions would you ask them. Include the names of each CEO. Include the name of the company's independent auditors You will be graded based on the following: Accuracy of Calculations Analysis Synopsis (including presentation and grammar) 30. 20%