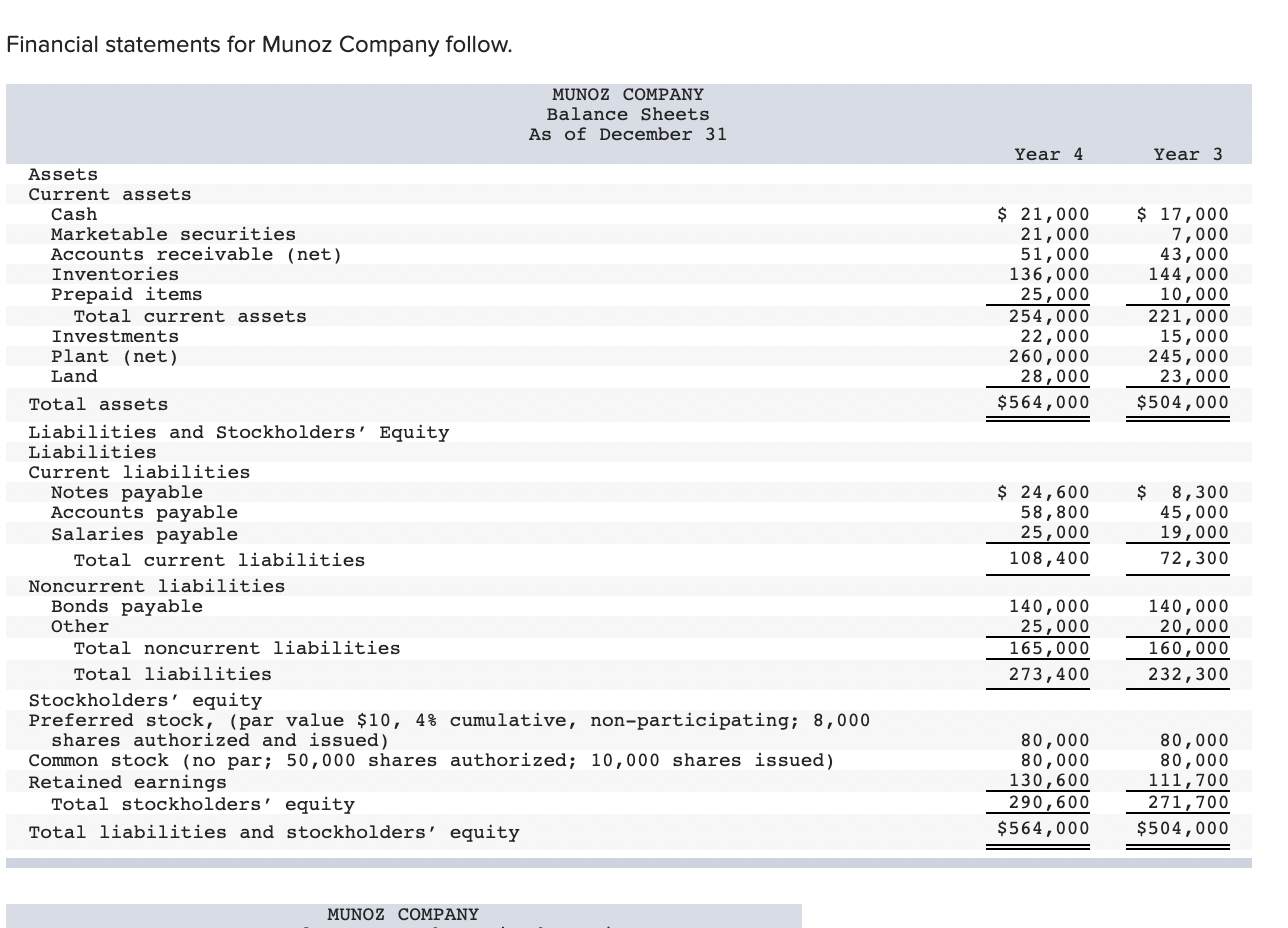

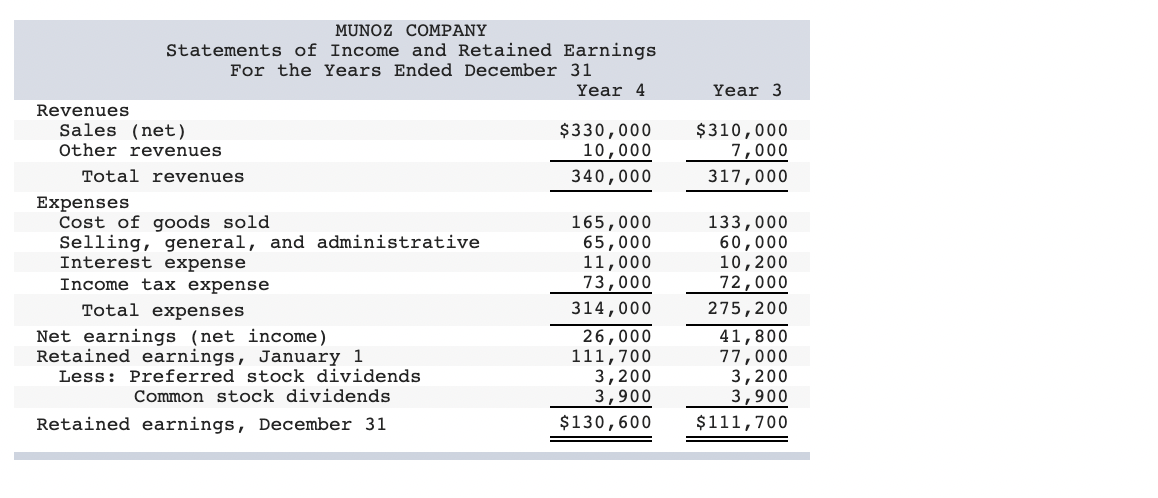

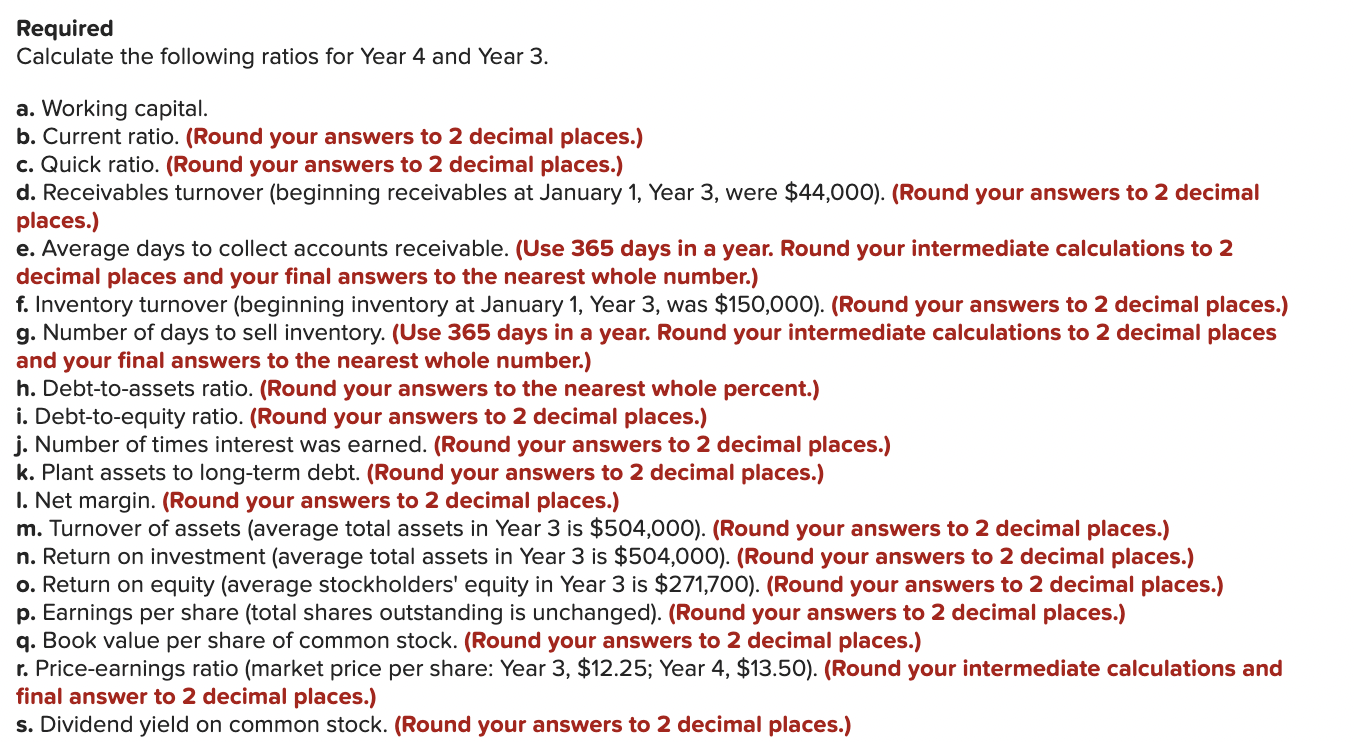

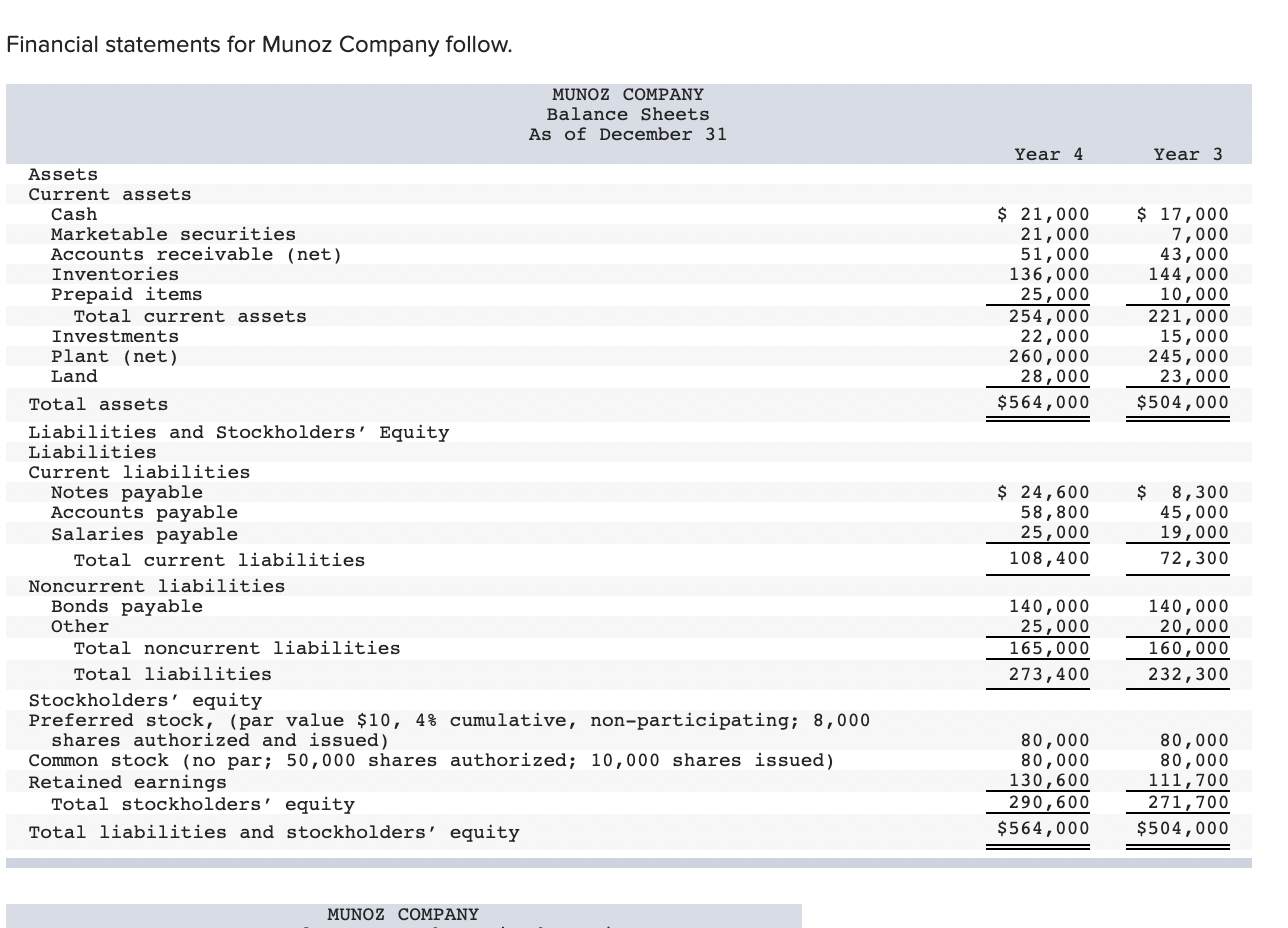

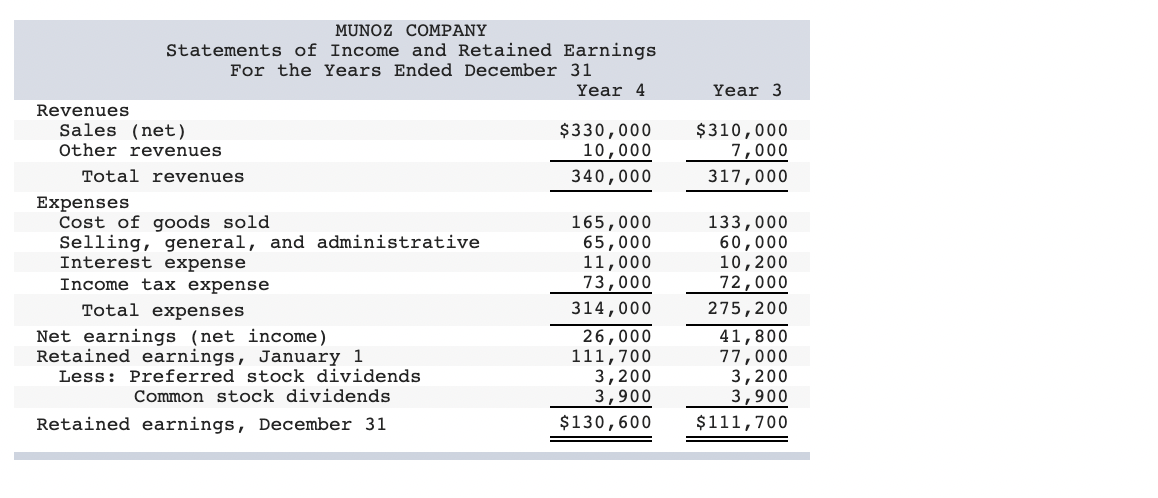

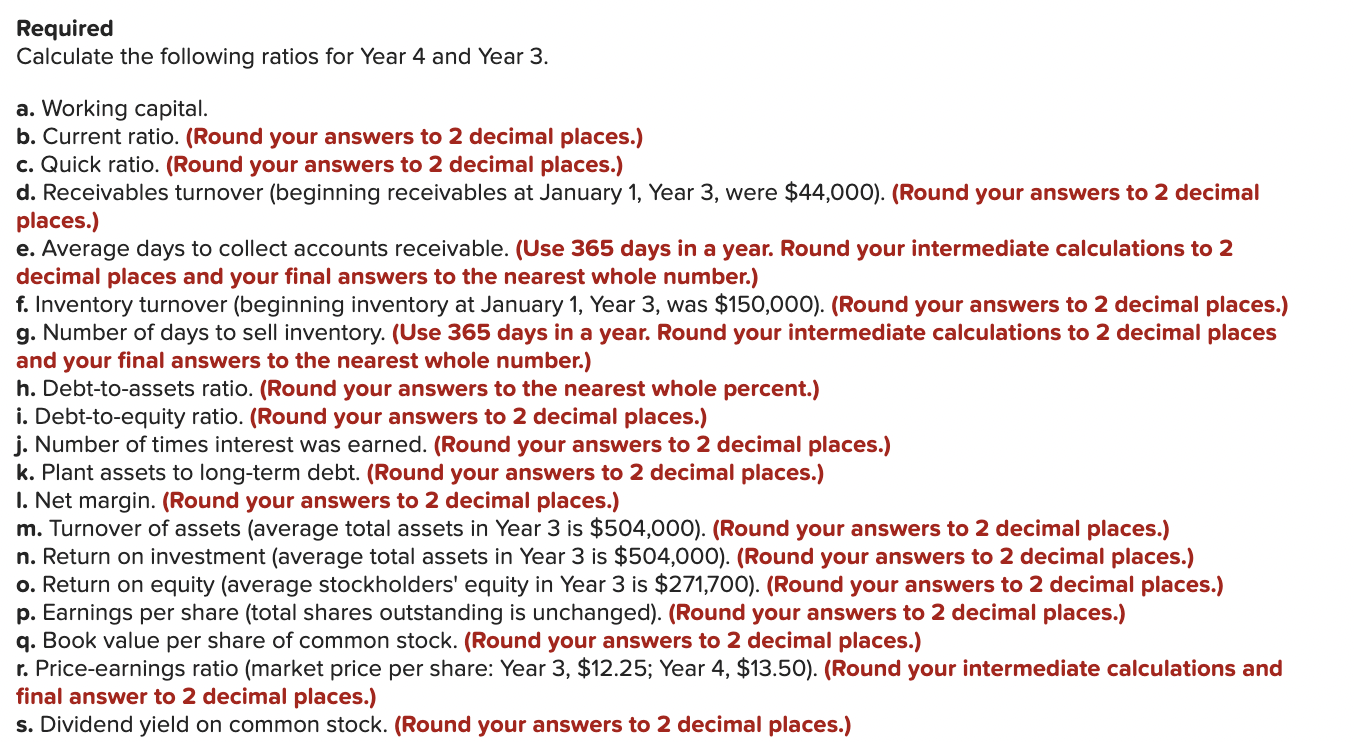

Financial statements for Munoz Company follow. MUNOZ COMPANY Balance Sheets As of December 31 Year 4 Year 3 Assets Current assets Cash Marketable securities Accounts receivable (net) Inventories Prepaid items Total current assets Investments Plant (net) Land $ 21,000 21,000 51,000 136,000 25,000 254,000 22,000 260,000 28,000 $564,000 $ 17,000 7,000 43,000 144,000 10,000 221,000 15,000 245,000 23,000 $504,000 $ $ 24,600 58, 800 25,000 108,400 8,300 45,000 19,000 72,300 Total assets Liabilities and Stockholders' Equity Liabilities Current liabilities Notes payable Accounts payable Salaries payable Total current liabilities Noncurrent liabilities Bonds payable Other Total noncurrent liabilities Total liabilities Stockholders' equity Preferred stock, (par value $10, 4% cumulative, non-participating; 8,000 shares authorized and issued) Common stock (no par; 50,000 shares authorized; 10,000 shares issued) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 140,000 25,000 165,000 273,400 140,000 20,000 160,000 232,300 80,000 80,000 130,600 290,600 $564,000 80,000 80,000 111,700 271,700 $504,000 MUNOZ COMPANY Year 3 $310,000 7,000 317,000 MUNOZ COMPANY Statements of Income and Retained Earnings For the Years Ended December 31 Year 4 Revenues Sales (net) $330,000 Other revenues 10,000 Total revenues 340,000 Expenses Cost of goods sold 165,000 Selling, general, and administrative 65,000 Interest expense 11,000 Income tax expense 73,000 Total expenses 314,000 Net earnings (net income) 26,000 Retained earnings, January 1 111,700 Less: Preferred stock dividends 3,200 Common stock dividends 3,900 Retained earnings, December 31 $130,600 133,000 60,000 10,200 72,000 275, 200 41,800 77,000 3,200 3,900 $111,700 Required Calculate the following ratios for Year 4 and Year 3. a. Working capital. b. Current ratio. (Round your answers to 2 decimal places.) c. Quick ratio. (Round your answers to 2 decimal places.) d. Receivables turnover (beginning receivables at January 1, Year 3, were $44,000). (Round your answers to 2 decimal places.) e. Average days to collect accounts receivable. (Use 365 days in a year. Round your intermediate calculations to 2 decimal places and your final answers to the nearest whole number.) f. Inventory turnover (beginning inventory at January 1, Year 3, was $150,000). (Round your answers to 2 decimal places.) g. Number of days to sell inventory. (Use 365 days in a year. Round your intermediate calculations to 2 decimal places and your final answers to the nearest whole number.) h. Debt-to-assets ratio. (Round your answers to the nearest whole percent.) i. Debt-to-equity ratio. (Round your answers to 2 decimal places.) j. Number of times interest was earned. (Round your answers to 2 decimal places.) k. Plant assets to long-term debt. (Round your answers to 2 decimal places.) 1. Net margin. (Round your answers to 2 decimal places.) m. Turnover of assets (average total assets in Year 3 is $504,000). (Round your answers to 2 decimal places.) n. Return on investment (average total assets in Year 3 is $504,000). (Round your answers to 2 decimal places.) o. Return on equity (average stockholders' equity in Year 3 is $271,700). (Round your answers to 2 decimal places.) p. Earnings per share (total shares outstanding is unchanged). (Round your answers to 2 decimal places.) q. Book value per share of common stock. (Round your answers to 2 decimal places.) r. Price-earnings ratio (market price per share: Year 3, $12.25; Year 4, $13.50). (Round your intermediate calculations and final answer to 2 decimal places.) s. Dividend yield on common stock. (Round your answers to 2 decimal places.)