Question

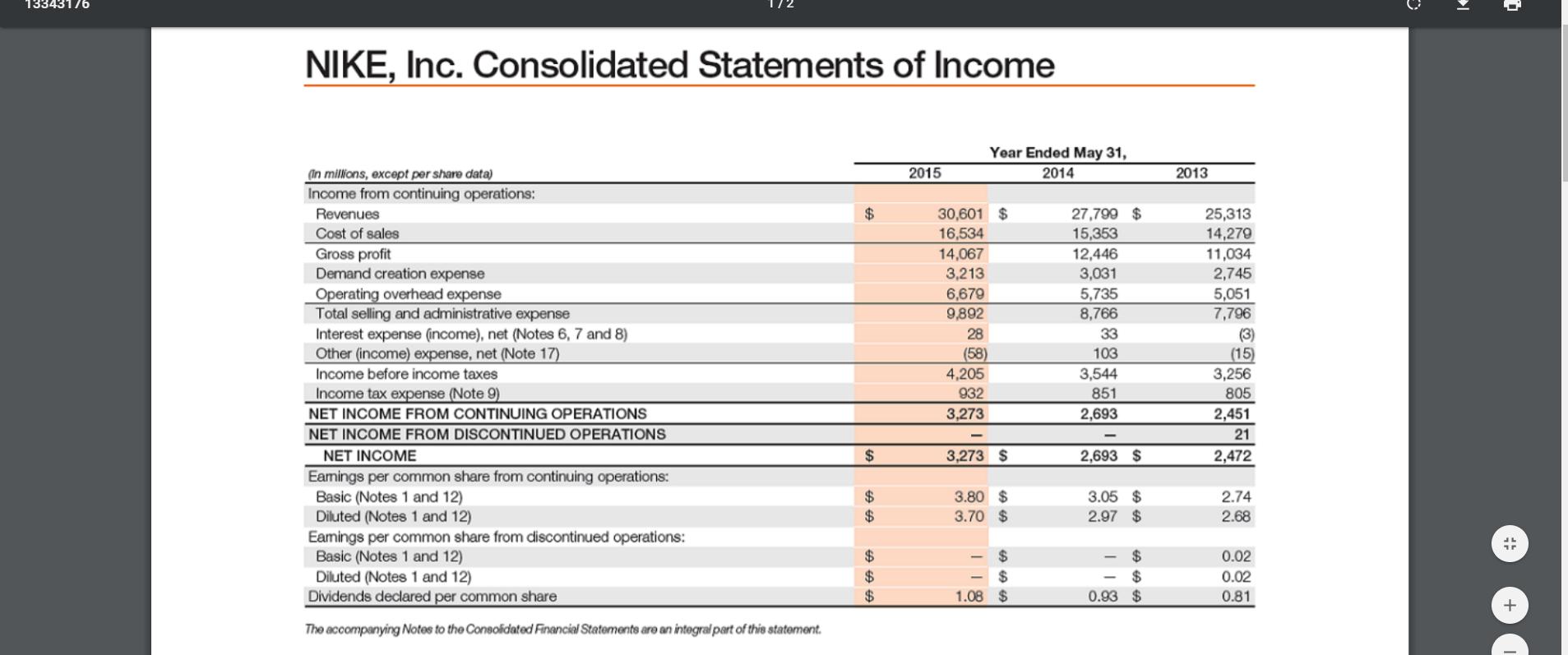

The financial statements for Nike, Inc. , are presented in at the end of the text. The following additional information is available (in thousands): Accounts

The financial statements for Nike, Inc., are presented in at the end of the text. The following additional information is available (in thousands):

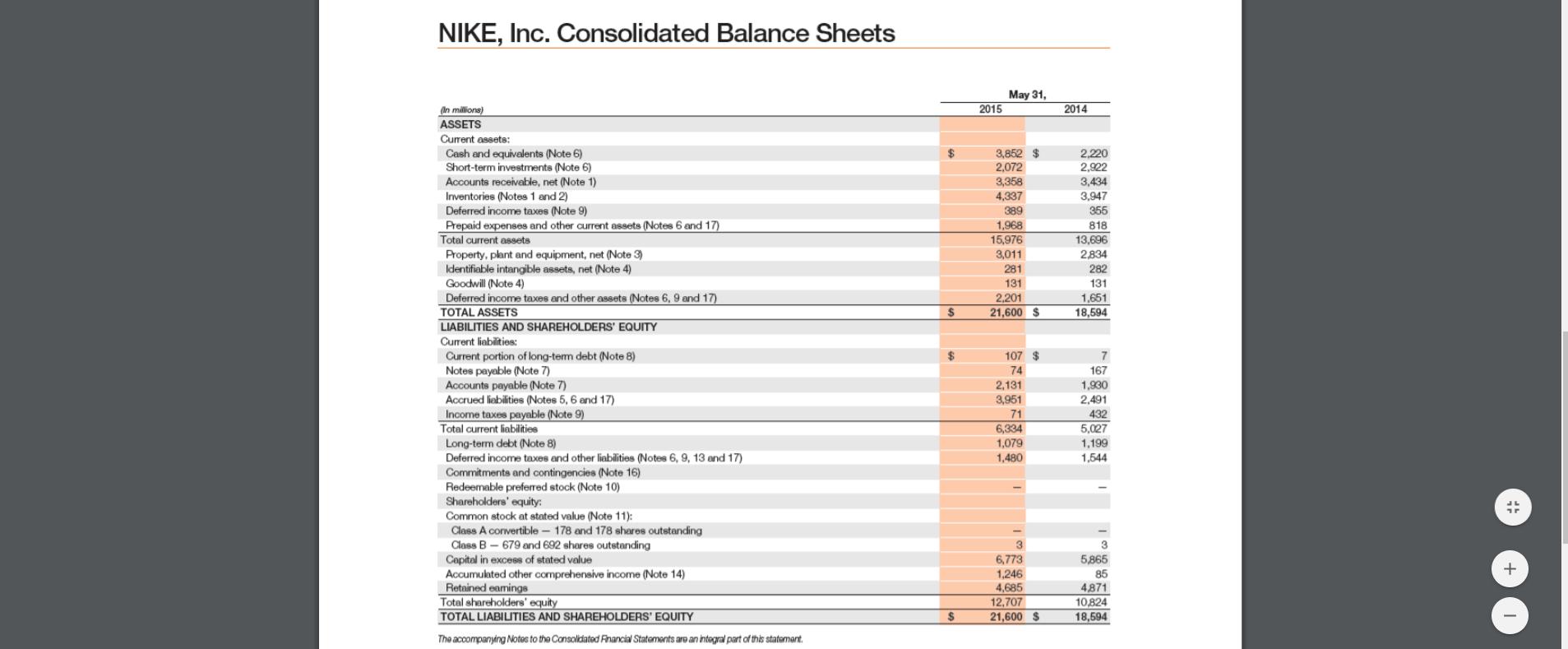

Accounts receivable at May 31, 2013 | $ 3,117 |

Inventories at May 31, 2013 | 3,484 |

Total assets at May 31, 2013 | 17,545 |

Stockholders' equity at May 31, 2013 | 11,081 |

Instructions

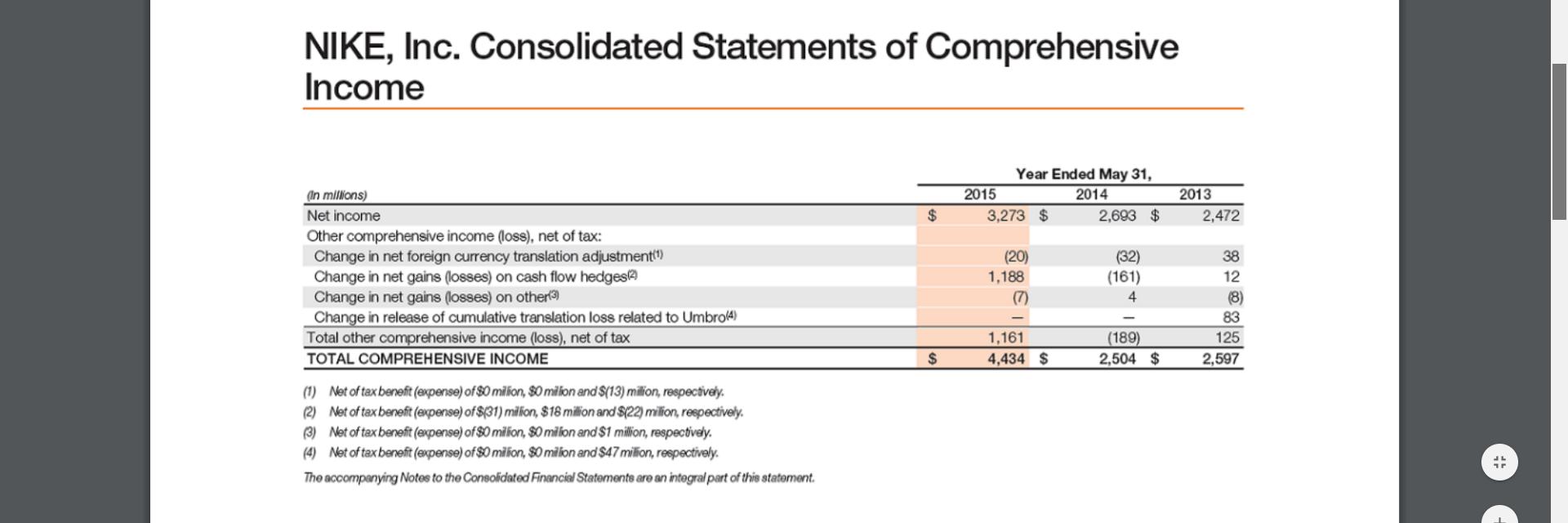

Find the income statement, balance sheet, and statement of cash flows. Without calculating any ratios, discuss with class peers both the financial position and performance of the entity. Be as specific as possible, yet, without using any ratios. What might need to change to increase their position?

- Determine the following measures for the fiscal years ended May 31, 2015, and May 31. (Round ratios and percentages to one decimal place.)

- Working capital

- Current ratio

- Quick ratio

- Accounts receivable turnover

- Number of days' sales in receivables

- Inventory turnover

- Number of days' sales in inventory

- Ratio of liabilities to stockholders' equity

- Asset turnover

- Return on total assets, assuming interest expense is $28 million for the year ending May 31, 2015, and $24 million for the year ending May 31, 2014

13343176 NIKE, Inc. Consolidated Statements of Income Year Ended May 31, (In millions, except per share data) Income from continuing operations: 2015 2014 2013 Revenues 24 30,601 $ 27,799 $ 25,313 14,279 Cost of sales 16,534 15,353 Gross profit Demand creation expense Operating overhead expense Total selling and administrative expense Interest expense (income), net (Notes 6, 7 and 8) Other (income) expense, net (Note 17) 11,034 2,745 5,051 7,796 14,067 3,213 12,446 3,031 6,679 9,892 5,735 8,766 28 33 (58) 4,205 (3) (15) 3,256 103 Income before income taxes 3,544 Income tax expense (Note 9) 932 851 805 NET INCOME FROM CONTINUING OPERATIONS 3,273 2,693 2,451 NET INCOME FROM DISCONTINUED OPERATIONS 21 NET INCOME 2$ 3,273 $ 2,693 $ 2,472 Eamings per common share from continuing operations: Basic (Notes 1 and 12) Diluted (Notes 1 and 12) Eamings per common share from discontinued operations: Basic (Notes 1 and 12) Diluted (Notes 1 and 12) Dividends declared per common share 2$ 24 3.05 $ 2.97 $ 3.80 $ 2.74 3.70 $ 2.68 24 24 $4 24 24 0.02 24 $ 0.02 1.08 $ 0.93 $ 0.81 The accompanying Notes to the Consolidated Financial Statements are an integral part of this statoment.

Step by Step Solution

3.35 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Management of NIKE Inc is responsible for the information and representations contained in this report The financial statements have been prepared in conformity with the generally accepted accounting ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d7d62c9020_176106.pdf

180 KBs PDF File

635d7d62c9020_176106.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started