Question

Financial statements and cash flows For each calculation, show your work; that means show the inputs and the calculations. This isnt graded, but when you

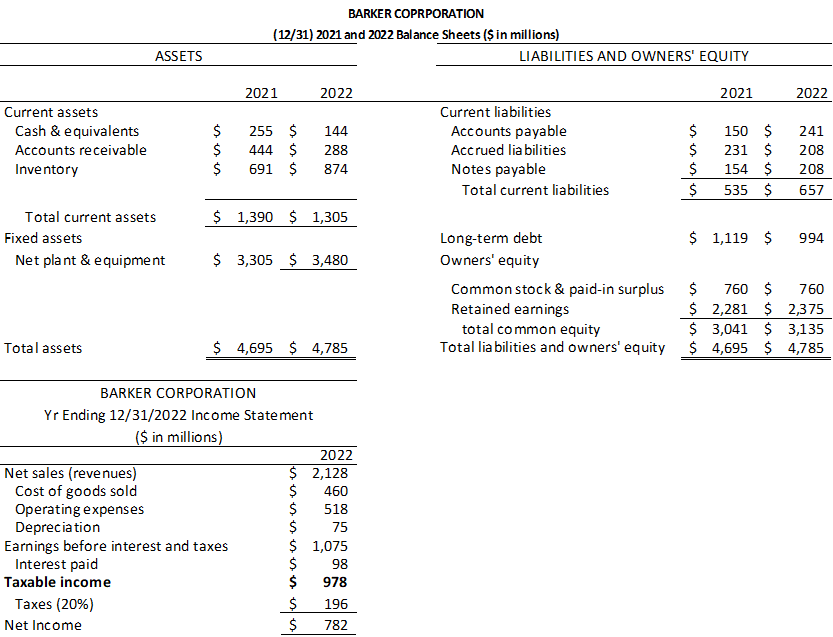

Financial statements and cash flows For each calculation, show your work; that means show the inputs and the calculations. This isnt graded, but when you go back to your work, it will be easier to see where you may have made a mistake. Calculate each of the following:

1. Gross profit margin for 2022

2. Operating profit margin for 2022

3. Net profit margin for 2022

4. Operating cash flow for 2022

5. Quick ratios for 2020 and 2022

a. Has the firms ability to pay off immediate debt increased or decreased?

6. Current ratios for 2021 and 2022

7. Total debt ratio for 2022

8. Book value of common equity per share for 2022, assuming 200mm shares outstanding

9. Market price to book (market to book) for 2022, assuming that the firms market price was $95.50 on December 31, 2022

10. Earnings per share for 2022, assuming that the firm has 200mm common shares outstanding

11. PE or price to earnings ratio for 2022, assuming that the firms market price was $95.50 on December 31, 2022

BARKER COPRPORATIONStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started