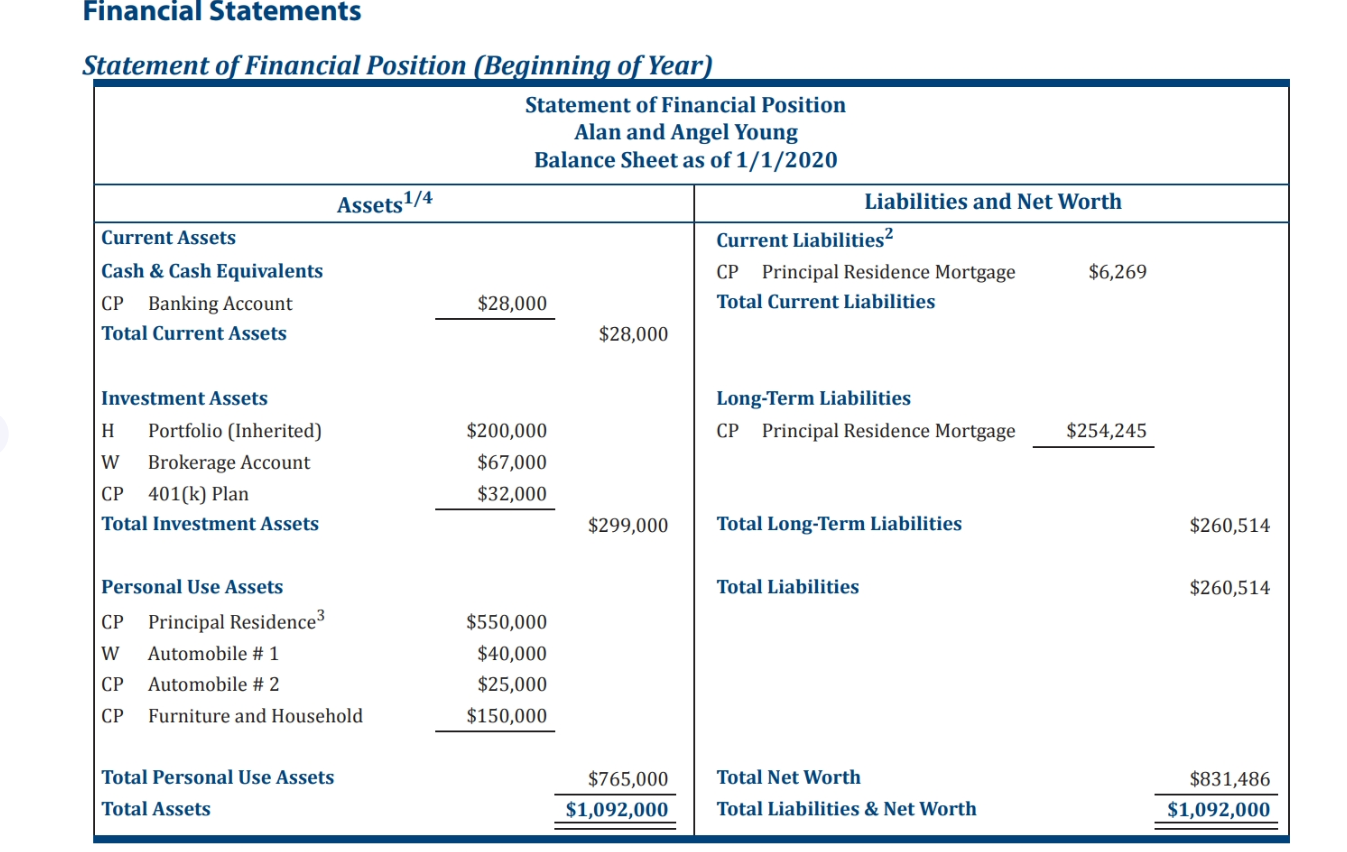

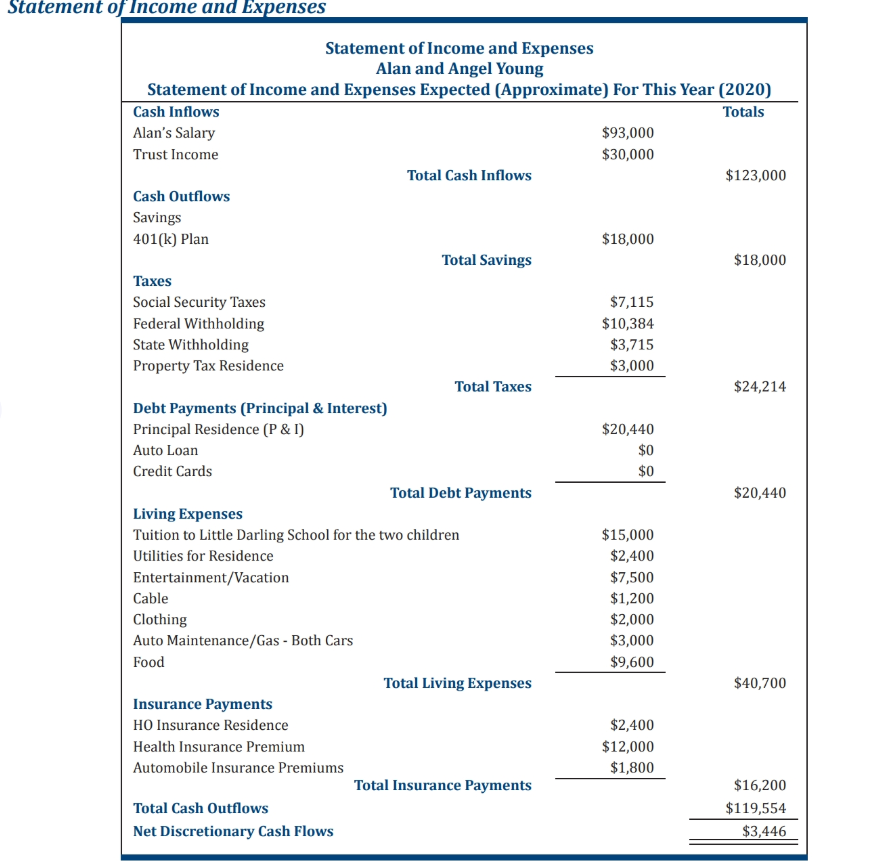

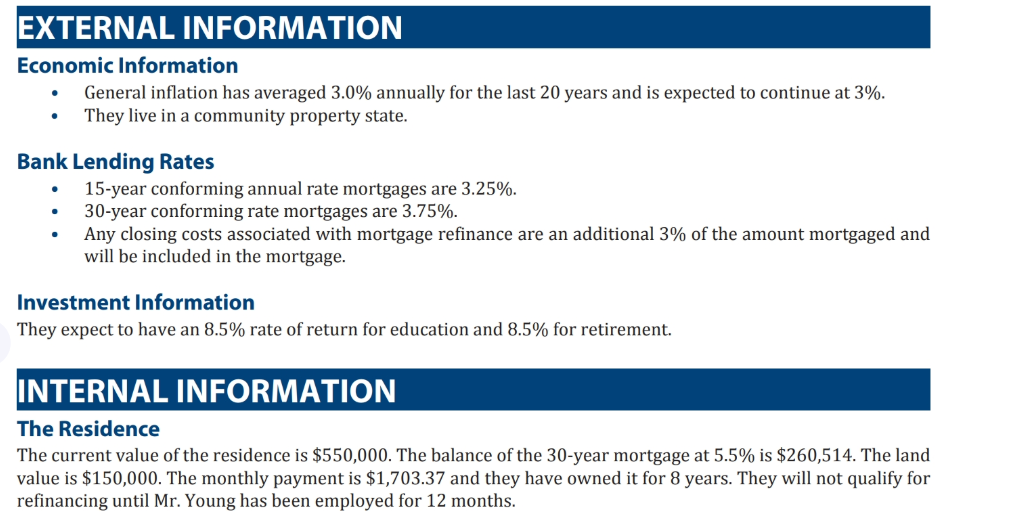

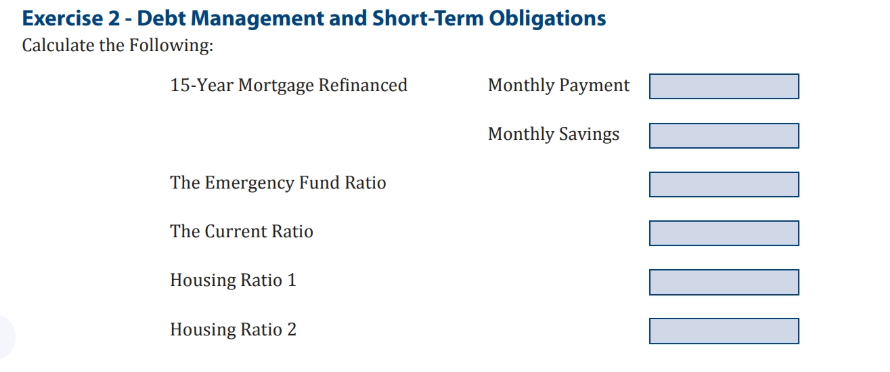

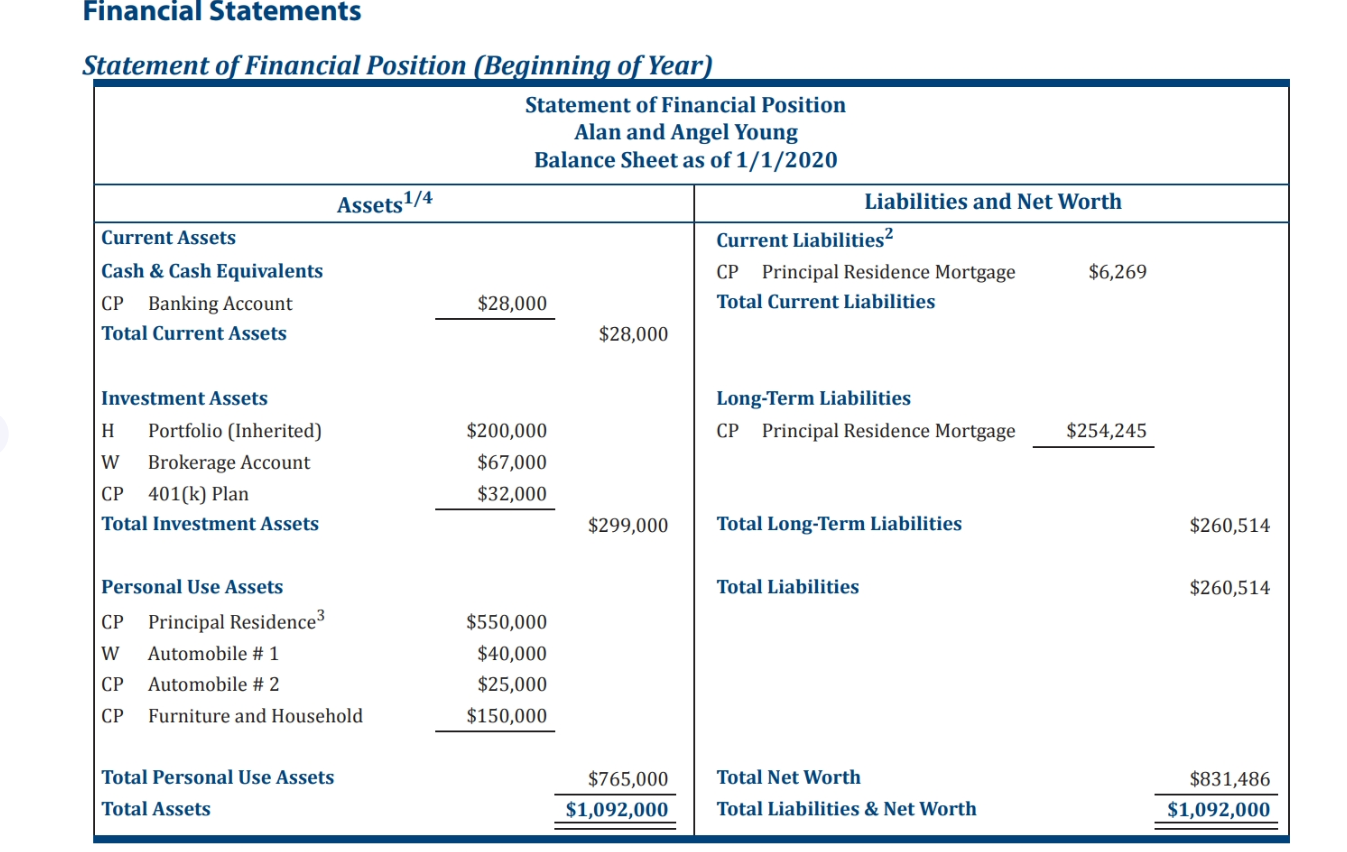

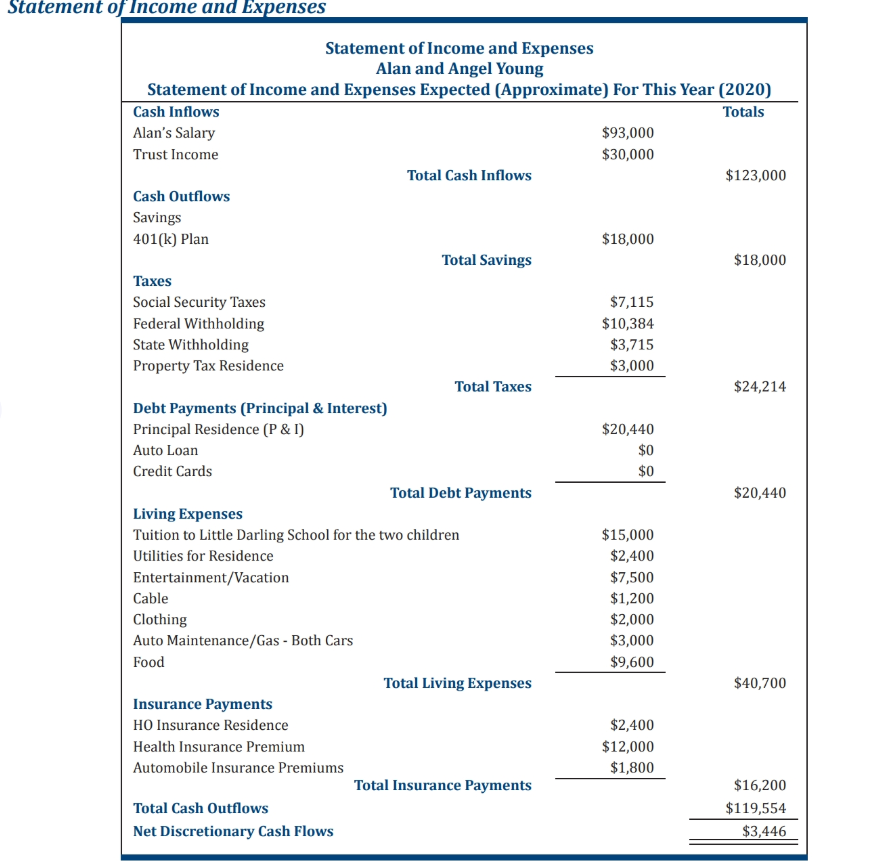

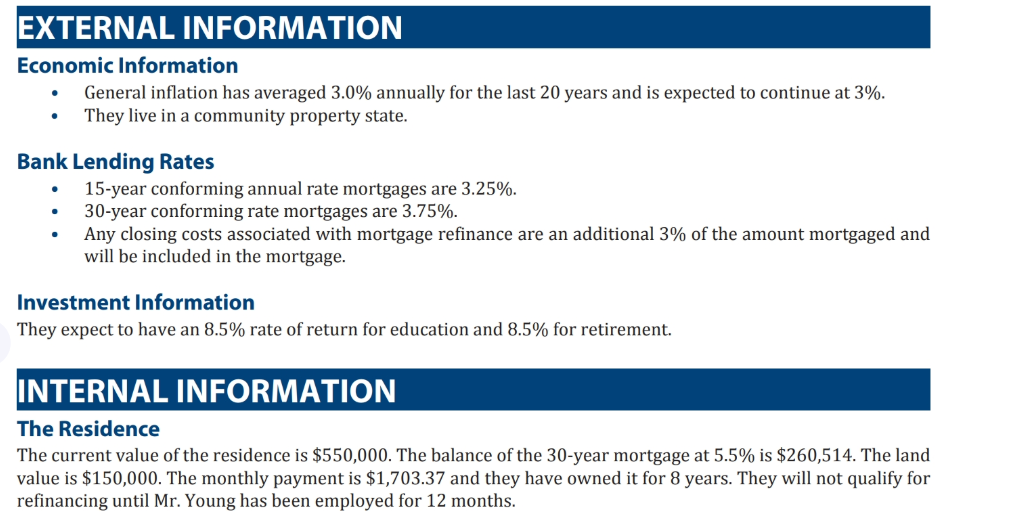

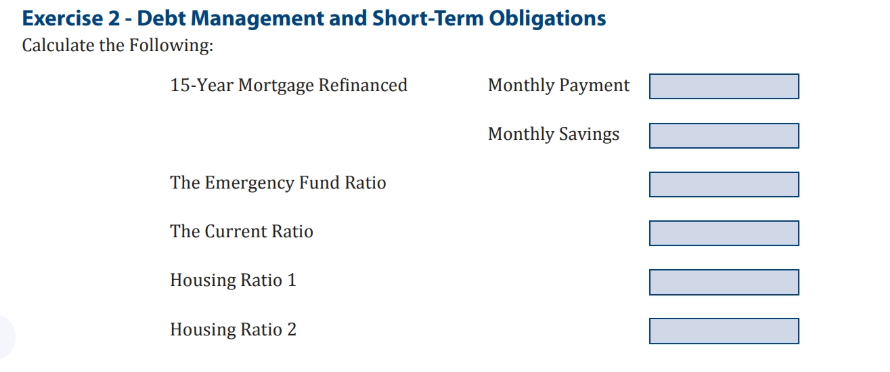

Financial Statements Statement of Financial Position (Beginning of Year) Statement of Financial Position Alan and Angel Young Balance Sheet as of 1/1/2020 Liabilities and Net Worth Current Assets Current Liabilities Cash & Cash Equivalents CP Principal Residence Mortgage $6,269 CP Banking Account $28,000 Total Current Liabilities Total Current Assets $28,000 Assets 1/4 Long-Term Liabilities CP Principal Residence Mortgage $254,245 Investment Assets H Portfolio (Inherited) W Brokerage Account CP 401(k) Plan Total Investment Assets $200,000 $67,000 $32,000 $299,000 Total Long-Term Liabilities $260,514 Total Liabilities $260,514 Personal Use Assets CP Principal Residence3 W Automobile # 1 CP Automobile # 2 CP Furniture and Household $550,000 $40,000 $25,000 $150,000 Total Personal Use Assets $765,000 $1,092,000 Total Net Worth Total Liabilities & Net Worth $831,486 $1,092,000 Total Assets Statement of Income and Expenses Statement of Income and Expenses Alan and Angel Young Statement of Income and Expenses Expected (Approximate) For This Year (2020) Cash Inflows Totals Alan's Salary $93,000 Trust Income $30,000 Total Cash Inflows $123,000 Cash Outflows Savings 401(k) Plan $18,000 Total Savings $18,000 Taxes Social Security Taxes $7,115 Federal Withholding $10,384 State Withholding $3,715 Property Tax Residence $3,000 Total Taxes $24,214 Debt Payments (Principal & Interest) Principal Residence (P & I) $20,440 Auto Loan $0 Credit Cards $0 Total Debt Payments $20,440 Living Expenses Tuition to Little Darling School for the two children $15,000 Utilities for Residence $2,400 Entertainment/Vacation $7,500 Cable $1,200 Clothing $2,000 Auto Maintenance/Gas - Both Cars $3,000 Food $9,600 Total Living Expenses $40,700 Insurance Payments HO Insurance Residence $2,400 Health Insurance Premium $12,000 Automobile Insurance Premiums $1,800 Total Insurance Payments $16,200 Total Cash Outflows $119,554 Net Discretionary Cash Flows $3,446 EXTERNAL INFORMATION Economic Information General inflation has averaged 3.0% annually for the last 20 years and is expected to continue at 3%. They live in a community property state. Bank Lending Rates 15-year conforming annual rate mortgages are 3.25%. 30-year conforming rate mortgages are 3.75%. Any closing costs associated with mortgage refinance are an additional 3% of the amount mortgaged and will be included in the mortgage. Investment Information They expect to have an 8.5% rate of return for education and 8.5% for retirement. INTERNAL INFORMATION The Residence The current value of the residence is $550,000. The balance of the 30-year mortgage at 5.5% is $260,514. The land value is $150,000. The monthly payment is $1,703.37 and they have owned it for 8 years. They will not qualify for refinancing until Mr. Young has been employed for 12 months. Exercise 2 - Debt Management and Short-Term Obligations Calculate the following: 15-Year Mortgage Refinanced Monthly Payment Monthly Savings The Emergency Fund Ratio IIIIII The Current Ratio Housing Ratio 1 Housing Ratio 2 Financial Statements Statement of Financial Position (Beginning of Year) Statement of Financial Position Alan and Angel Young Balance Sheet as of 1/1/2020 Liabilities and Net Worth Current Assets Current Liabilities Cash & Cash Equivalents CP Principal Residence Mortgage $6,269 CP Banking Account $28,000 Total Current Liabilities Total Current Assets $28,000 Assets 1/4 Long-Term Liabilities CP Principal Residence Mortgage $254,245 Investment Assets H Portfolio (Inherited) W Brokerage Account CP 401(k) Plan Total Investment Assets $200,000 $67,000 $32,000 $299,000 Total Long-Term Liabilities $260,514 Total Liabilities $260,514 Personal Use Assets CP Principal Residence3 W Automobile # 1 CP Automobile # 2 CP Furniture and Household $550,000 $40,000 $25,000 $150,000 Total Personal Use Assets $765,000 $1,092,000 Total Net Worth Total Liabilities & Net Worth $831,486 $1,092,000 Total Assets Statement of Income and Expenses Statement of Income and Expenses Alan and Angel Young Statement of Income and Expenses Expected (Approximate) For This Year (2020) Cash Inflows Totals Alan's Salary $93,000 Trust Income $30,000 Total Cash Inflows $123,000 Cash Outflows Savings 401(k) Plan $18,000 Total Savings $18,000 Taxes Social Security Taxes $7,115 Federal Withholding $10,384 State Withholding $3,715 Property Tax Residence $3,000 Total Taxes $24,214 Debt Payments (Principal & Interest) Principal Residence (P & I) $20,440 Auto Loan $0 Credit Cards $0 Total Debt Payments $20,440 Living Expenses Tuition to Little Darling School for the two children $15,000 Utilities for Residence $2,400 Entertainment/Vacation $7,500 Cable $1,200 Clothing $2,000 Auto Maintenance/Gas - Both Cars $3,000 Food $9,600 Total Living Expenses $40,700 Insurance Payments HO Insurance Residence $2,400 Health Insurance Premium $12,000 Automobile Insurance Premiums $1,800 Total Insurance Payments $16,200 Total Cash Outflows $119,554 Net Discretionary Cash Flows $3,446 EXTERNAL INFORMATION Economic Information General inflation has averaged 3.0% annually for the last 20 years and is expected to continue at 3%. They live in a community property state. Bank Lending Rates 15-year conforming annual rate mortgages are 3.25%. 30-year conforming rate mortgages are 3.75%. Any closing costs associated with mortgage refinance are an additional 3% of the amount mortgaged and will be included in the mortgage. Investment Information They expect to have an 8.5% rate of return for education and 8.5% for retirement. INTERNAL INFORMATION The Residence The current value of the residence is $550,000. The balance of the 30-year mortgage at 5.5% is $260,514. The land value is $150,000. The monthly payment is $1,703.37 and they have owned it for 8 years. They will not qualify for refinancing until Mr. Young has been employed for 12 months. Exercise 2 - Debt Management and Short-Term Obligations Calculate the following: 15-Year Mortgage Refinanced Monthly Payment Monthly Savings The Emergency Fund Ratio IIIIII The Current Ratio Housing Ratio 1 Housing Ratio 2