Question

Financial Statements for Partnership The ledger of Camila Ramirez and Ping Xue, attorneys-at-law, contains the following accounts and balances after adjustments have been recorded on

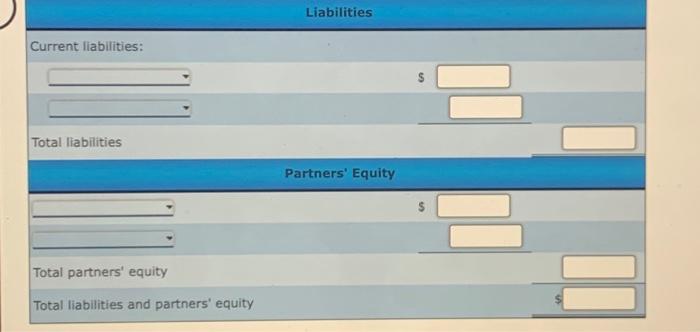

Financial Statements for Partnership

The ledger of Camila Ramirez and Ping Xue, attorneys-at-law, contains the following accounts and balances after adjustments have been recorded on December 31, 20Y2:

| Ramirez and Xue | |||

| Trial Balance | |||

| December 31, 20Y2 | |||

| Debit Balances | Credit Balances | ||

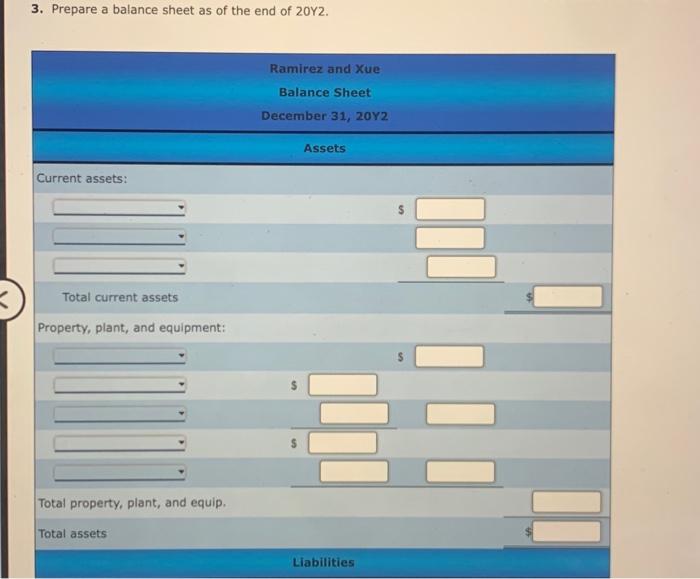

| Cash | 47,500 | ||

| Accounts Receivable | 45,200 | ||

| Supplies | 1,700 | ||

| Land | 113,000 | ||

| Building | 123,800 | ||

| Accumulated DepreciationBuilding | 70,600 | ||

| Office Equipment | 52,000 | ||

| Accumulated DepreciationOffice Equipment | 21,900 | ||

| Accounts Payable | 33,700 | ||

| Salaries Payable | 3,600 | ||

| Camila Ramirez, Capital | 110,000 | ||

| Camila Ramirez, Drawing | 50,900 | ||

| Ping Xue, Capital | 67,800 | ||

| Ping Xue, Drawing | 73,500 | ||

| Professional Fees | 414,200 | ||

| Salary Expense | 165,000 | ||

| Depreciation ExpenseBuilding | 16,400 | ||

| Property Tax Expense | 10,200 | ||

| Heating and Lighting Expense | 8,100 | ||

| Supplies Expense | 5,900 | ||

| Depreciation ExpenseOffice Equipment | 5,100 | ||

| Miscellaneous Expense | 3,500 | ||

| 721,800 | 721,800 |

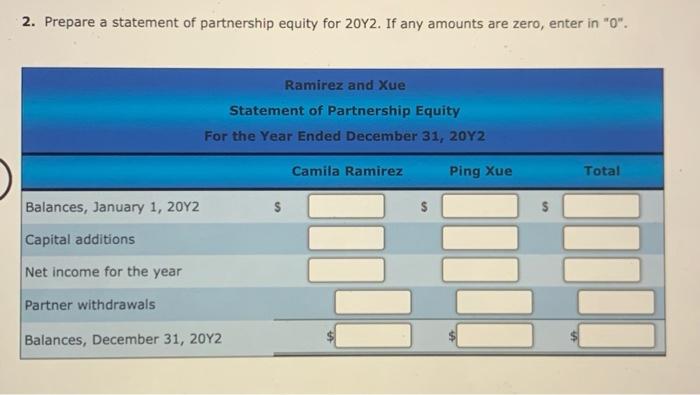

The balance in Xue' capital account includes an additional investment of $12,000 made on May 5, 20Y2.

Required:

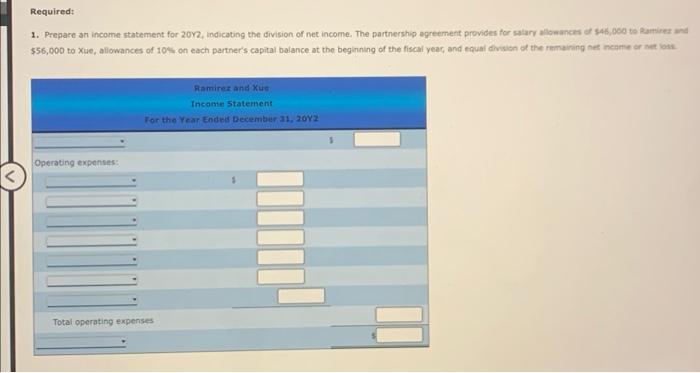

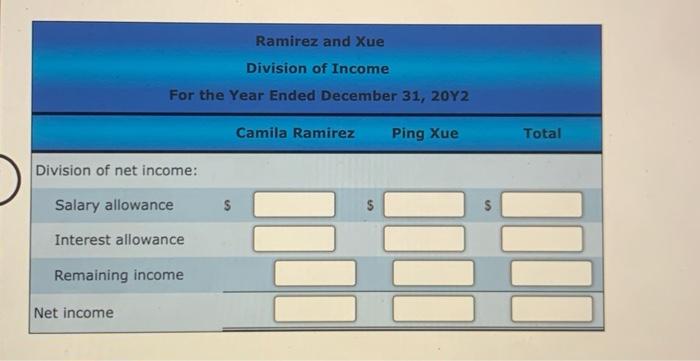

1. Prepare an income statement for 20Y2, indicating the division of net income. The partnership agreement provides for salary allowances of $46,000 to Ramirez and $56,000 to Xue, allowances of 10% on each partner's capital balance at the beginning of the fiscal year, and equal division of the remaining net income or net loss.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started