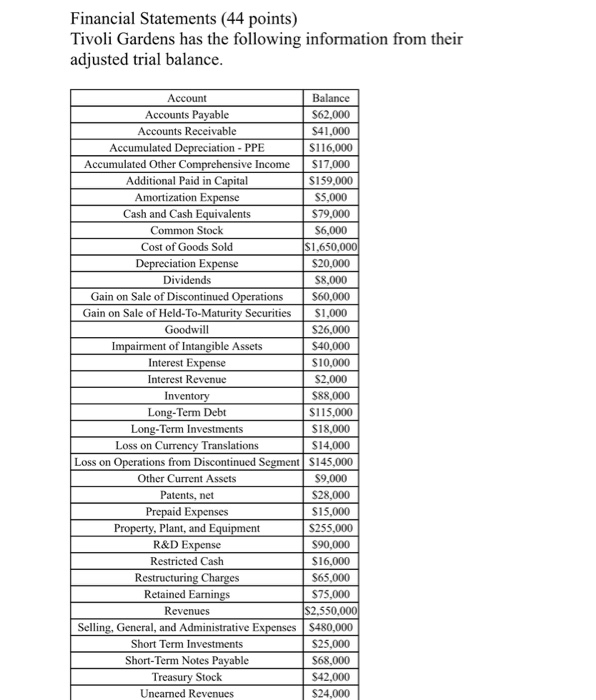

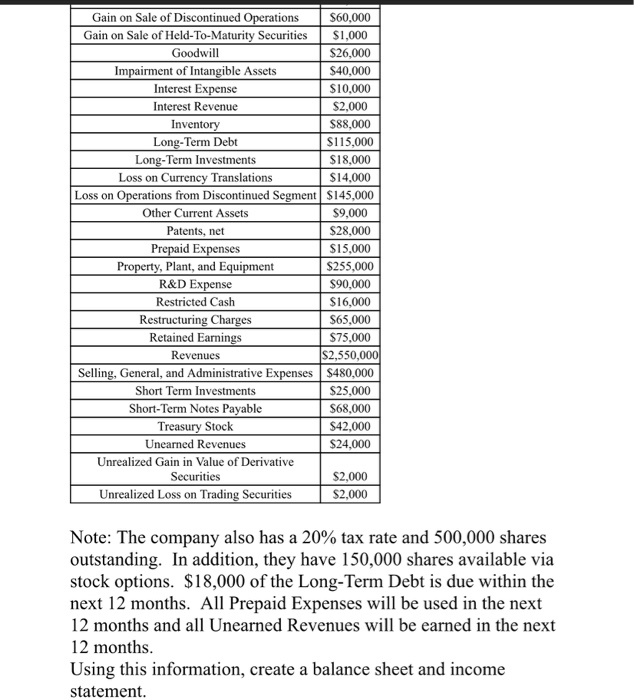

Financial Statements (44 points) Tivoli Gardens has the following information from their adjusted trial balance. Account Balance Accounts Payable S62,000 Accounts Receivable $41,000 Accumulated Depreciation - PPE $116,000 Accumulated Other Comprehensive Income $17,000 Additional Paid in Capital $159,000 Amortization Expense $5,000 Cash and Cash Equivalents $79.000 Common Stock $6,000 Cost of Goods Sold $1,650,000 Depreciation Expense $20,000 Dividends $8,000 Gain on Sale of Discontinued Operations $60,000 Gain on Sale of Held-To-Maturity Securities $1,000 Goodwill $26.000 Impairment of Intangible Assets $40,000 Interest Expense $10,000 Interest Revenue $2,000 Inventory $88,000 Long-Term Debt S115,000 Long-Term Investments $18,000 Loss on Currency Translations $14,000 Loss on Operations from Discontinued Segment S145,000 Other Current Assets $9,000 Patents, net $28,000 Prepaid Expenses $15,000 Property, Plant, and Equipment S255,000 R&D Expense $90,000 Restricted Cash $16,000 Restructuring Charges $65.000 Retained Earnings $75,000 Revenues $2,550,000 Selling, General, and Administrative Expenses $480,000 Short Term Investments $25,000 Short-Term Notes Payable $68,000 Treasury Stock S42,000 Uneamed Revenues $24,000 Gain on Sale of Discontinued Operations $60,000 Gain on Sale of Held-To-Maturity Securities $1,000 Goodwill $26,000 Impairment of Intangible Assets $40,000 Interest Expense $10,000 Interest Revenue $2,000 Inventory $88,000 Long-Term Debt $115,000 Long-Term Investments $18,000 Loss on Currency Translations $14,000 Loss on Operations from Discontinued Segment $145,000 Other Current Assets $9,000 Patents, net $28,000 Prepaid Expenses $15,000 Property, Plant, and Equipment $255,000 R&D Expense $90,000 Restricted Cash $16,000 Restructuring Charges $65,000 Retained Earnings $75,000 Revenues $2,550,000 Selling, General, and Administrative Expenses $480,000 Short Term Investments $25,000 Short-Term Notes Payable $68,000 Treasury Stock $42,000 Unearned Revenues $24,000 Unrealized Gain in Value of Derivative Securities $2,000 Unrealized Loss on Trading Securities $2,000 Note: The company also has a 20% tax rate and 500,000 shares outstanding. In addition, they have 150,000 shares available via stock options. $18,000 of the Long-Term Debt is due within the next 12 months. All Prepaid Expenses will be used in the next 12 months and all Unearned Revenues will be earned in the next 12 months. Using this information, create a balance sheet and income statement