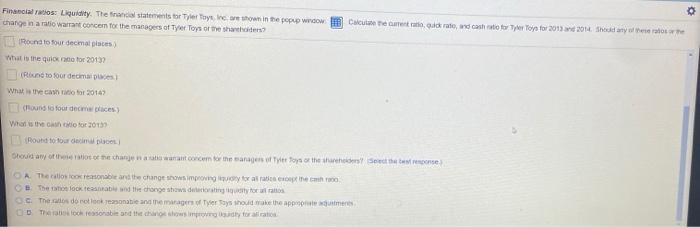

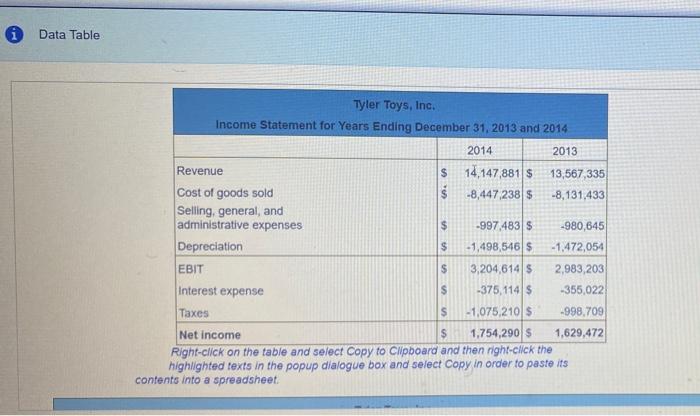

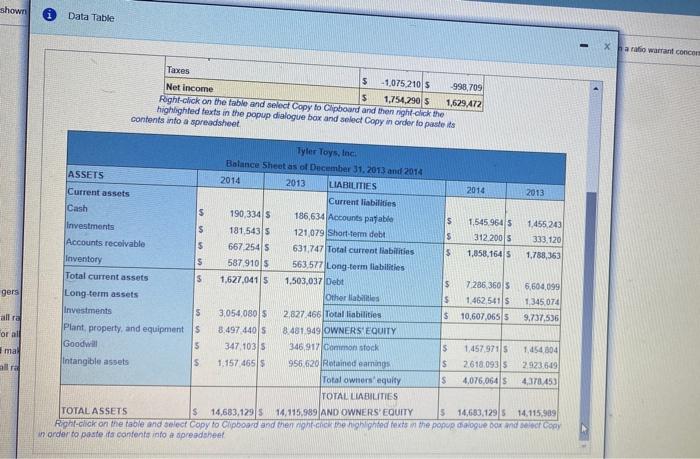

Financials Liquidity. The financial statements for Tyler Toys Inc in the popup Wow Cateur, id cash wory Toys for 2013 2014. Shodne change in a ratio warrant concern for the managers of Tye Toys or the shares Roond to four decimat plicus) What is the quilofor 2013 (to four decima What is the cast for 2014) Cound to four declices) What is the cash for 2015 AtRound to our client Odry oferite the change ancocem or the sangers of Tieto See the best recente A Theros coronable and the changes og for at opnem The look table de changestaw do loro C. The maio do rotokezonable and the manager of yer ays should make the appement Tertiochesonable and technology for Data Table Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 AA 2014 2013 Revenue $ 14,147,881 $ 13,567,335 Cost of goods sold -8,447,238 $ -8,131,433 Selling, general and administrative expenses -997.4835 -980,645 Depreciation - 1,498,546 $ -1.472,054 EBIT $ 3,204,614 $ 2,983,203 Interest expense s -375,114 $ -355,022 Taxes $ -1,075,2101$ -998.709 Net income $ 1,754,290 $ 1,629,472 Right click on the table and select Copy to clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet shown Data Table - a rais wa Coc Taxes $ -1,075 210 5 -998, 709 Net Income 5 1,754.290 5 1,629.472 Right click on the table and select Copy to clipboard and then night click the highlighted texts in the popup dialogue box and select Copy in order to pasteis contents into a spreadsheet gers Tyler Toys, Inc Balance Sheet as of December 31, 2013 and 2014 ASSETS 2014 2013 LIABILITIES 2014 Current assets 2013 Current liabilities Cash S 190,3345 186,634 Accounts payable $ 1.545.9645 1.455 243 Investments $ 181 5435 121,079 Short-term debt $ 312.2005 333.120 Accounts receivable 5 667 2545 631,747 Total current liabilities $ 1,858,164 5 1,788,363 Inventory S 587 9105 563577 Long-term liabilities Total current assets s 1,627,0415 1,503,037 Debt $ 7.286 36015 6,604,099 Long-term assets Other abilities $ 1.462 5415 1.345.074 Investments 5 3,0540805 2.827.466 Total liabilities $10.607,0655 9.737,536 Plant, property, and equipment $ 8.497 44015 8 481 949 OWNERS' EQUITY Goodwill 5 347 1035 346,917 common stock 5 1.45797115 1454804 Intangible assets S 1.157 465 956.620 Rotained eaming s 2.618.0935 2.923.549 Total owners equity s 4,076 06415 4,370.450 TOTAL LIABILITIES TOTAL ASSETS $ 14,683,12915 14,115,989 AND OWNERS' EQUITY 3 14,683.129 5 14,115,989 Right click on the table and select Copy to clipboard and the night.com me highlighted texts in the popup dialogue cor and select Copy order to poste a contents into a spreadsheet or all mal allra