Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Statement Analysis The financial statements for Nike, Inc., are presented in Appendix C. Use the following additional information (in millions): Accounts receivable at

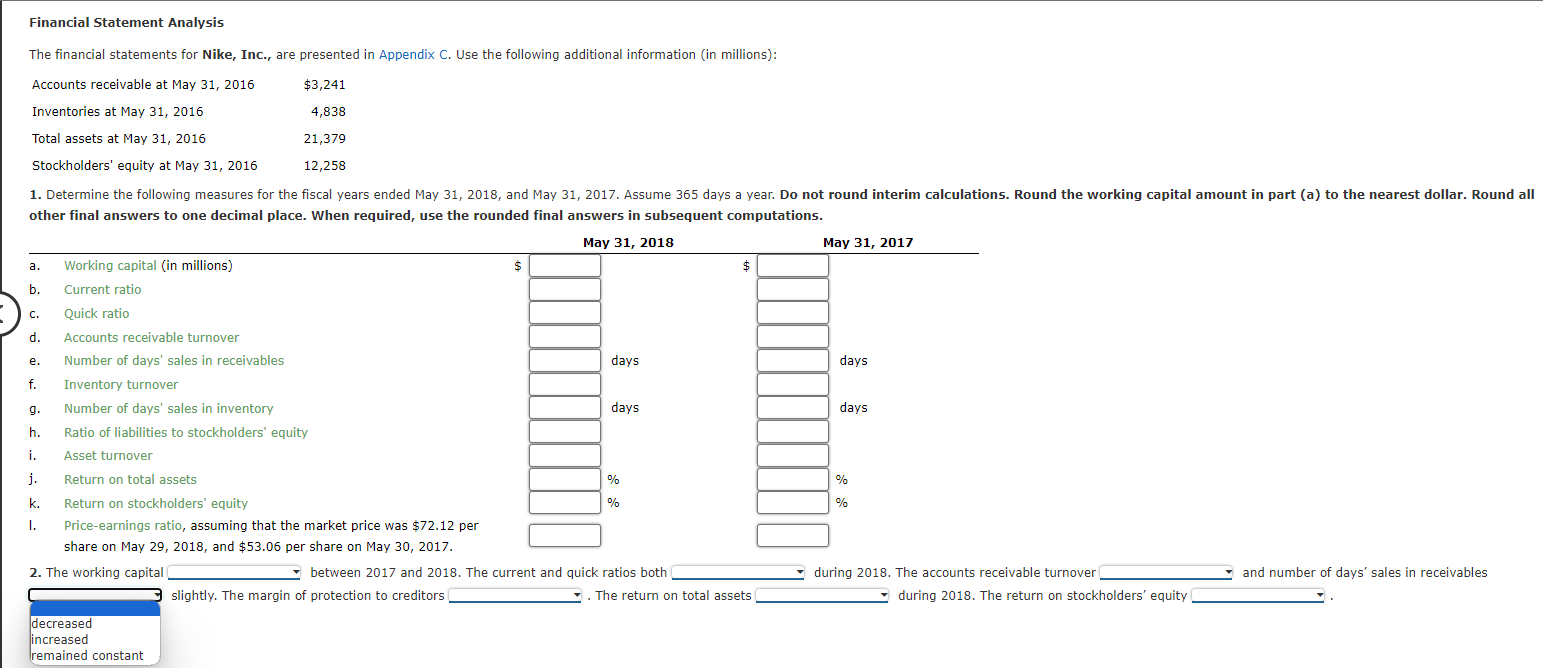

Financial Statement Analysis The financial statements for Nike, Inc., are presented in Appendix C. Use the following additional information (in millions): Accounts receivable at May 31, 2016 Inventories at May 31, 2016 $3,241 4,838 Total assets at May 31, 2016 Stockholders' equity at May 31, 2016 21,379 12,258 1. Determine the following measures for the fiscal years ended May 31, 2018, and May 31, 2017. Assume 365 days a year. Do not round interim calculations. Round the working capital amount in part (a) to the nearest dollar. Round all other final answers to one decimal place. When required, use the rounded final answers in subsequent computations. May 31, 2018 May 31, 2017 a. Working capital (in millions) $ b. Current ratio C. Quick ratio d. Accounts receivable turnover e. Number of days' sales in receivables days days f. Inventory turnover g. Number of days' sales in inventory days days h. Ratio of liabilities to stockholders' equity i. Asset turnover j. Return on total assets k. Return on stockholders' equity % % % % I. Price-earnings ratio, assuming that the market price was $72.12 per share on May 29, 2018, and $53.06 per share on May 30, 2017. 2. The working capital between 2017 and 2018. The current and quick ratios both slightly. The margin of protection to creditors The return on total assets during 2018. The accounts receivable turnover during 2018. The return on stockholders' equity and number of days' sales in receivables decreased increased remained constant

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started