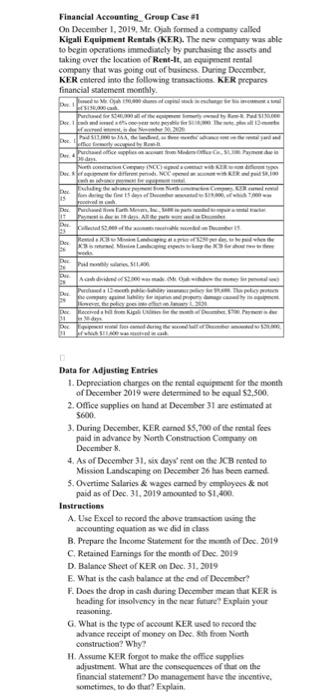

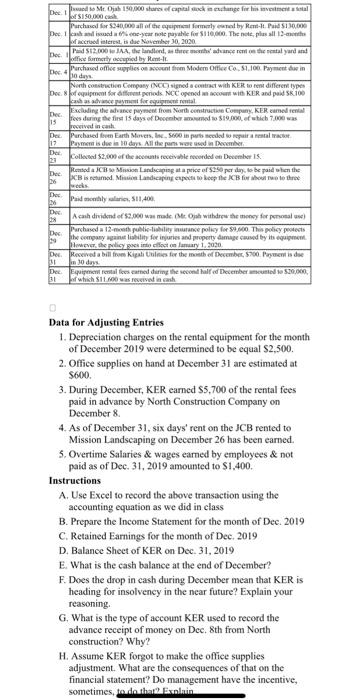

Financlal Acceunting_Groep Case 21 On December 1, 2019, Mr. Ojah formsed a conpuny called Kifgali Equipment Rentals (KER). The new company was able to begin operations immediundy by purchusisg the assets and taking over the location of Rent-lt, as equipment rental company that was going out of busiscss. Darieg Dectmber. KER entered into the following transactions. KFR prepurs financial saverment montlly. Data for Adjustieng Entries 1. Depreciation charges on the renal squipencat for the month of Decernber 2019 were delermined so he cqual 52,500 . 2. Office supplies os hand at December 31 are extimated at 5600. 3. During Desember, KER carnod S5, 700 of the rental fees paid in advance by Narth Constraction Coompary on December 8 . 4. As of December 31, six deys' rent en the MCB renevel to Mission Landseaping on December 26 has bew eamed. 5. Overtime Salaries & wages carned by enployees &/ not paid as of Dec, 31, 2019 amounted to $1,400. Instructions A. Use Excel to record the above tratuaction using the accounting equation as we did in class B. Prepare the Income Statement for the manth of Doc. 2019 C. Retained Farnings for the month of Dec. 2019 D. Bslance Shect of KER on Dec. 31, 2019 E. What is the cash balance at the crd of December? F. Does the drop in cash during December moan that KER is heading for issolvency in the near future? Explain yout reasoning. G. What is the type of acoount KER used to tooond the advasce receipt of moncy on Dos. Sth froen Noch consiruction? Why? II. Ascume KER forgot to make the office sepplies adjustment. Whal are the conseguences of that on the fieancial statement? Do managensent have the incentive. wometimes, to do thua? Fxplain. Data for Adjusting Eatries 1. Depreciation charges on the rental equipment for the month of December 2019 were determined to be equal $2,500. 2. Office supplies on hand at December 31 are estimated at 3. During December, KER earned $5,700 of the rental fees paid in advance by North Construction Company on December 8 . 4. As of December 31, six days' rent on the JCB rented to Mission Landscaping on December 26 has been earned. 5. Overtime Salaries \& wages earned by employees \& not paid as of Dec, 31,2019 amounted to $1,400. Instructions A. Use Excel to record the above transaction using the accounting equation as we did in class B. Prepare the Income Statement for the month of Dec. 2019 C. Retained Earnings for the month of Dec, 2019 D. Balance Sheet of KER on Dec. 31, 2019 E. What is the cash balance at the end of December? F. Does the drop in cash during December mean that KER is heading for insolvency in the near future? Explain your reasoning. G. What is the type of account KER used to record the advance receipt of money on Dec. 8th from North construction? Why? H. Assume KER forgot to make the office supplies adjustment. What are the consequences of that on the financial statement? Do management have the incentive, sometimes, toudouthar Exilain Financlal Acceunting_Groep Case 21 On December 1, 2019, Mr. Ojah formsed a conpuny called Kifgali Equipment Rentals (KER). The new company was able to begin operations immediundy by purchusisg the assets and taking over the location of Rent-lt, as equipment rental company that was going out of busiscss. Darieg Dectmber. KER entered into the following transactions. KFR prepurs financial saverment montlly. Data for Adjustieng Entries 1. Depreciation charges on the renal squipencat for the month of Decernber 2019 were delermined so he cqual 52,500 . 2. Office supplies os hand at December 31 are extimated at 5600. 3. During Desember, KER carnod S5, 700 of the rental fees paid in advance by Narth Constraction Coompary on December 8 . 4. As of December 31, six deys' rent en the MCB renevel to Mission Landseaping on December 26 has bew eamed. 5. Overtime Salaries & wages carned by enployees &/ not paid as of Dec, 31, 2019 amounted to $1,400. Instructions A. Use Excel to record the above tratuaction using the accounting equation as we did in class B. Prepare the Income Statement for the manth of Doc. 2019 C. Retained Farnings for the month of Dec. 2019 D. Bslance Shect of KER on Dec. 31, 2019 E. What is the cash balance at the crd of December? F. Does the drop in cash during December moan that KER is heading for issolvency in the near future? Explain yout reasoning. G. What is the type of acoount KER used to tooond the advasce receipt of moncy on Dos. Sth froen Noch consiruction? Why? II. Ascume KER forgot to make the office sepplies adjustment. Whal are the conseguences of that on the fieancial statement? Do managensent have the incentive. wometimes, to do thua? Fxplain. Data for Adjusting Eatries 1. Depreciation charges on the rental equipment for the month of December 2019 were determined to be equal $2,500. 2. Office supplies on hand at December 31 are estimated at 3. During December, KER earned $5,700 of the rental fees paid in advance by North Construction Company on December 8 . 4. As of December 31, six days' rent on the JCB rented to Mission Landscaping on December 26 has been earned. 5. Overtime Salaries \& wages earned by employees \& not paid as of Dec, 31,2019 amounted to $1,400. Instructions A. Use Excel to record the above transaction using the accounting equation as we did in class B. Prepare the Income Statement for the month of Dec. 2019 C. Retained Earnings for the month of Dec, 2019 D. Balance Sheet of KER on Dec. 31, 2019 E. What is the cash balance at the end of December? F. Does the drop in cash during December mean that KER is heading for insolvency in the near future? Explain your reasoning. G. What is the type of account KER used to record the advance receipt of money on Dec. 8th from North construction? Why? H. Assume KER forgot to make the office supplies adjustment. What are the consequences of that on the financial statement? Do management have the incentive, sometimes, toudouthar Exilain