Answered step by step

Verified Expert Solution

Question

1 Approved Answer

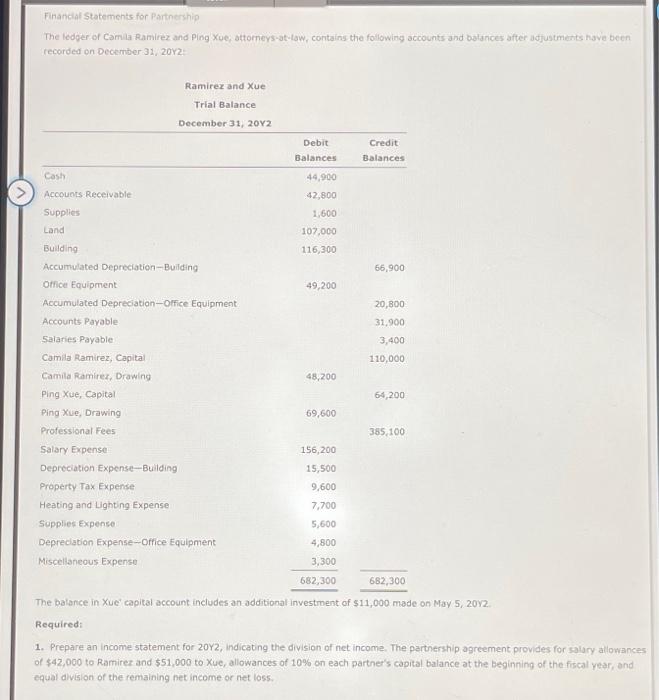

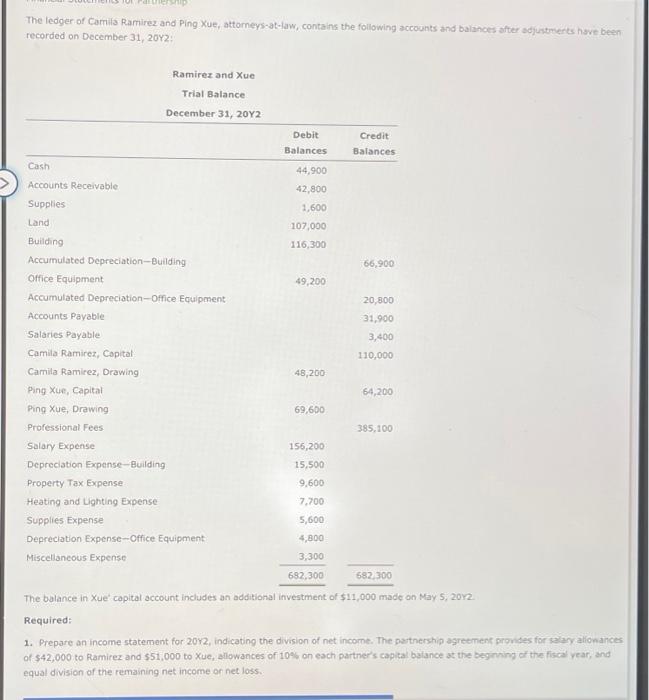

Financial Statements for Partnership The ledger of Camila Ramirez and Ping Xue, attorneys-at-law, contains the following accounts and balances after adjustments have been recorded on

Financial Statements for Partnership The ledger of Camila Ramirez and Ping Xue, attorneys-at-law, contains the following accounts and balances after adjustments have been recorded on December 31, 20Y2: Cash Accounts Receivable Supplies Land Building Accumulated Depreciation-Building Office Equipment Accumulated Depreciation-Office Equipment Accounts Payable Salaries Payable Camila Ramirez, Capital Camila Ramirez, Drawing Ping Xue, Capital Ping Xue, Drawing Professional Fees Ramirez and Xue Trial Balance December 31, 20Y2 Salary Expense Depreciation Expense-Building Property Tax Expense Heating and Lighting Expense Supplies Expense Debit Balances Depreciation Expense-Office Equipment Miscellaneous Expense 44,900 42,800 1,600 107,000 116,300 49,200 48,200 69,600 Credit Balances 66,900 20,800 31,900 3,400 110,000 64,200 385,100 156,200 15,500 9,600 7,700 5,600 4,800 3,300 682,300 The balance in Xue' capital account includes an additional investment of $11,000 made on May 5, 20Y2. 682,300 Required: 1. Prepare an income statement for 20Y2, indicating the division of net income. The partnership agreement provides for salary allowances of $42,000 to Ramirez and $51,000 to Xue, allowances of 10% on each partner's capital balance at the beginning of the fiscal year, and equal division of the remaining net income or net loss.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started