Question

Finch Home Maintenance Company earned operating income of $6,610,500 on operating assets of $58,500,000 during Year 2. The Tree Cutting Division earned $1,240,470 on operating

Finch Home Maintenance Company earned operating income of $6,610,500 on operating assets of $58,500,000 during Year 2. The Tree Cutting Division earned $1,240,470 on operating assets of $6,930,000. Finch has offered the Tree Cutting Division $2,250,000 of additional operating assets. The manager of the Tree Cutting Division believes he could use the additional assets to generate operating income amounting to $450,000. Finch has a desired return on investment (ROI) of 9.30 percent. Required

Calculate the return on investment for Finch, the Tree Cutting Division, and the additional investment opportunity.

Calculate the residual income for Finch, the Tree Cutting Division, and the additional investment opportunity.

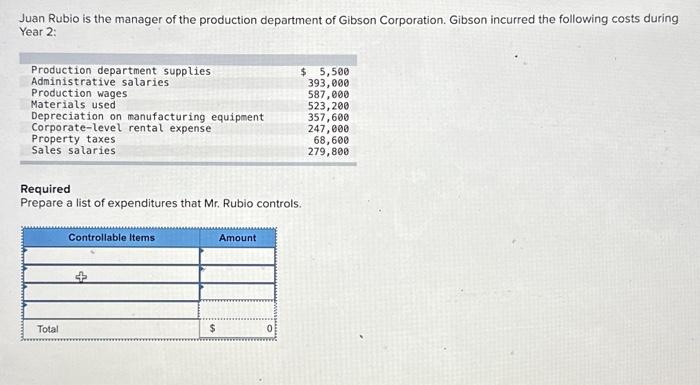

Juan Rubio is the manager of the production department of Gibson Corporation. Gibson incurred the following costs during Year 2: Production department supplies $ 5,500 Administrative salaries 393,000 Production wages 587,000 Materials used 523,200 Depreciation on manufacturing equipment 357,600 Corporate-level rental expense 247,000 Property taxes 68,600 Sales salaries 279,800 Required Prepare a list of expenditures that Mr. Rubio controls. Controllable Items Amount Total $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started