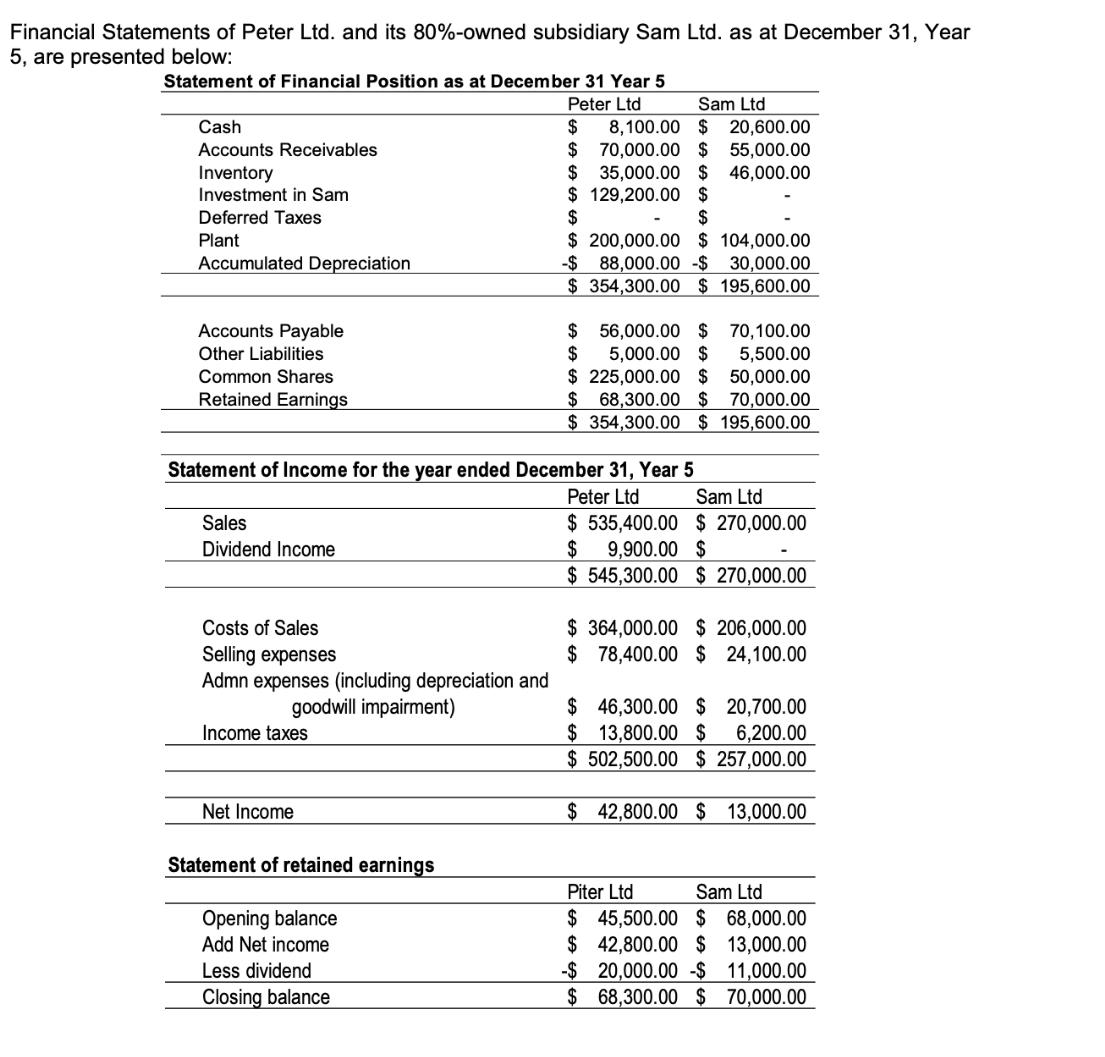

Financial Statements of Peter Ltd. and its 80%-owned subsidiary Sam Ltd. as at December 31, Year 5, are presented below: Statement of Financial Position

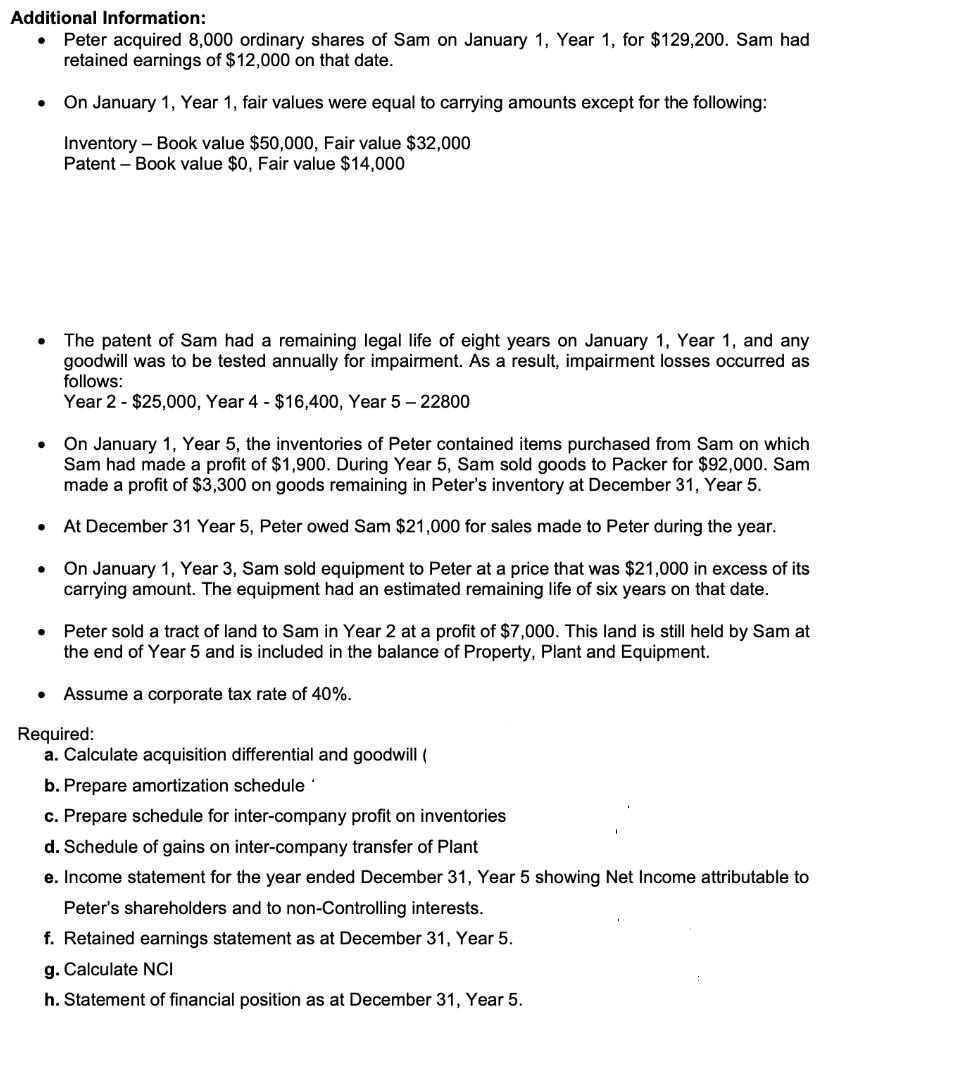

Financial Statements of Peter Ltd. and its 80%-owned subsidiary Sam Ltd. as at December 31, Year 5, are presented below: Statement of Financial Position as at December 31 Year 5 Peter Ltd Sam Ltd Cash Accounts Receivables $ 8,100.00 $ 20,600.00 $70,000.00 $ 55,000.00 $ 35,000.00 $ 46,000.00 $ 129,200.00 $ Inventory Investment in Sam Deferred Taxes $ $ - Plant $ 200,000.00 $ 104,000.00 Accumulated Depreciation -$ 88,000.00 $ 30,000.00 $ 354,300.00 $ 195,600.00 Accounts Payable Other Liabilities Common Shares $ 56,000.00 $ 70,100.00 $ 5,000.00 $ 5,500.00 $225,000.00 $ 50,000.00 $ 68,300.00 $ 70,000.00 $ 354,300.00 $ 195,600.00 Retained Earnings Statement of Income for the year ended December 31, Year 5 Peter Ltd Sam Ltd Sales $ 535,400.00 $ 270,000.00 $ 9,900.00 $ Dividend Income $545,300.00 $ 270,000.00 Costs of Sales $364,000.00 $ 206,000.00 $78,400.00 $ 24,100.00 Selling expenses Admn expenses (including depreciation and goodwill impairment) Income taxes $46,300.00 $ 20,700.00 $ 13,800.00 $ 6,200.00 $502,500.00 $ 257,000.00 Net Income $ 42,800.00 $ 13,000.00 Statement of retained earnings Piter Ltd Sam Ltd Opening balance Add Net income $ 45,500.00 $ 68,000.00 $ 42,800.00 $ 13,000.00 -$20,000.00 $ 11,000.00 $ 68,300.00 $ 70,000.00 Less dividend Closing balance Additional Information: Peter acquired 8,000 ordinary shares of Sam on January 1, Year 1, for $129,200. Sam had retained earnings of $12,000 on that date. On January 1, Year 1, fair values were equal to carrying amounts except for the following: Inventory Book value $50,000, Fair value $32,000 Patent - Book value $0, Fair value $14,000 The patent of Sam had a remaining legal life of eight years on January 1, Year 1, and any goodwill was to be tested annually for impairment. As a result, impairment losses occurred as follows: Year 2 - $25,000, Year 4 - $16,400, Year 5-22800 On January 1, Year 5, the inventories of Peter contained items purchased from Sam on which Sam had made a profit of $1,900. During Year 5, Sam sold goods to Packer for $92,000. Sam made a profit of $3,300 on goods remaining in Peter's inventory at December 31, Year 5. At December 31 Year 5, Peter owed Sam $21,000 for sales made to Peter during the year. On January 1, Year 3, Sam sold equipment to Peter at a price that was $21,000 in excess of its carrying amount. The equipment had an estimated remaining life of six years on that date. Peter sold a tract of land to Sam in Year 2 at a profit of $7,000. This land is still held by Sam at the end of Year 5 and is included in the balance of Property, Plant and Equipment. Assume a corporate tax rate of 40%. Required: a. Calculate acquisition differential and goodwill ( b. Prepare amortization schedule c. Prepare schedule for inter-company profit on inventories d. Schedule of gains on inter-company transfer of Plant e. Income statement for the year ended December 31, Year 5 showing Net Income attributable to Peter's shareholders and to non-Controlling interests. f. Retained earnings statement as at December 31, Year 5. g. Calculate NCI h. Statement of financial position as at December 31, Year 5.

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a The acquisition differential is 129200 12000 117200 The goodwill is 117200 14000 103200 b The amor...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started