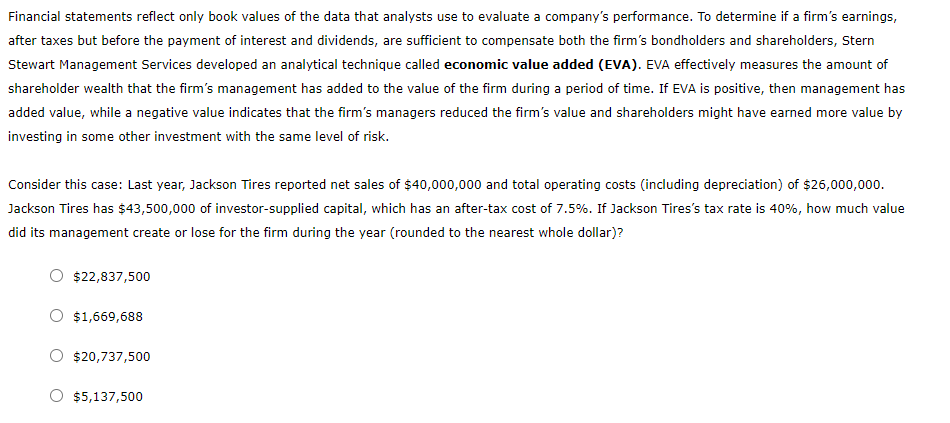

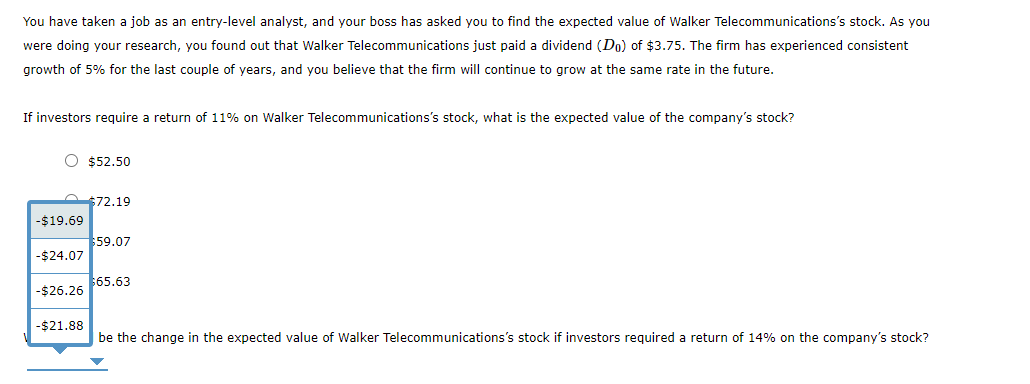

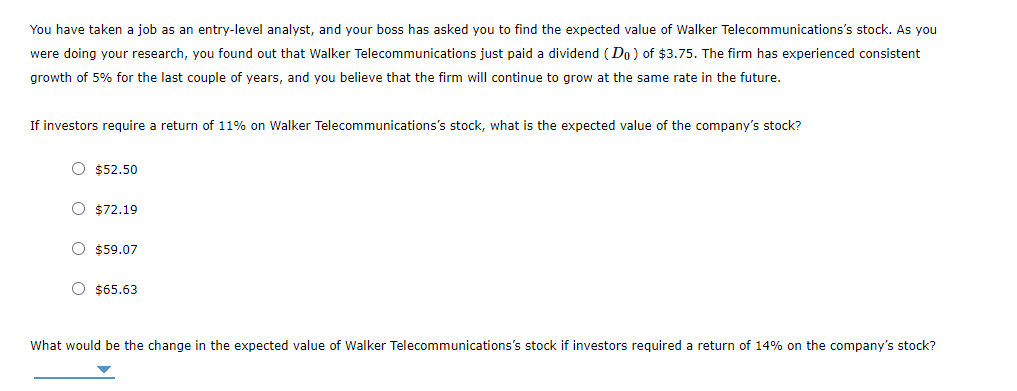

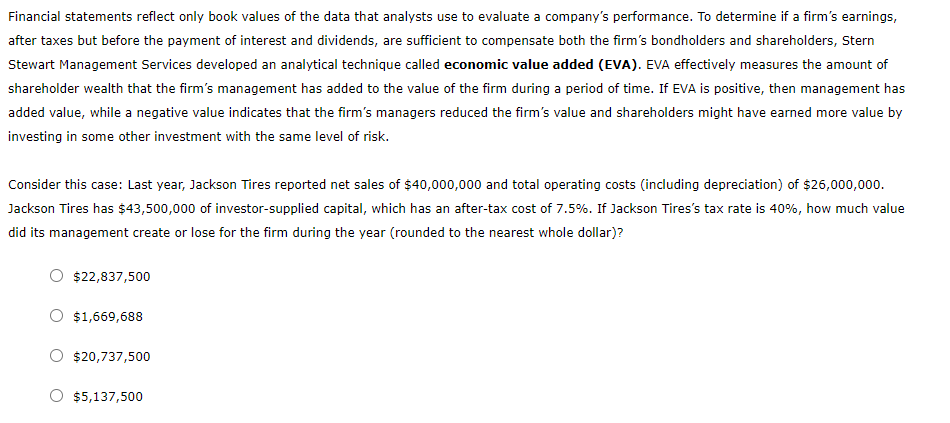

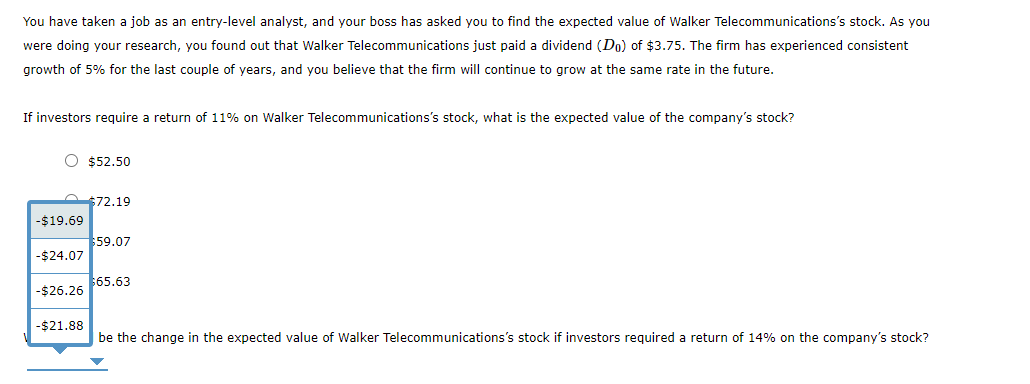

Financial statements reflect only book values of the data that analysts use to evaluate a company's performance. To determine if a firm's earnings, after taxes but before the payment of interest and dividends, are sufficient to compensate both the firm's bondholders and shareholders, Stern Stewart Management Services developed an analytical technique called economic value added (EVA). EVA effectively measures the amount of shareholder wealth that the firm's management has added to the value of the firm during a period of time. If EVA is positive, then management has added value, while a negative value indicates that the firm's managers reduced the firm's value and shareholders might have earned more value by investing in some other investment with the same level of risk. Consider this case: Last year, Jackson Tires reported net sales of $40,000,000 and total operating costs (including depreciation) of $26,000,000. Jackson Tires has $43,500,000 of investor-supplied capital, which has an after-tax cost of 7.5%. If Jackson Tires's tax rate is 40%, how much value did its management create or lose for the firm during the year (rounded to the nearest whole dollar)? $22,837,500 $1,669,688 $20,737,500 $5,137,500 You have taken a job as an entry-level analyst, and your boss has asked you to find the expected value of Walker Telecommunications's stock. As you were doing your research, you found out that Walker Telecommunications just paid a dividend (D) of $3.75. The firm has experienced consistent growth of 5% for the last couple of years, and you believe that the firm will continue to grow at the same rate in the future. If investors require a return of 11% on Walker Telecommunications's stock, what is the expected value of the company's stock? O $52.50 a $72.19 -$19.69 $59.07 -$24.07 $65.63 -$26.26 -$21.88 be the change in the expected value of Walker Telecommunications's stock if investors required a return of 14% on the company's stock? You have taken a job as an entry-level analyst, and your boss has asked you to find the expected value of Walker Telecommunications's stock. As you were doing your research, you found out that Walker Telecommunications just paid a dividend (D) of $3.75. The firm has experienced consistent growth of 5% for the last couple of years, and you believe that the firm will continue to grow at the same rate in the future. If investors require a return of 11% on Walker Telecommunications's stock, what is the expected value of the company's stock? $52.50 O $72.19 O $59.07 O $65.63 What would be the change in the expected value of Walker Telecommunications's stock if investors required a return of 14% on the company's stock