Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial statements relect only book values of the data that analysts use to evaluate a company's performance. To determine if a firm's earnings, after taxes

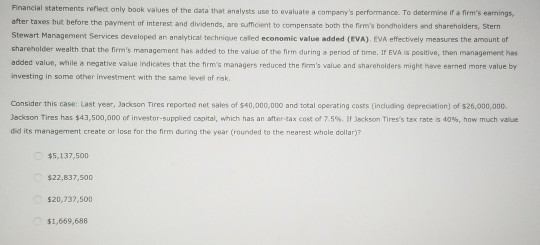

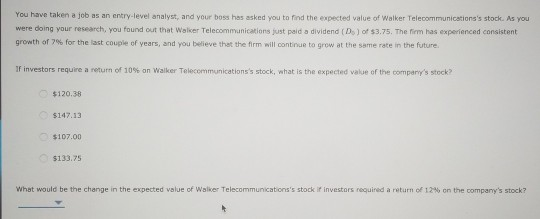

Financial statements relect only book values of the data that analysts use to evaluate a company's performance. To determine if a firm's earnings, after taxes but before the payment of interest and dividends, are su n t to compensate both the firm's bondholders and shareholders, Stern Stewart Management Services developed an analytical technical economic value added (EVA) EVA effectively measures the amount of shareholder wealth that the firm's management has added to the value of the firm during period of time. I EVA positive, the management has added value, while a negative value indicates that the firm's managers reduced the firm's value and shareholders might have earned more value by investing in some other investment with the same level of risk Consider this caser Last year, Jackson Tires reported net sales of $40,000,000 and total operating costs (including depreciation of $20,000,000 Jackson Tires has $43,500,000 of investor supplied capital, which has an after-tax cost of 7.5% fackson Tire's tax rate is 10% how much value did its management create or lose for the firm during the year (rounded to the nearest whole dollar? $5,137,500 $22,837,500 $20,737,500 $1,559.688 You have taken a job as an entry level analyst, and your boss has asked you to find the expected value of Walker Telecommunications's stock. As you were doing your research, you found out that Walker Telecommunications just paid a dividend (D) of $3.75. The firm has experienced consistent growth of 7 for the last couple of years, and you believe that the firm will continue to grow at the same rate in the future IF investors require a return of 10% on Walker Telecommunications's stock, what is the expected value of the company's stock? $120.38 $147.13 $107.00 $133.75 What would be the change in the expected value of Walker Telecommunications's stock investors required a return of 124 on the company's stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started