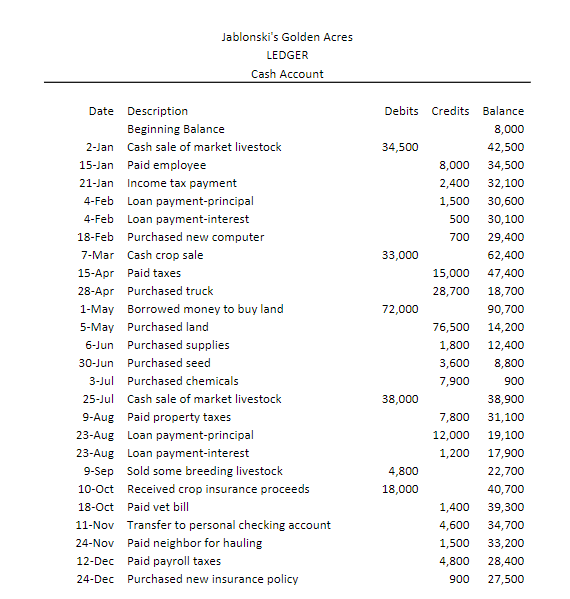

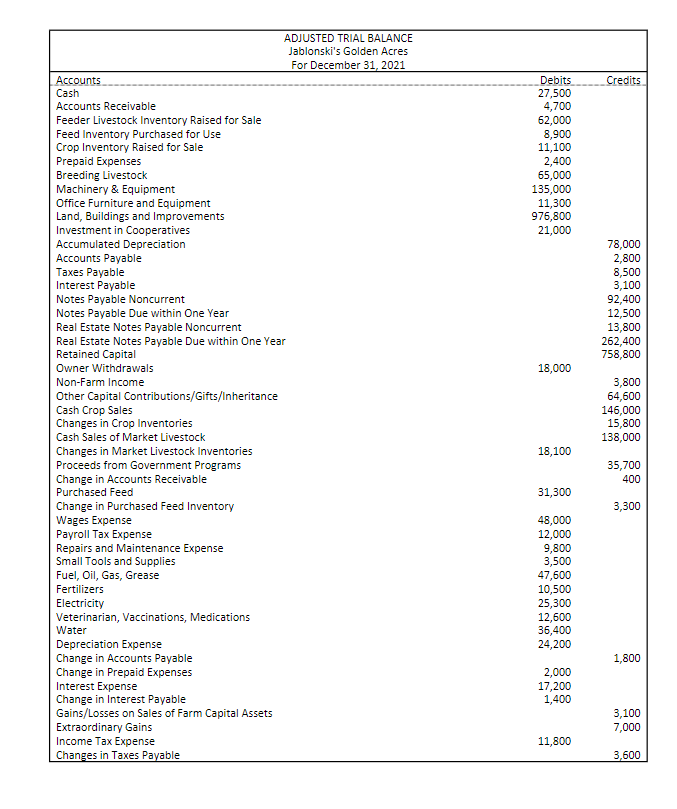

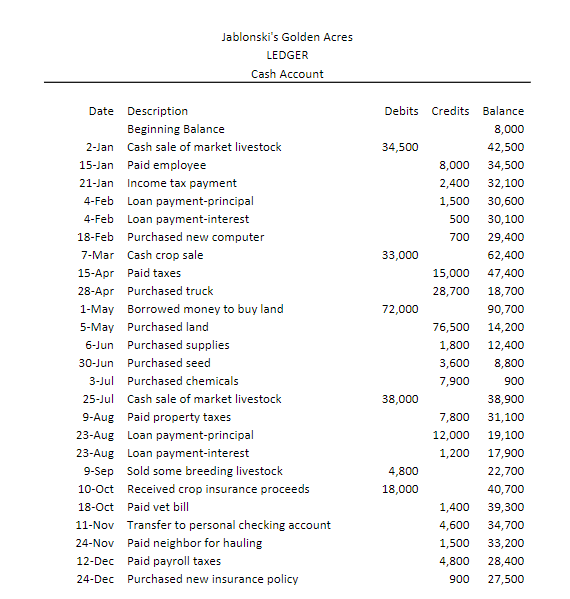

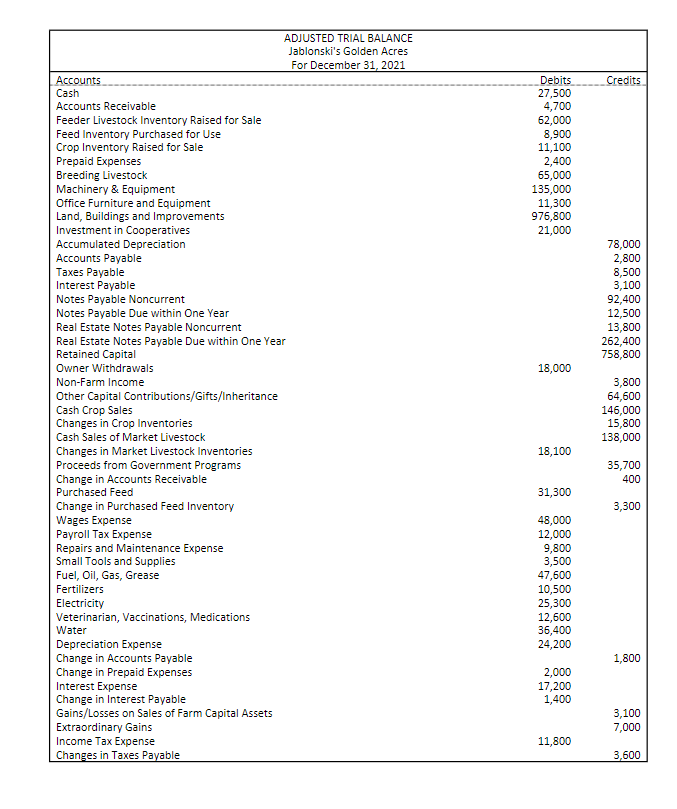

Financial statements are formal documents, so they must be typed for this assignment. Any hand-written financial statement will receive a score of zero. Also, presentation matters for financial statements. For example, acronyms and abbreviations are not allowed on financial statements. The statements are required to be neat, organized, easy-to-read, and easy-to-follow. The formats presented in class are good ones to follow (but are by no means the only acceptable format). Using the attached Adjusted Trial Balance, prepare Jablonskis Golden Acres financial statements for the end of the year. Complete each statement on its own page in the following order: A) Income Statement for 2021 (23 points) B) Statement of Owner Equity for 2021 (17 points) C) Balance Sheet for December 31, 2021 (33 points) D) Cash Flow Statement for 2021 (22 points)

Jablonski's Golden Acres LEDGER Cash Account Debits 34,500 33,000 72,000 Date Description Beginning Balance 2-Jan Cash sale of market livestock 15-Jan Paid employee 21-Jan Income tax payment 4-Feb Loan payment-principal 4-Feb Loan payment-interest 18-Feb Purchased new computer 7-Mar Cash crop sale 15-Apr Paid taxes 28-Apr Purchased truck 1-May Borrowed money to buy land 5-May Purchased land 6-Jun Purchased supplies 30-Jun Purchased seed 3-Jul Purchased chemicals 25-Jul Cash sale of market livestock 9-Aug Paid property taxes 23-Aug Loan payment-principal 23-Aug Loan payment-interest 9-Sep Sold some breeding livestock 10-Oct Received crop insurance proceeds 18-Oct Paid vet bill 11-Nov Transfer to personal checking account 24-Nov Paid neighbor for hauling 12-Dec Paid payroll taxes 24-Dec Purchased new insurance policy Credits Balance 8,000 42,500 8,000 34,500 2,400 32,100 1,500 30,600 500 30,100 700 29,400 62,400 15,000 47,400 28,700 18,700 90,700 76,500 14,200 1,800 12,400 3,600 8,800 7,900 900 38,900 7,800 31,100 12,000 19,100 1,200 17,900 22,700 40,700 1,400 39,300 4,600 34,700 1,500 33,200 4,800 28,400 900 27,500 38,000 4,800 18,000 Credits Debits 27,500 4,700 62,000 8,900 11,100 2,400 65,000 135,000 11,300 976,800 21,000 78,000 2,800 8,500 3,100 92,400 12,500 13,800 262,400 758,800 18,000 ADJUSTED TRIAL BALANCE Jablonski's Golden Acres For December 31, 2021 Accounts Cash Accounts Receivable Feeder Livestock Inventory Raised for Sale Feed Inventory Purchased for Use Crop Inventory Raised for Sale Prepaid Expenses Breeding Livestock Machinery & Equipment Office Furniture and Equipment Land, Buildings and Improvements Investment in Cooperatives Accumulated Depreciation Accounts Payable Taxes Payable Interest Payable Notes Payable Noncurrent Notes Payable Due within One Year Real Estate Notes Payable Noncurrent Real Estate Notes Payable Due within One Year Retained Capital Owner Withdrawals Non-Farm Income Other Capital Contributions/Gifts/Inheritance Cash Crop Sales Changes in Crop Inventories Cash Sales of Market Livestock Changes in Market Livestock Inventories Proceeds from Government Programs Change in Accounts Receivable Purchased Feed Change in Purchased Feed Inventory Wages Expense Payroll Tax Expense Repairs and Maintenance Expense Small Tools and Supplies Fuel, Oil, Gas, Grease Fertilizers Electricity Veterinarian, Vaccinations, Medications Water Depreciation Expense Change in Accounts Payable Change in Prepaid Expenses Interest Expense Change in Interest Payable Gains/Losses on Sales of Farm Capital Assets Extraordinary Gains Income Tax Expense Changes in Taxes Payable 3,800 64,600 146,000 15,800 138,000 18,100 35,700 400 31,300 3,300 48,000 12,000 9,800 3,500 47,600 10,500 25,300 12,600 36,400 24,200 1,800 2,000 17,200 1,400 3,100 7,000 11,800 3,600 Jablonski's Golden Acres LEDGER Cash Account Debits 34,500 33,000 72,000 Date Description Beginning Balance 2-Jan Cash sale of market livestock 15-Jan Paid employee 21-Jan Income tax payment 4-Feb Loan payment-principal 4-Feb Loan payment-interest 18-Feb Purchased new computer 7-Mar Cash crop sale 15-Apr Paid taxes 28-Apr Purchased truck 1-May Borrowed money to buy land 5-May Purchased land 6-Jun Purchased supplies 30-Jun Purchased seed 3-Jul Purchased chemicals 25-Jul Cash sale of market livestock 9-Aug Paid property taxes 23-Aug Loan payment-principal 23-Aug Loan payment-interest 9-Sep Sold some breeding livestock 10-Oct Received crop insurance proceeds 18-Oct Paid vet bill 11-Nov Transfer to personal checking account 24-Nov Paid neighbor for hauling 12-Dec Paid payroll taxes 24-Dec Purchased new insurance policy Credits Balance 8,000 42,500 8,000 34,500 2,400 32,100 1,500 30,600 500 30,100 700 29,400 62,400 15,000 47,400 28,700 18,700 90,700 76,500 14,200 1,800 12,400 3,600 8,800 7,900 900 38,900 7,800 31,100 12,000 19,100 1,200 17,900 22,700 40,700 1,400 39,300 4,600 34,700 1,500 33,200 4,800 28,400 900 27,500 38,000 4,800 18,000 Credits Debits 27,500 4,700 62,000 8,900 11,100 2,400 65,000 135,000 11,300 976,800 21,000 78,000 2,800 8,500 3,100 92,400 12,500 13,800 262,400 758,800 18,000 ADJUSTED TRIAL BALANCE Jablonski's Golden Acres For December 31, 2021 Accounts Cash Accounts Receivable Feeder Livestock Inventory Raised for Sale Feed Inventory Purchased for Use Crop Inventory Raised for Sale Prepaid Expenses Breeding Livestock Machinery & Equipment Office Furniture and Equipment Land, Buildings and Improvements Investment in Cooperatives Accumulated Depreciation Accounts Payable Taxes Payable Interest Payable Notes Payable Noncurrent Notes Payable Due within One Year Real Estate Notes Payable Noncurrent Real Estate Notes Payable Due within One Year Retained Capital Owner Withdrawals Non-Farm Income Other Capital Contributions/Gifts/Inheritance Cash Crop Sales Changes in Crop Inventories Cash Sales of Market Livestock Changes in Market Livestock Inventories Proceeds from Government Programs Change in Accounts Receivable Purchased Feed Change in Purchased Feed Inventory Wages Expense Payroll Tax Expense Repairs and Maintenance Expense Small Tools and Supplies Fuel, Oil, Gas, Grease Fertilizers Electricity Veterinarian, Vaccinations, Medications Water Depreciation Expense Change in Accounts Payable Change in Prepaid Expenses Interest Expense Change in Interest Payable Gains/Losses on Sales of Farm Capital Assets Extraordinary Gains Income Tax Expense Changes in Taxes Payable 3,800 64,600 146,000 15,800 138,000 18,100 35,700 400 31,300 3,300 48,000 12,000 9,800 3,500 47,600 10,500 25,300 12,600 36,400 24,200 1,800 2,000 17,200 1,400 3,100 7,000 11,800 3,600