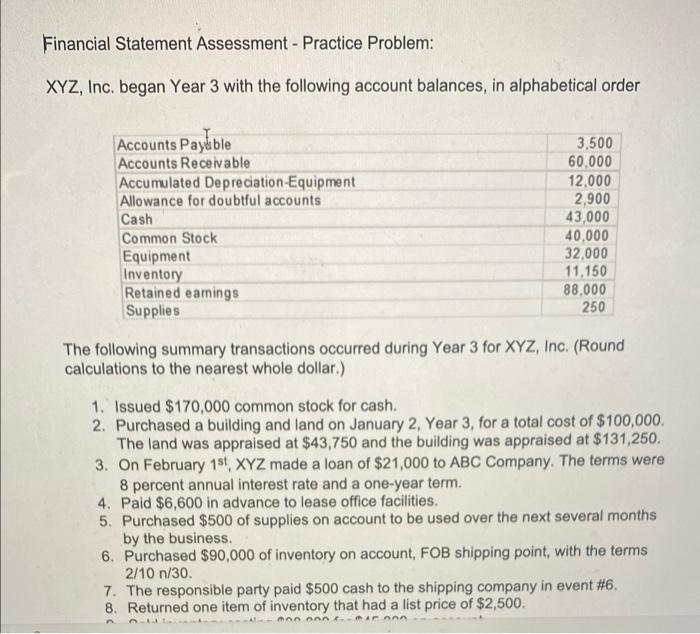

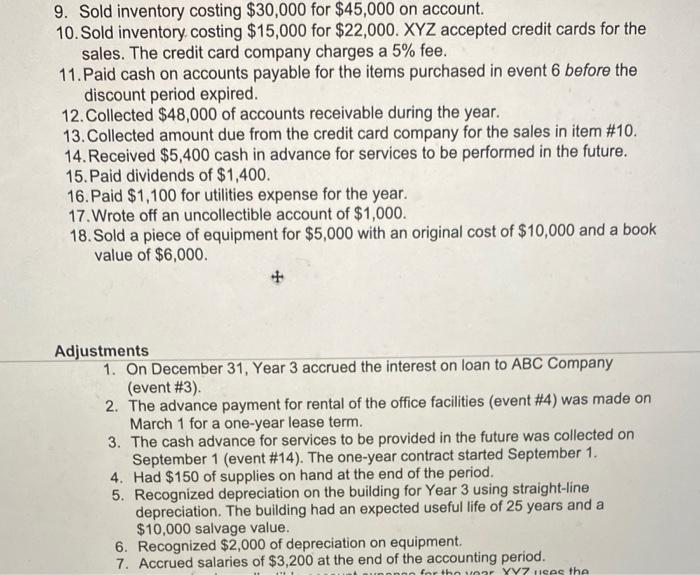

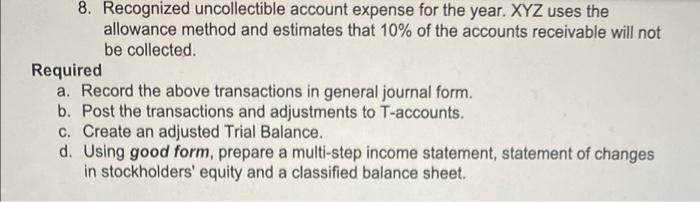

Financial Statement Assessment - Practice Problem: XYZ, Inc. began Year 3 with the following account balances, in alphabetical order Accounts Payable Accounts Receivable Accumulated Depreciation-Equipment Allowance for doubtful accounts Cash Common Stock Equipment Inventory Retained earnings Supplies 3,500 60,000 12,000 2,900 43,000 40,000 32,000 11.150 88,000 250 The following summary transactions occurred during Year 3 for XYZ, Inc. (Round calculations to the nearest whole dollar.) 1. Issued $170,000 common stock for cash. 2. Purchased a building and land on January 2, Year 3, for a total cost of $100,000 The land was appraised at $43,750 and the building was appraised at $131,250. 3. On February 1st, XYZ made a loan of $21,000 to ABC Company. The terms were 8 percent annual interest rate and a one-year term. 4. Paid $6,600 in advance to lease office facilities. 5. Purchased $500 of supplies on account to be used over the next several months by the business 6. Purchased $90,000 of inventory on account, FOB shipping point, with the terms 2/10 n/30. 7. The responsible party paid $500 cash to the shipping company in event #6. 8. Returned one item of inventory that had a list price of $2,500. a MAAAF 9. Sold inventory costing $30,000 for $45,000 on account. 10. Sold inventory costing $15,000 for $22,000. XYZ accepted credit cards for the sales. The credit card company charges a 5% fee. 11. Paid cash on accounts payable for the items purchased in event 6 before the discount period expired. 12. Collected $48,000 of accounts receivable during the year. 13. Collected amount due from the credit card company for the sales in item #10. 14. Received $5,400 cash in advance for services to be performed in the future. 15. Paid dividends of $1,400. 16. Paid $1,100 for utilities expense for the year. 17. Wrote off an uncollectible account of $1,000. 18. Sold a piece of equipment for $5,000 with an original cost of $10,000 and a book value of $6,000 Adjustments 1. On December 31, Year 3 accrued the interest on loan to ABC Company (event #3) 2. The advance payment for rental of the office facilities (event #4) was made on March 1 for a one-year lease term. 3. The cash advance for services to be provided in the future was collected on September 1 (event #14). The one-year contract started September 1. 4. Had $150 of supplies on hand at the end of the period. 5. Recognized depreciation on the building for Year 3 using straight-line depreciation. The building had an expected useful life of 25 years and a $10,000 salvage value. 6. Recognized $2,000 of depreciation on equipment. 7. Accrued salaries of $3,200 at the end of the accounting period. for the war YYZ uses the 8. Recognized uncollectible account expense for the year. XYZ uses the allowance method and estimates that 10% of the accounts receivable will not be collected Required a. Record the above transactions in general journal form. b. Post the transactions and adjustments to T-accounts. c. Create an adjusted Trial Balance. d. Using good form, prepare a multi-step income statement, statement of changes in stockholders' equity and a classified balance sheet. Financial Statement Assessment - Practice Problem: XYZ, Inc. began Year 3 with the following account balances, in alphabetical order Accounts Payable Accounts Receivable Accumulated Depreciation-Equipment Allowance for doubtful accounts Cash Common Stock Equipment Inventory Retained earnings Supplies 3,500 60,000 12,000 2,900 43,000 40,000 32,000 11.150 88,000 250 The following summary transactions occurred during Year 3 for XYZ, Inc. (Round calculations to the nearest whole dollar.) 1. Issued $170,000 common stock for cash. 2. Purchased a building and land on January 2, Year 3, for a total cost of $100,000 The land was appraised at $43,750 and the building was appraised at $131,250. 3. On February 1st, XYZ made a loan of $21,000 to ABC Company. The terms were 8 percent annual interest rate and a one-year term. 4. Paid $6,600 in advance to lease office facilities. 5. Purchased $500 of supplies on account to be used over the next several months by the business 6. Purchased $90,000 of inventory on account, FOB shipping point, with the terms 2/10 n/30. 7. The responsible party paid $500 cash to the shipping company in event #6. 8. Returned one item of inventory that had a list price of $2,500. a MAAAF 9. Sold inventory costing $30,000 for $45,000 on account. 10. Sold inventory costing $15,000 for $22,000. XYZ accepted credit cards for the sales. The credit card company charges a 5% fee. 11. Paid cash on accounts payable for the items purchased in event 6 before the discount period expired. 12. Collected $48,000 of accounts receivable during the year. 13. Collected amount due from the credit card company for the sales in item #10. 14. Received $5,400 cash in advance for services to be performed in the future. 15. Paid dividends of $1,400. 16. Paid $1,100 for utilities expense for the year. 17. Wrote off an uncollectible account of $1,000. 18. Sold a piece of equipment for $5,000 with an original cost of $10,000 and a book value of $6,000 Adjustments 1. On December 31, Year 3 accrued the interest on loan to ABC Company (event #3) 2. The advance payment for rental of the office facilities (event #4) was made on March 1 for a one-year lease term. 3. The cash advance for services to be provided in the future was collected on September 1 (event #14). The one-year contract started September 1. 4. Had $150 of supplies on hand at the end of the period. 5. Recognized depreciation on the building for Year 3 using straight-line depreciation. The building had an expected useful life of 25 years and a $10,000 salvage value. 6. Recognized $2,000 of depreciation on equipment. 7. Accrued salaries of $3,200 at the end of the accounting period. for the war YYZ uses the 8. Recognized uncollectible account expense for the year. XYZ uses the allowance method and estimates that 10% of the accounts receivable will not be collected Required a. Record the above transactions in general journal form. b. Post the transactions and adjustments to T-accounts. c. Create an adjusted Trial Balance. d. Using good form, prepare a multi-step income statement, statement of changes in stockholders' equity and a classified balance sheet