Financial statements:

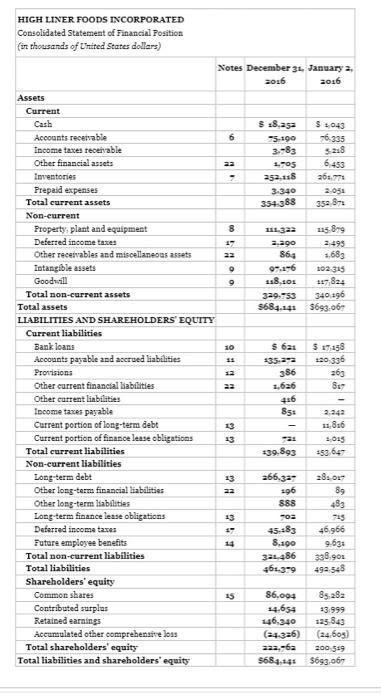

used to help investors understand a company's

performance, to compare amounts in or between

financial statements.

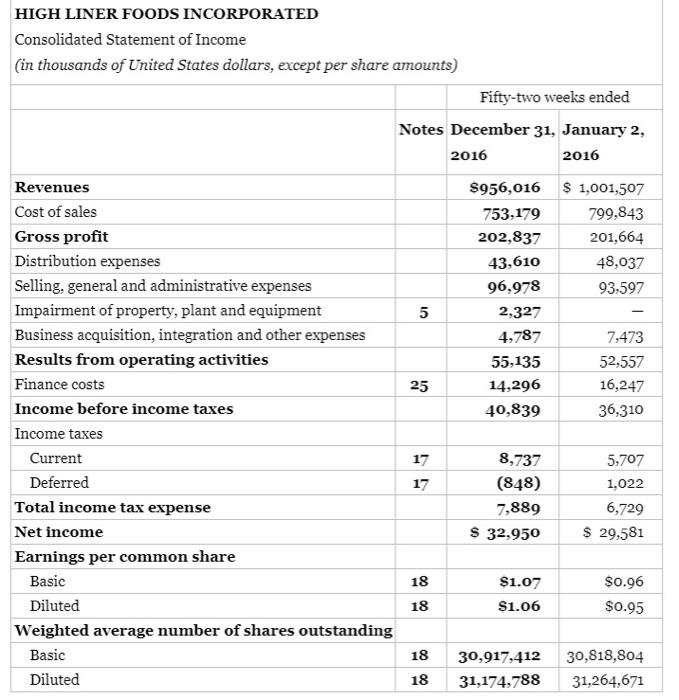

On the income statment, review it and stop when

it gets to the line net income

Write on the detail or lack of detail provided on

the statements of income. As an investor would

you find this statement helpful in understanding

the company's operations?

"Income tax expense' on the statement of income

is $7,870 (in thousands) for the fiscal year ended

January 2, 2021. Estimate the income tax rate

(%) paid by the company by dividing this year's

income tax expense by the 'Income before

income taxes. Is the income tax rate (%) similar

in the prior fiscal year?

HIGH LINER FOODS INCORPORATED Consolidated Statement of Income (in thousands of United States dollars, except per share amounts) Fifty-two weeks ended Notes December 31, January 2, 2016 2016 $ 1,001,507 799,843 201,664 48,037 93,597 $956,016 753,179 202,837 43,610 96,978 2,327 4,787 55,135 14,296 40,839 5 7,473 52,557 16,247 36,310 25 Revenues Cost of sales Gross profit Distribution expenses Selling, general and administrative expenses Impairment of property, plant and equipment Business acquisition, integration and other expenses Results from operating activities Finance costs Income before income taxes Income taxes Current Deferred Total income tax expense Net income Earnings per common share Basic Diluted Weighted average number of shares outstanding Basic Diluted 17 17 8,737 (848) 7,889 $ 32,950 5,707 1,022 6,729 $ 29,581 18 18 $1.07 $1.06 $0.96 $0.95 18 S 30,917,412 31,174,788 30,818,804 31,264,671 18 HIGH LINER FOODS INCORPORATED Consolidated Statement of Financial Position (in thousands of United States dollars) : 0 OH100 3,683 Oo Notes December 31. January 2, 2016 2016 Assets Current Cash $ 28.aga Accounts receivable 6 5.190 26.335 Income taxes receivable 3.-83 52:8 Other financial assets 1.905 6.453 Inventories 252,158 26.773 Prepaid expenses 3.340 2-051 Total current assets 354-388 352 - Non-current Property, plant and equipment 111.3a 125.899 Deferred income taxes a. ago 2493 Other receivables and miscellaneous assets 22 864 Intangible assets 04.-6 102315 Goodwill 18sos 127 824 Total non-current assets 329,753 340296 Total assets 5684.145 3693.06 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Bank loans 10 $ 621 $ 19:38 Accounts payable and accrued liabilities 135.aa 120 336 Provisions 386 363 Other current financial abilities 1,626 8 Other current liabilities 416 Income taxes payable 85: 2.242 Current portion of long-term debt 13 1836 Current portion of finance lease obligations 13 1.013 Total current liabilities 139,893 353 647 Non-current liabilities Long term debt 23 266.32 - 280 Other long-term financial liabilities 22 196 89 Other long-term liabilities 888 Long term finance lease obligations -oa 75 Deferred income taxes 17 45.383 46.966 Future employee benefits 14 8.100 9.631 Total non-current liabilities 321.486 338.901 Total liabilities 361.379 499 348 Shareholders' equity Common shares 15 86.004 85282 Contributed surplus 34.654 23.999 Retained earnings 146,340 125.843 Accumulated other comprehenste loss (24-326) (24 603) Total shareholders' equity 222.-6a 200-519 Total liabilities and shareholders' equity 5684,145 $693,06 D# 2 HIGH LINER FOODS INCORPORATED Consolidated Statement of Income (in thousands of United States dollars, except per share amounts) Fifty-two weeks ended Notes December 31, January 2, 2016 2016 $ 1,001,507 799,843 201,664 48,037 93,597 $956,016 753,179 202,837 43,610 96,978 2,327 4,787 55,135 14,296 40,839 5 7,473 52,557 16,247 36,310 25 Revenues Cost of sales Gross profit Distribution expenses Selling, general and administrative expenses Impairment of property, plant and equipment Business acquisition, integration and other expenses Results from operating activities Finance costs Income before income taxes Income taxes Current Deferred Total income tax expense Net income Earnings per common share Basic Diluted Weighted average number of shares outstanding Basic Diluted 17 17 8,737 (848) 7,889 $ 32,950 5,707 1,022 6,729 $ 29,581 18 18 $1.07 $1.06 $0.96 $0.95 18 S 30,917,412 31,174,788 30,818,804 31,264,671 18 HIGH LINER FOODS INCORPORATED Consolidated Statement of Financial Position (in thousands of United States dollars) : 0 OH100 3,683 Oo Notes December 31. January 2, 2016 2016 Assets Current Cash $ 28.aga Accounts receivable 6 5.190 26.335 Income taxes receivable 3.-83 52:8 Other financial assets 1.905 6.453 Inventories 252,158 26.773 Prepaid expenses 3.340 2-051 Total current assets 354-388 352 - Non-current Property, plant and equipment 111.3a 125.899 Deferred income taxes a. ago 2493 Other receivables and miscellaneous assets 22 864 Intangible assets 04.-6 102315 Goodwill 18sos 127 824 Total non-current assets 329,753 340296 Total assets 5684.145 3693.06 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Bank loans 10 $ 621 $ 19:38 Accounts payable and accrued liabilities 135.aa 120 336 Provisions 386 363 Other current financial abilities 1,626 8 Other current liabilities 416 Income taxes payable 85: 2.242 Current portion of long-term debt 13 1836 Current portion of finance lease obligations 13 1.013 Total current liabilities 139,893 353 647 Non-current liabilities Long term debt 23 266.32 - 280 Other long-term financial liabilities 22 196 89 Other long-term liabilities 888 Long term finance lease obligations -oa 75 Deferred income taxes 17 45.383 46.966 Future employee benefits 14 8.100 9.631 Total non-current liabilities 321.486 338.901 Total liabilities 361.379 499 348 Shareholders' equity Common shares 15 86.004 85282 Contributed surplus 34.654 23.999 Retained earnings 146,340 125.843 Accumulated other comprehenste loss (24-326) (24 603) Total shareholders' equity 222.-6a 200-519 Total liabilities and shareholders' equity 5684,145 $693,06 D# 2