Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financing Alternative 1 SS could perform a rights issue with a subscription price of R24 per share. Currently. as at 1 April 2023, SS's ordinary

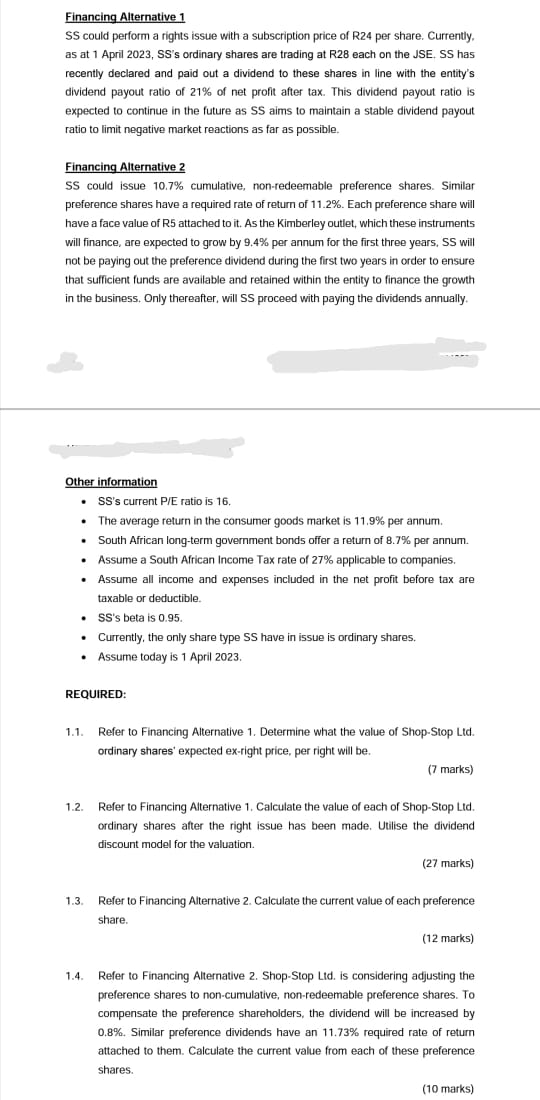

Financing Alternative 1 SS could perform a rights issue with a subscription price of R24 per share. Currently. as at 1 April 2023, SS's ordinary shares are trading at R28 each on the JSE. SS has recently declared and paid out a dividend to these shares in line with the entity's dividend payout ratio of 21% of net profit after tax. This dividend payout ratio is expected to continue in the future as SS aims to maintain a stable dividend payout ratio to limit negative market reactions as far as possible. Financing Alternative 2 SS could issue 10.7% cumulative, non-redeemable preference shares. Similar preference shares have a required rate of return of 11.2%. Each preference share will have a face value of R5 attached to it. As the Kimberley outlet, which these instruments will finance, are expected to grow by 9,4% per annum for the first three years, SS will not be paying out the preference dividend during the first two years in order to ensure that sufficient funds are available and retained within the entity to finance the growth in the business. Only thereafter, will SS proceed with paying the dividends annually. Other information - SS's current P/E ratio is 16. - The average return in the consumer goods market is 11,9% per annum. - South African long-term government bonds offer a return of 8.7% per annum. - Assume a South African Income Tax rate of 27% applicable to companies. - Assume all income and expenses included in the net profit before tax are taxable or deductible. - SS's beta is 0.95 . - Currently, the only share type SS have in issue is ordinary shares. - Assume today is 1 April 2023. REQUIRED: 1.1. Refer to Financing Alternative 1. Determine what the value of Shop-Stop Ltd. ordinary shares' expected ex-right price, per right will be. (7 marks) 1.2. Refer to Financing Alternative 1. Calculate the value of each of Shop-Stop Lid. ordinary shares after the right issue has been made. Utilise the dividend discount model for the valuation. (27 marks) 1.3. Refer to Financing Alternative 2. Calculate the current value of each preference share. (12 marks) 1.4. Refer to Financing Alternative 2. Shop-Stop Lid. is considering adjusting the preference shares to non-cumulative, non-redeemable preference shares. To compensate the preference shareholders, the dividend will be increased by 0.8%. Similar preference dividends have an 11.73% required rate of return attached to them. Calculate the current value from each of these preference shares

Financing Alternative 1 SS could perform a rights issue with a subscription price of R24 per share. Currently. as at 1 April 2023, SS's ordinary shares are trading at R28 each on the JSE. SS has recently declared and paid out a dividend to these shares in line with the entity's dividend payout ratio of 21% of net profit after tax. This dividend payout ratio is expected to continue in the future as SS aims to maintain a stable dividend payout ratio to limit negative market reactions as far as possible. Financing Alternative 2 SS could issue 10.7% cumulative, non-redeemable preference shares. Similar preference shares have a required rate of return of 11.2%. Each preference share will have a face value of R5 attached to it. As the Kimberley outlet, which these instruments will finance, are expected to grow by 9,4% per annum for the first three years, SS will not be paying out the preference dividend during the first two years in order to ensure that sufficient funds are available and retained within the entity to finance the growth in the business. Only thereafter, will SS proceed with paying the dividends annually. Other information - SS's current P/E ratio is 16. - The average return in the consumer goods market is 11,9% per annum. - South African long-term government bonds offer a return of 8.7% per annum. - Assume a South African Income Tax rate of 27% applicable to companies. - Assume all income and expenses included in the net profit before tax are taxable or deductible. - SS's beta is 0.95 . - Currently, the only share type SS have in issue is ordinary shares. - Assume today is 1 April 2023. REQUIRED: 1.1. Refer to Financing Alternative 1. Determine what the value of Shop-Stop Ltd. ordinary shares' expected ex-right price, per right will be. (7 marks) 1.2. Refer to Financing Alternative 1. Calculate the value of each of Shop-Stop Lid. ordinary shares after the right issue has been made. Utilise the dividend discount model for the valuation. (27 marks) 1.3. Refer to Financing Alternative 2. Calculate the current value of each preference share. (12 marks) 1.4. Refer to Financing Alternative 2. Shop-Stop Lid. is considering adjusting the preference shares to non-cumulative, non-redeemable preference shares. To compensate the preference shareholders, the dividend will be increased by 0.8%. Similar preference dividends have an 11.73% required rate of return attached to them. Calculate the current value from each of these preference shares Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started