- Financial Statements: Create financial statements using appropriate methods based on accepted accounting principles. Be sure to prepare these financial statements in the order listed, as there are important interdependencies among them.

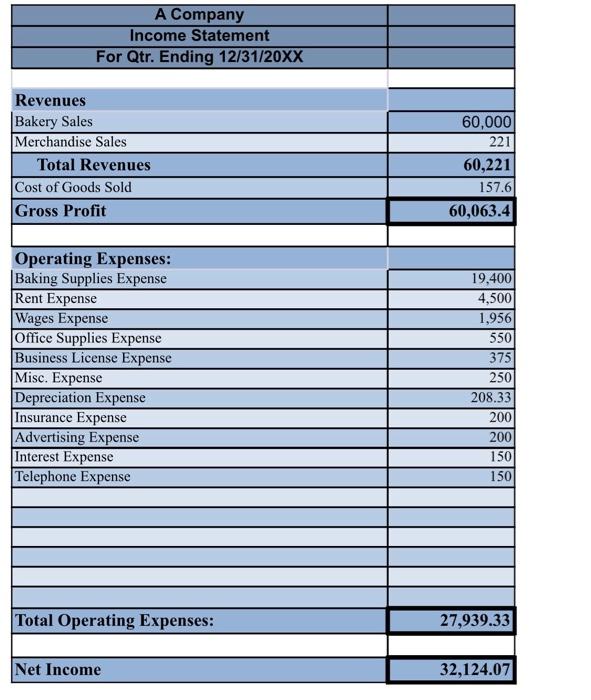

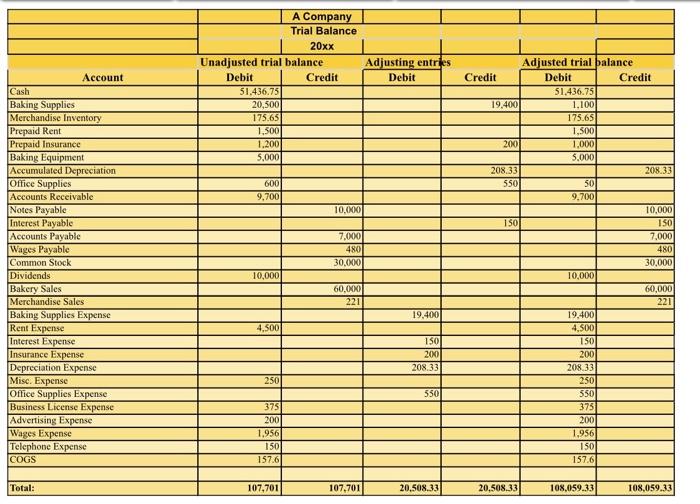

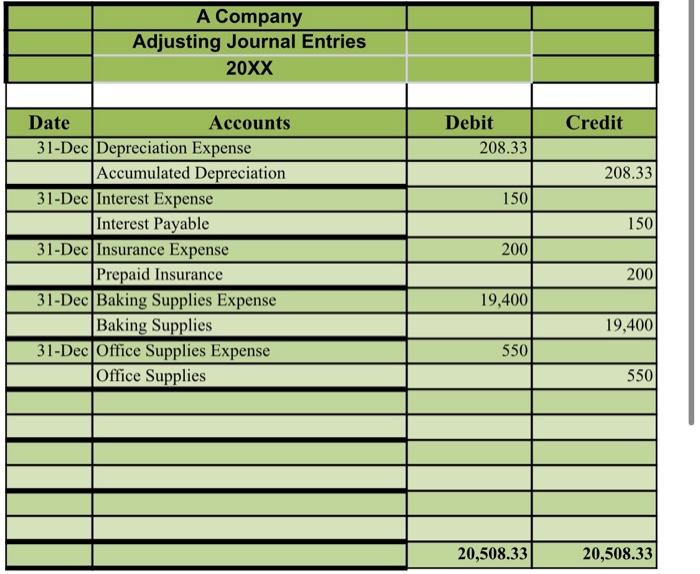

- Income Statement: Prepare the income statement using the adjusted trial balance.

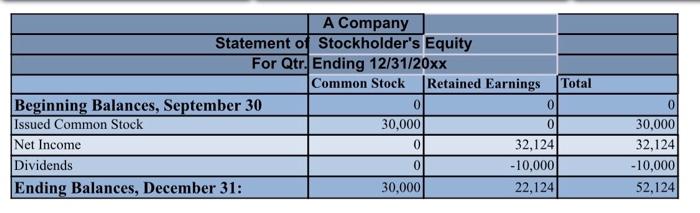

- Statement of Owners Equity: Prepare the statement of owners equity using the adjusted trial balance.

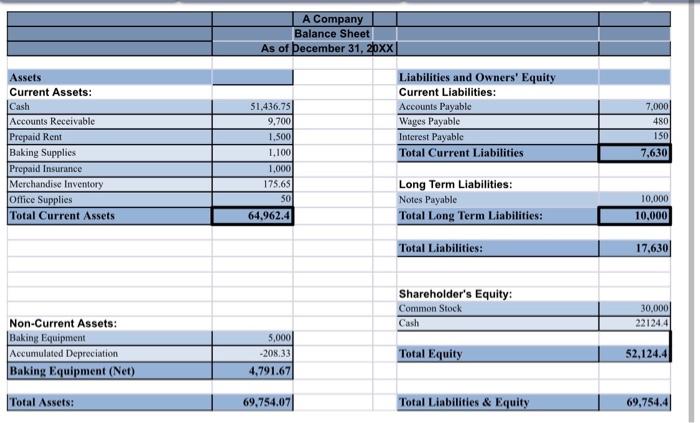

- Balance Sheet: Prepare the balance sheet using the adjusted trial balance.

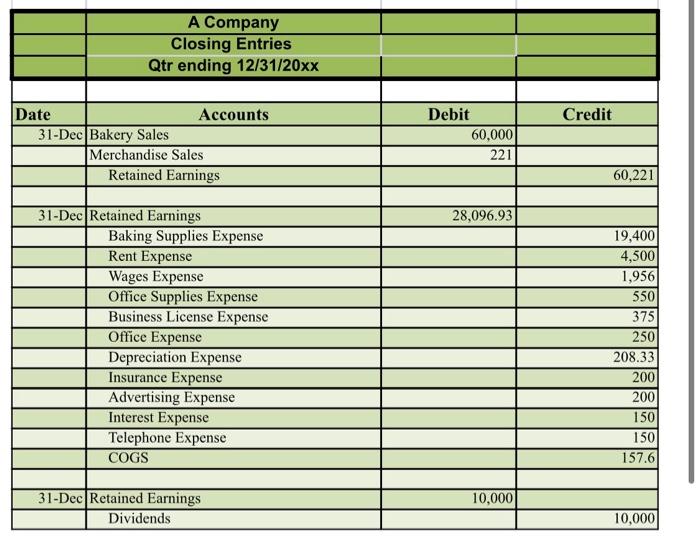

- Closing Entries: Complete the Closing Entries tab of the company accounting workbook by closing all temporary income statement amounts to create closing entries.

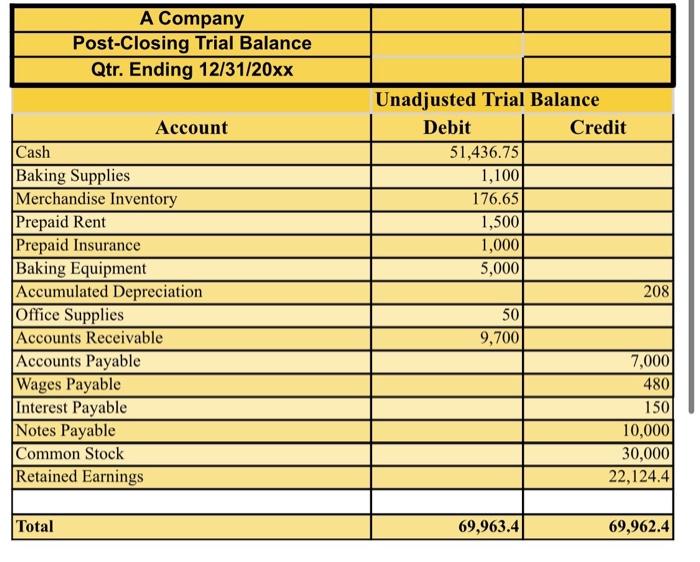

- Post-Closing Trial Balance: Prepare the Post-Closing Trial Balance tab of the company accounting workbook in preparation for the next accounting period.

can you please help me and making sure the above financial atatements are correct?

A Company Income Statement For Qtr. Ending 12/31/20XX Revenues Bakery Sales Merchandise Sales Total Revenues 60,000 221 Cost of Goods Sold 60,221 157.6 60,063.4 Gross Profit Operating Expenses: Baking Supplies Expense Rent Expense Wages Expense Office Supplies Expense Business License Expense Misc. Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense 19,400 4,500 1,956 550 375 250 208.33 200 200 150 150 Total Operating Expenses: 27,939.33 Net Income 32,124.07 A Company Statement of Stockholder's Equity For Qtr. Ending 12/31/20xx Common Stock Retained Earnings Total Beginning Balances, September 30 Issued Common Stock 30,000 Net Income 32,124 - 10,000 Ending Balances, December 31: 30,000 22,124 0 0 0 0 30,000 32,124 -10,000 Dividends 0 52,124 A Company Balance Sheet As of December 31, 20xx Liabilities and Owners' Equity Current Liabilities: Accounts Payable Wages Payable Interest Payable Total Current Liabilities 7,000 480 Assets Current Assets: Cash Accounts Receivable Prepaid Rent Baking Supplies Prepaid Insurance Merchandise Inventory Office Supplies Total Current Assets 150 7,630 51.436.75 9,700 1,500 1.100 1,000 175.65 SO 64,962.4 Long Term Liabilities: Notes Payable Total Long Term Liabilities: 10,000 10.000 Total Liabilities: 17,630 Shareholder's Equity: Common Stock 30.000 Non-Current Assets: Cash 221244 5,000 -208.33 Total Equity 52,124.4 Baking Equipment Accumulated Depreciation Baking Equipment (Net) Total Assets: 4,791.67 69,754.071 Total Liabilities & Equity 69,754.4 A Company Closing Entries Qtr ending 12/31/20xx Accounts Credit Date 31-Dec Bakery Sales Merchandise Sales Retained Earnings Debit 60,000 221 60,221 28,096.93 31-Dec Retained Earnings Baking Supplies Expense Rent Expense Wages Expense Office Supplies Expense Business License Expense Office Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense COGS 19,4001 4,5001 1,956 550 375 250 208.33 2001 200 1501 1501 157.6 31-Dec Retained Earnings 10,000 Dividends 10,000 A Company Post-Closing Trial Balance Qtr. Ending 12/31/20xx Unadjusted Trial Balance Account Debit Credit 51,436.75 1,100 176.65 1,500 1,000 5,000 208 Cash Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Baking Equipment Accumulated Depreciation Office Supplies Accounts Receivable Accounts Payable Wages Payable Interest Payable Notes Payable Common Stock Retained Earnings 50 9,700 7,000 480 150 10,000 30,000 22,124.4 Total 69,963.4 69,962.4 A Company Trial Balance Adjusting entries Debit 20xx Unadjusted trial balance Debit Credit 51.436.75 20,500 175.65 1,500 1.200 5,000 000 9,700 10.000 Account Cash Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Baking Equipment Accumulated Depreciation Office Supplies Accounts Receivable Notes Payable Interest Payable Accounts Payable Wages Payable Common Stock Dividends Bakery Sales Merchandise Sales Baking Supplies Expense Rent Expense Interest Expense Insurance Expense Depreciation Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense COGS 7,000 480 30.000 Adjusted trial balance Credit Debit Credit 51.436.75 19.400 1.100 175.65 1.500 2001 1,000 5.000 208.33 208.33 550 50 9,700 10,000 150 150 7,000 480 30,000 10,000 60,000 221 19,400 4.500 150 200 208.33 250 550 375 200 1,956 150 157.6 10,000 60.000 221 19,400 4,500 150 200 208.33 250 550 375 200 1.956 150 157.6 Total: 107,701 107,701 20,508.33 20.508.33 108,059.33 108,059.33 A Company Adjusting Journal Entries 20XX Debit Credit 208.33 208.33 150 150 Date Accounts 31-Dec Depreciation Expense Accumulated Depreciation 31-Dec Interest Expense Interest Payable 31-Dec Insurance Expense Prepaid Insurance 31-Dec Baking Supplies Expense Baking Supplies 31-Dec Office Supplies Expense Office Supplies 200 200 19,400 19,400 550 550 20,508.33 20,508.33