Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fincial Accounting the solution from the expert is only opyion 1 only. I need all of them. please post my question. the case is the

Fincial Accounting

the solution from the expert is only opyion only. I need all of them. please post my question.

the case is the picture

please provide the detail answer all the question ofunder the following:

Question

Sam would like you to provide the initial recording of the asset.

Sam would like you to prepare the journal entry to record depreciation for the first year.

option

Sam would like to see the entry for the receipt of loan and the recording of the journal entries on december for each of the first two years.

Date Description Debit Credit

Option : Financing Option #

Sam would like the journal entry for the bond issue and the journal entry for the first two interest payment.

Date Description Debit Credit

Option : Financing #

Sam would like the journal entry for the issuance of the shares and any dividend

entries for this year under the assumption the dividend does get declared.

NOTE: when recording the dividend, please ensure you separate dividends to preferred

shareholders from dividends to common shareholders.

Date Description Debit Credit

Question : comment on advantages and disadvantages.

For each financing option, identify at least advantage and disadvantage and explain why it is an advantage or

disadvantage to Sam in this case.

Financing Option # Bank Loan

Financing Option # Bonds

Financing Option # Issue shares

Stealth Sky Views

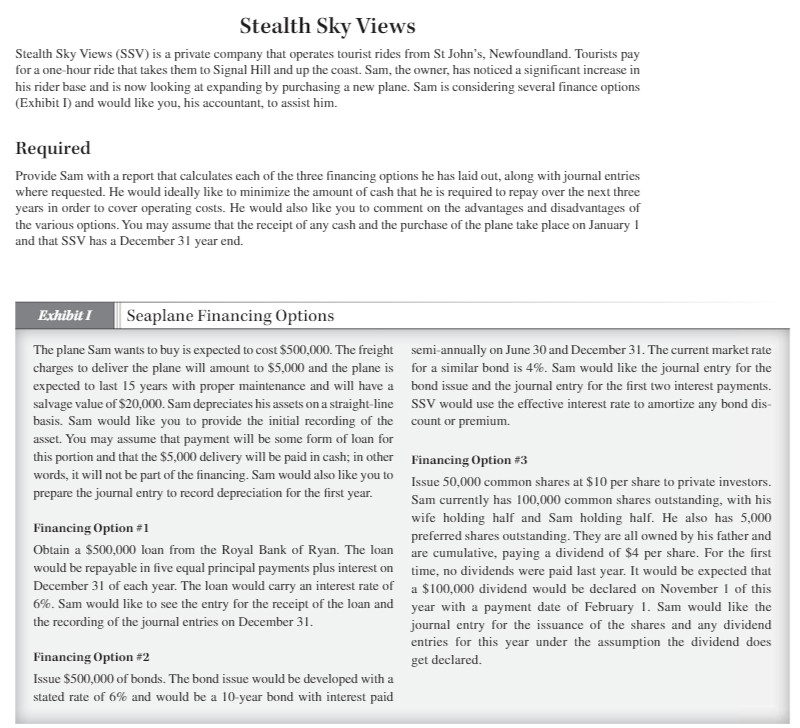

Stealth Sky Views SSV is a private company that operates tourist rides from St John's, Newfoundland. Tourists pay

for a onehour ride that takes them to Signal Hill and up the coast. Sam, the owner, has noticed a significant increase in

his rider base and is now looking at expanding by purchasing a new plane. Sam is considering several finance options

Exhibit I and would like you, his accountant, to assist him.

Required

Provide Sam with a report that calculates each of the three financing options he has laid out, along with journal entries

where requested. He would ideally like to minimize the amount of cash that he is required to repay over the next three

years in order to cover operating costs. He would also like you to comment on the advantages and disadvantages of

the various options. You may assume that the receipt of any cash and the purchase of the plane take place on January

and that SSV has a December year end.

Exhibit I

Seaplane Financing Options

The plane Sam wants to buy is expected to cost $ The freight

charges to deliver the plane will amount to $ and the plane is

expected to last years with proper maintenance and will have a

salvage value of $ Sam depreciates his assets on a straightline

basis. Sam would like you to provide the initial recording of the

asset. You may assume that payment will be some form of loan for

this portion and that the $ delivery will be paid in cash; in other

words, it will not be part of the financing. Sam would also like you to

prepare the journal entry to record depreciation for the first year.

Financing Option #

Obtain a $ loan from the Royal Bank of Ryan. The loan

would be repayable in five equal principal payments plus interest on

December of each year. The loan would carry an interest rate of

Sam would like to see the entry for the receipt of the loan and

the recording of the journal entries on December

Financing Option #

Issue $ of bonds. The bond issue would be developed with a

stated rate of and would be a year bond with interest paid

semiannually on June and December The current market rate

for a similar bond is Sam would like the journal entry for the

bond issue and the journal entry for the first two interest payments.

SSV would use the effective interest rate to amortize any bond dis

count or premium.

Financing Option #

Issue common shares at $ per share to private investors.

Sam currently has common shares outstanding, with his

wife holding half and Sam holding half. He also has

preferred shares outstanding. They are all owned by his father and

are cumulative, paying a dividend of $ per share. For the first

time, no dividends were paid last year. It would be expected that

a $ dividend would be declared on November of this

year with a payment date of February Sam would like the

journal entry for the issuance of the shares and any dividend

entries for this year under the assumption the dividend does

get declared.

Finan

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started