FinancialACCT2 Chapter 10 Problem 36 Recording and Reporting Equity

Please fill out my spreadsheet, any help is greatly appreciated! Thanks!

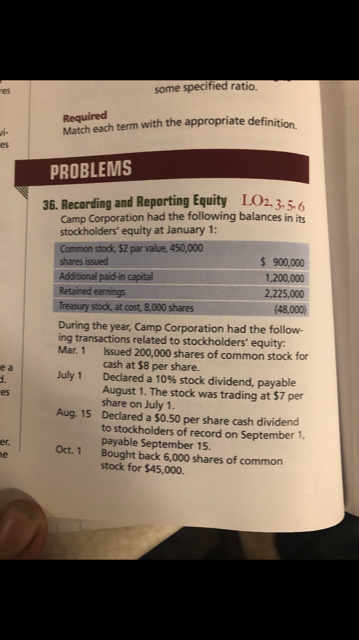

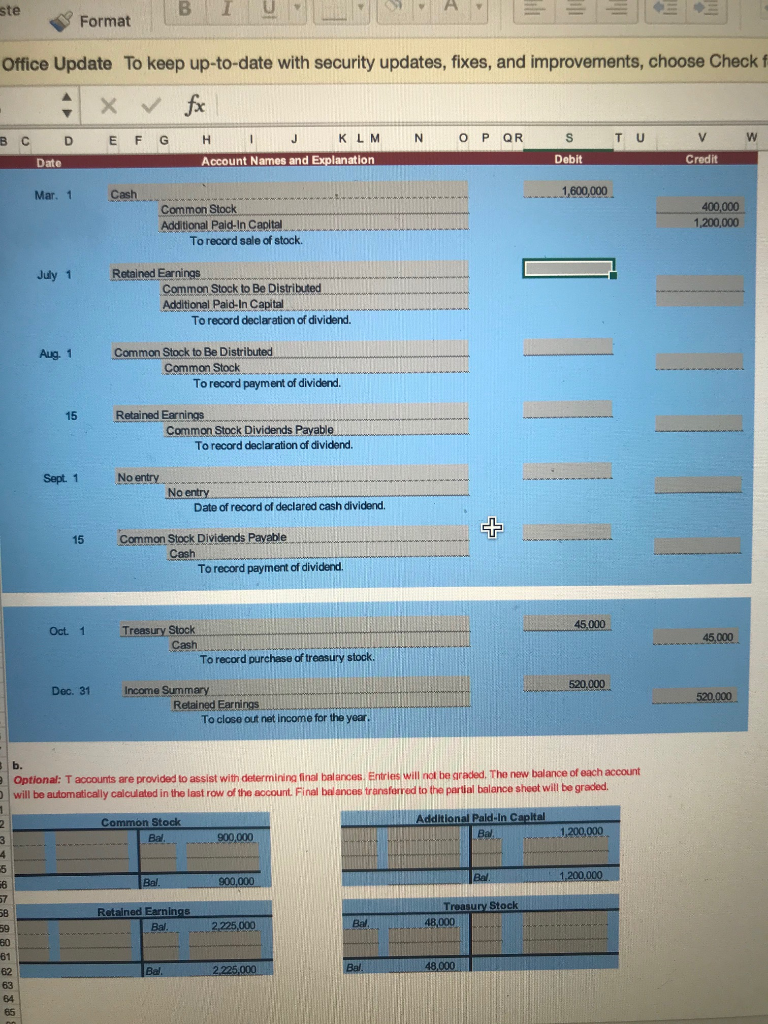

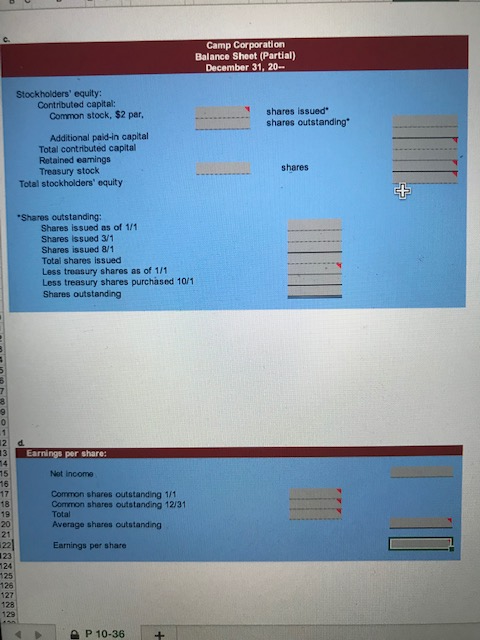

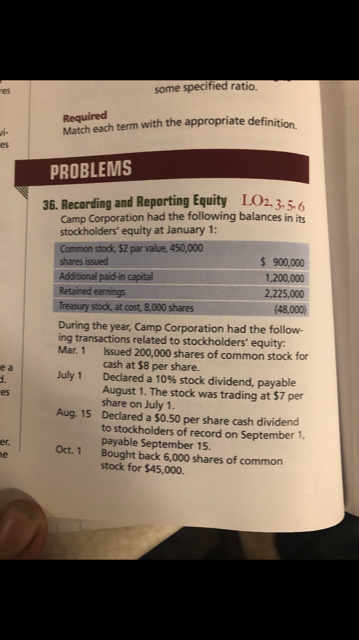

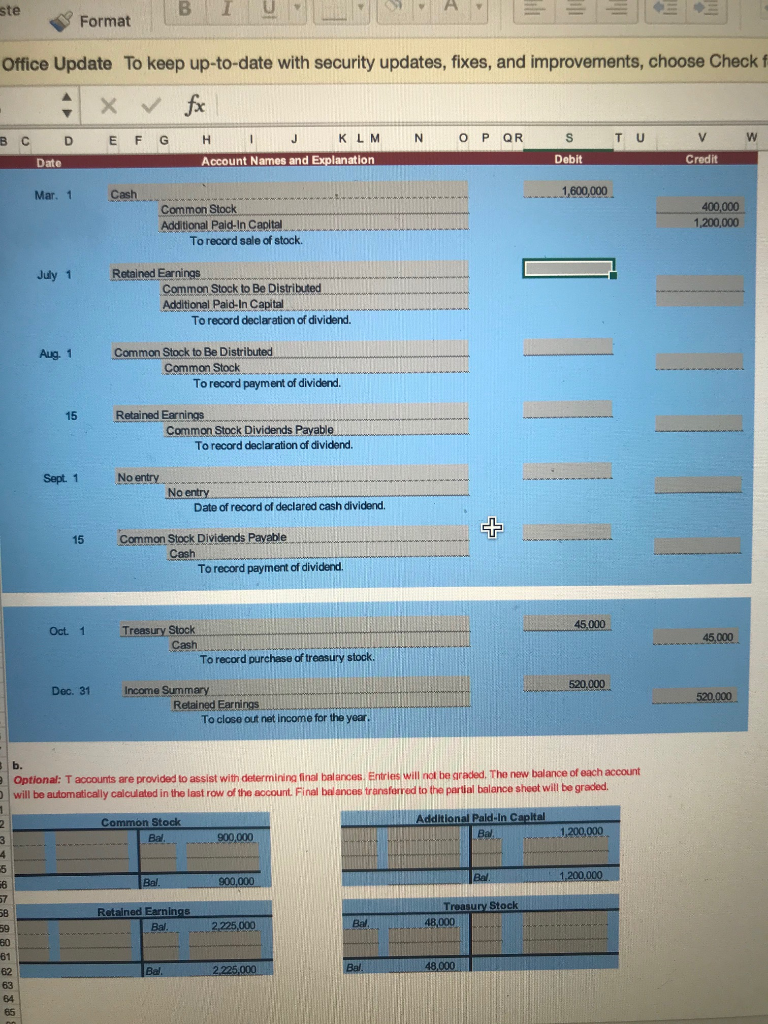

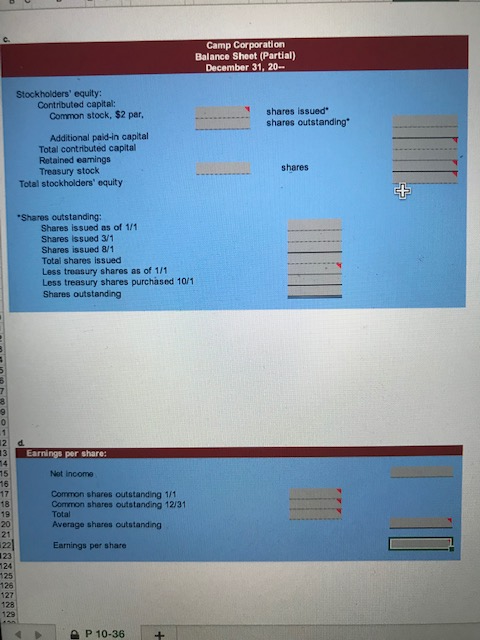

some specified ratio. es Required Match each term with the appropriate definition. vi- es PROBLEMS 36. Recording and Reporting Equity LO2, 3. 5,6. Camp Corporation had the following balances in its stockholders' equity at January 1: Common stock, $2 par value, 450,000 shares issued S 900,000 Additional paid-in capital Retained earnings 1,200,000 2,225,000 Treasury stock, at cost, 8,000 shares (48,000) During the year, Camp Corporation had the follow- ing transactions related to stockholders' equity: Issued 200,000 shares of common stock for Mar. 1 cash at $8 per share. e a Declared a 10% stock dividend, payable August 1. The stock was trading at $7 per July 1 es share on July 1. Aug. 15 Declared a $0.50 per share cash dividend to stockholders of record on payable September 15. Bought back 6,000 shares of common stock for $45,000. September 1, er. Oct. 1 e B I ste Format Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check f fx X P S KLM N O QR T U V J F G H E Debit Credit Account Names and Explanation Date 1,600,000 Mar. 1 Cash ww.s Common Stock 400,000 1.200,000 Additional Paid-In Capital To record sale of stock. Retained Earnings July 1 Common Stock to Be Distributed Paid-In Canital To record declaration of dividend. Common Stock to Be Distributed Aug. 1 Common Stock To record payment of dividend. Retained Earnings 15 Common Stock Dividends Payable To record declaration of dividend. Sept. 1 No entry No entry Date of record of declared cash dividend. Common Stock Dividends Payable Cash To record payment of dividend. 45.000 Treasury Stock Oct. 1 45,000 Cash To record purchase of treasury stock. 520,000 Dec. 31 Income Summary 520,000 Retained Earnings To close out net income for the year. Optional: T accounts are provided to assist with determining final balances. Entries will not be graded, The new balance of each account will be automatically calculated in the last row of the account. Final balances transferred to the partial balance sheet will be graded. Additional Pald-In Capital Common Stock 2 Bal. m 200,000 900.000 Bal. 3 4 Bal NW1,20 Ral 900.000 6 Treasury Stock 58 Retained Earnings 48,000 Bal 2,225,000 59 Bal. 60 61 48.000 Bal. Bal 2,225,000 82 65 15 Camp Corporation Balance Sheet (Partial) December 31, 20- Stockholders' equity: Contributed capital: Common stock, $2 par, shares issued shares outstanding Additional paid-in capital Total contributed capital Retained eamings Treasury stock Total stockholders' equity shares Shares outstanding: Shares issued as of 1/1 Shares issued 3/1 Shares issued 8/1 Total shares issued Less treasury shares as of 1/1 Less treasury shares purchased 10/1 Shares outstanding 9 1 12 13 Earnings per share: 14 15 Not income 16 Common shares outstanding 1/1 Common shares outstanding 12/31 17 18 19 Total 20 21 22 123 124 125 126 Average shares outstanding Earnings per share 127 128 129 AP 10-36 8808588: some specified ratio. es Required Match each term with the appropriate definition. vi- es PROBLEMS 36. Recording and Reporting Equity LO2, 3. 5,6. Camp Corporation had the following balances in its stockholders' equity at January 1: Common stock, $2 par value, 450,000 shares issued S 900,000 Additional paid-in capital Retained earnings 1,200,000 2,225,000 Treasury stock, at cost, 8,000 shares (48,000) During the year, Camp Corporation had the follow- ing transactions related to stockholders' equity: Issued 200,000 shares of common stock for Mar. 1 cash at $8 per share. e a Declared a 10% stock dividend, payable August 1. The stock was trading at $7 per July 1 es share on July 1. Aug. 15 Declared a $0.50 per share cash dividend to stockholders of record on payable September 15. Bought back 6,000 shares of common stock for $45,000. September 1, er. Oct. 1 e B I ste Format Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check f fx X P S KLM N O QR T U V J F G H E Debit Credit Account Names and Explanation Date 1,600,000 Mar. 1 Cash ww.s Common Stock 400,000 1.200,000 Additional Paid-In Capital To record sale of stock. Retained Earnings July 1 Common Stock to Be Distributed Paid-In Canital To record declaration of dividend. Common Stock to Be Distributed Aug. 1 Common Stock To record payment of dividend. Retained Earnings 15 Common Stock Dividends Payable To record declaration of dividend. Sept. 1 No entry No entry Date of record of declared cash dividend. Common Stock Dividends Payable Cash To record payment of dividend. 45.000 Treasury Stock Oct. 1 45,000 Cash To record purchase of treasury stock. 520,000 Dec. 31 Income Summary 520,000 Retained Earnings To close out net income for the year. Optional: T accounts are provided to assist with determining final balances. Entries will not be graded, The new balance of each account will be automatically calculated in the last row of the account. Final balances transferred to the partial balance sheet will be graded. Additional Pald-In Capital Common Stock 2 Bal. m 200,000 900.000 Bal. 3 4 Bal NW1,20 Ral 900.000 6 Treasury Stock 58 Retained Earnings 48,000 Bal 2,225,000 59 Bal. 60 61 48.000 Bal. Bal 2,225,000 82 65 15 Camp Corporation Balance Sheet (Partial) December 31, 20- Stockholders' equity: Contributed capital: Common stock, $2 par, shares issued shares outstanding Additional paid-in capital Total contributed capital Retained eamings Treasury stock Total stockholders' equity shares Shares outstanding: Shares issued as of 1/1 Shares issued 3/1 Shares issued 8/1 Total shares issued Less treasury shares as of 1/1 Less treasury shares purchased 10/1 Shares outstanding 9 1 12 13 Earnings per share: 14 15 Not income 16 Common shares outstanding 1/1 Common shares outstanding 12/31 17 18 19 Total 20 21 22 123 124 125 126 Average shares outstanding Earnings per share 127 128 129 AP 10-36 8808588