Answered step by step

Verified Expert Solution

Question

1 Approved Answer

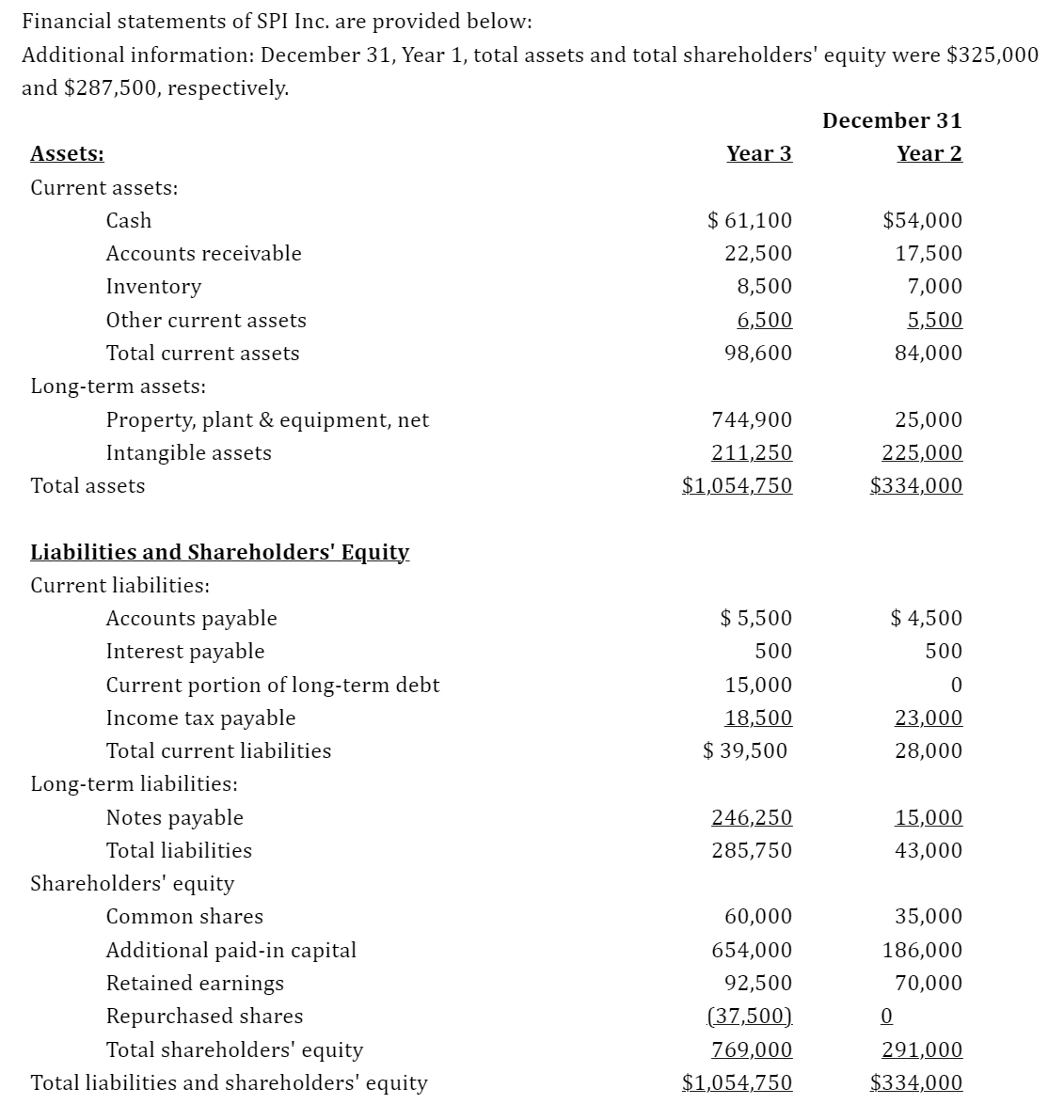

Financial statements of SPI Inc. are provided below: Additional information: December 31, Year 1, total assets and total shareholders' equity were $325,000 and $287,500, respectively.

Financial statements of SPI Inc. are provided below: Additional information: December 31, Year 1, total assets and total shareholders' equity were $325,000 and $287,500, respectively.

December 31Assets:Year 3Year 2Current assets:Cash$ 61,100$54,000Accounts receivable22,50017,500Inventory8,5007,000Other current assets6,5005,500Total current assets98,60084,000Long-term assets:Property, plant & equipment, net744,90025,000Intangible assets211,250225,000Total assets$1,054,750$334,000Liabilities and Shareholders' EquityCurrent liabilities:Accounts payable$ 5,500$ 4,500Interest payable500500Current portion of long-term debt15,0000Income tax payable18,50023,000Total current liabilities $ 39,50028,000Long-term liabilities:Notes payable246,25015,000Total liabilities285,75043,000Shareholders' equityCommon shares60,00035,000Additional paid-in capital654,000186,000Retained earnings92,50070,000Repurchased shares(37,500)0Total shareholders' equity769,000291,000Total liabilities and shareholders' equity$1,054,750$334,000For the Years EndedYear 3Year 2Net sales$475,000$387,500Cost of goods sold240,000200,000Gross profit235,000187,500Operating expenses170,000138,500Income from operations65,00049,000Interest expense26,0001,750Income before taxes39,00047,250Income taxes15,00018,500Net income$ 24,000$ 28,750

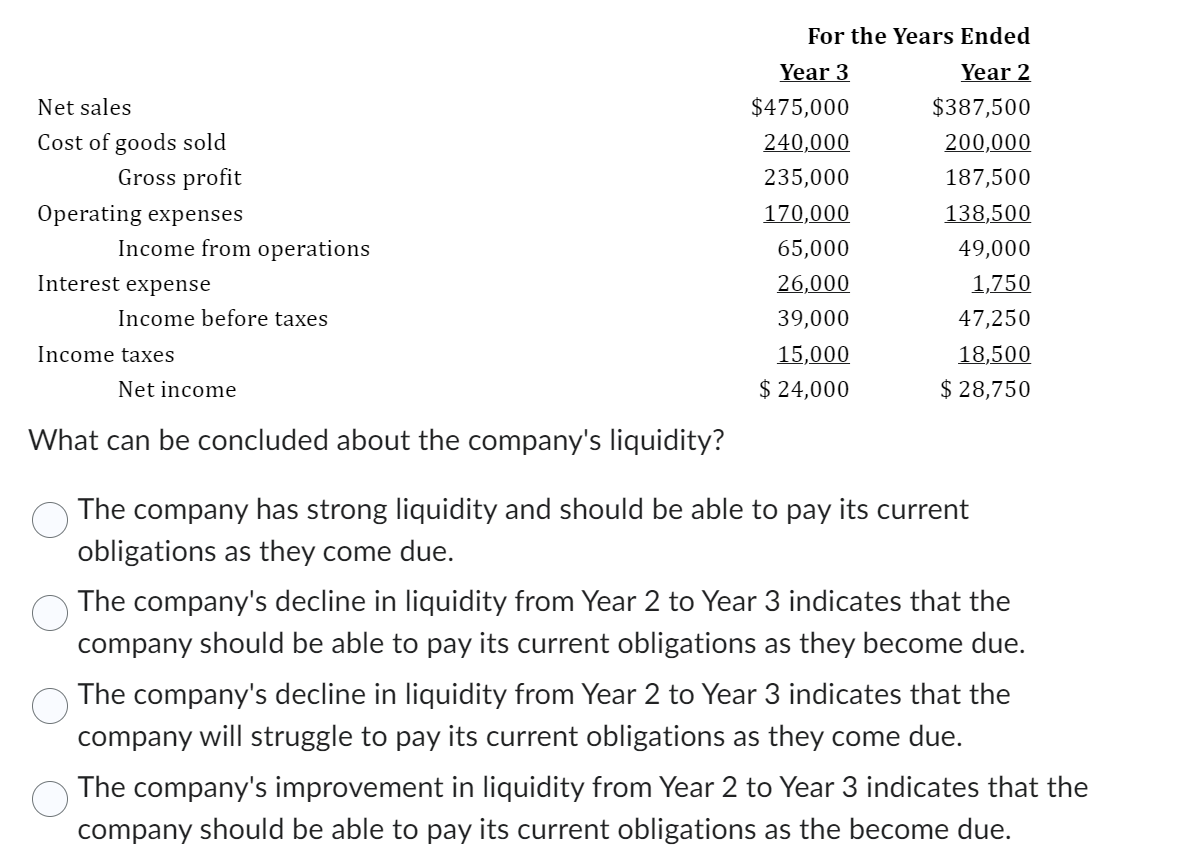

What can be concluded about the company's liquidity?

The company has strong liquidity and should be able to pay its current obligations as they come due. The company's decline in liquidity from Year 2 to Year 3 indicates that the company should be able to pay its current obligations as they become due. The company's decline in liquidity from Year 2 to Year 3 indicates that the company will struggle to pay its current obligations as they come due. The company's improvement in liquidity from Year 2 to Year 3 indicates that the company should be able to pay its current obligations as the become due.What can be concluded about the company's debt management?

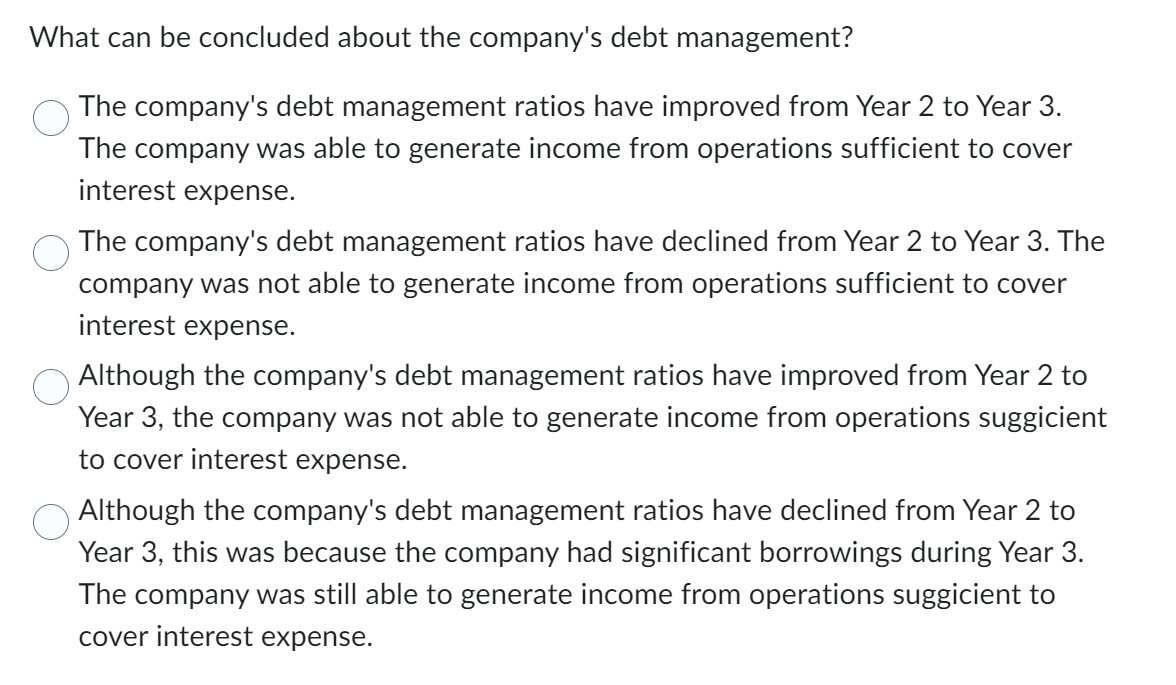

The company's debt management ratios have improved from Year 2 to Year 3. The company was able to generate income from operations sufficient to cover interest expense. The company's debt management ratios have declined from Year 2 to Year 3. The company was not able to generate income from operations sufficient to cover interest expense. Although the company's debt management ratios have improved from Year 2 to Year 3, the company was not able to generate income from operations suggicient to cover interest expense. Although the company's debt management ratios have declined from Year 2 to Year 3, this was because the company had significant borrowings during Year 3. The company was still able to generate income from operations suggicient to cover interest expense.

Financial statements of SPI Inc. are provided below: vvnat can pe concuaea about the company s IIquaty? The company has strong liquidity and should be able to pay its current obligations as they come due. The company's decline in liquidity from Year 2 to Year 3 indicates that the company should be able to pay its current obligations as they become due. The company's decline in liquidity from Year 2 to Year 3 indicates that the company will struggle to pay its current obligations as they come due. The company's improvement in liquidity from Year 2 to Year 3 indicates that th company should be able to pay its current obligations as the become due. What can be concluded about the company's debt management? The company's debt management ratios have improved from Year 2 to Year 3. The company was able to generate income from operations sufficient to cover interest expense. The company's debt management ratios have declined from Year 2 to Year 3. The company was not able to generate income from operations sufficient to cover interest expense. Although the company's debt management ratios have improved from Year 2 to Year 3, the company was not able to generate income from operations suggicient to cover interest expense. Although the company's debt management ratios have declined from Year 2 to Year 3, this was because the company had significant borrowings during Year 3. The company was still able to generate income from operations suggicient to cover interest expense

Financial statements of SPI Inc. are provided below: vvnat can pe concuaea about the company s IIquaty? The company has strong liquidity and should be able to pay its current obligations as they come due. The company's decline in liquidity from Year 2 to Year 3 indicates that the company should be able to pay its current obligations as they become due. The company's decline in liquidity from Year 2 to Year 3 indicates that the company will struggle to pay its current obligations as they come due. The company's improvement in liquidity from Year 2 to Year 3 indicates that th company should be able to pay its current obligations as the become due. What can be concluded about the company's debt management? The company's debt management ratios have improved from Year 2 to Year 3. The company was able to generate income from operations sufficient to cover interest expense. The company's debt management ratios have declined from Year 2 to Year 3. The company was not able to generate income from operations sufficient to cover interest expense. Although the company's debt management ratios have improved from Year 2 to Year 3, the company was not able to generate income from operations suggicient to cover interest expense. Although the company's debt management ratios have declined from Year 2 to Year 3, this was because the company had significant borrowings during Year 3. The company was still able to generate income from operations suggicient to cover interest expense Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started