Answered step by step

Verified Expert Solution

Question

1 Approved Answer

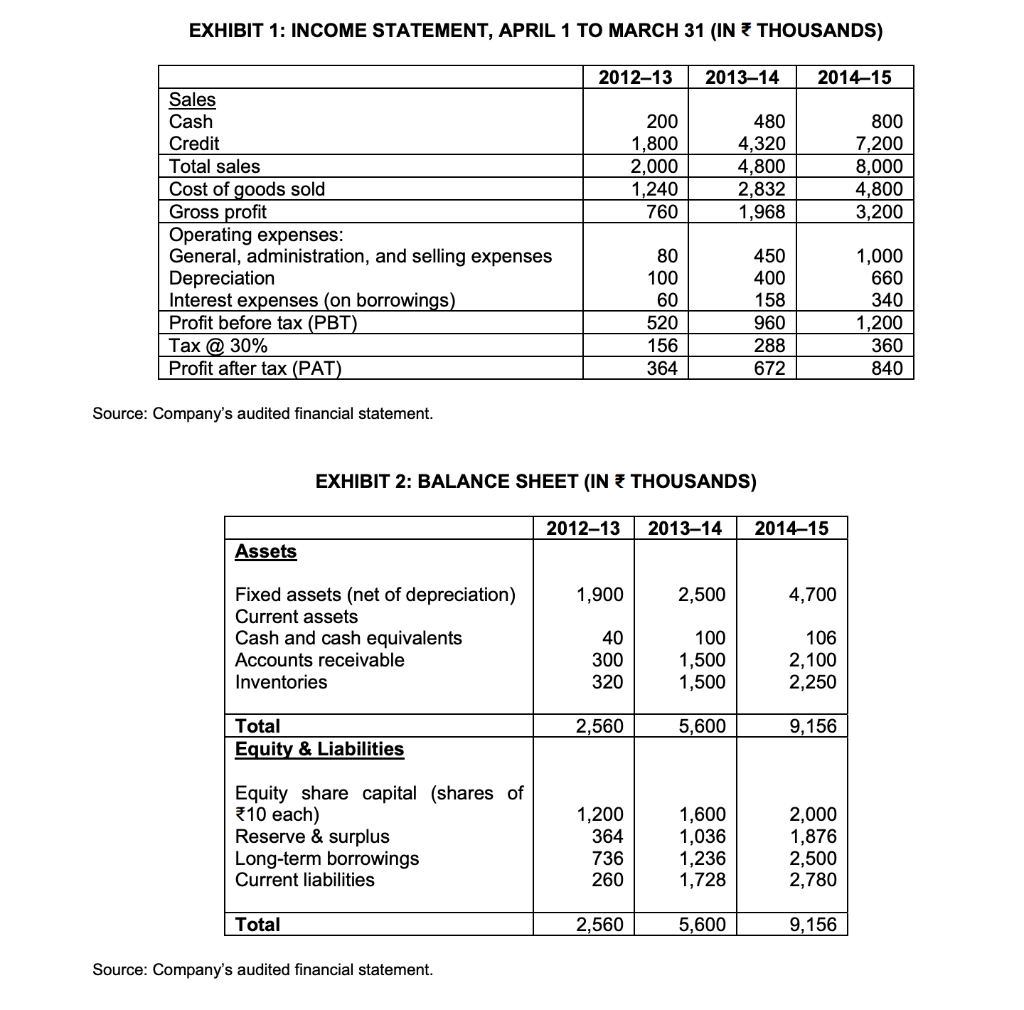

Find 1. Debt to Equity 2. Receivables Turnover (times per year) 3. Working Capital turnover ratio EXHIBIT 1: INCOME STATEMENT, APRIL 1 TO MARCH 31

Find

1. Debt to Equity

2. Receivables Turnover (times per year)

3. Working Capital turnover ratio

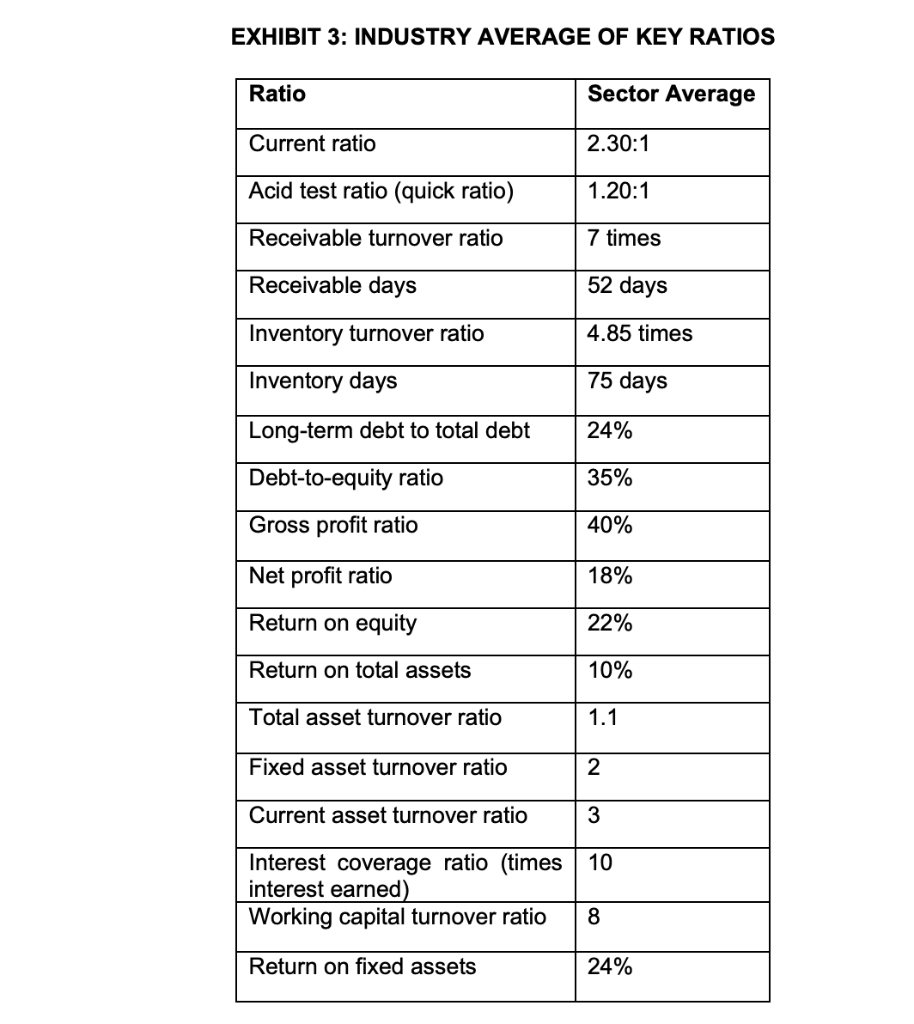

EXHIBIT 1: INCOME STATEMENT, APRIL 1 TO MARCH 31 (IN THOUSANDS) Source: Company's audited financial statement. EXHIBIT 2: BALANCE SHEET (IN THOUSANDS) Source: Company's audited financial statement. EXHIBIT 3: INDUSTRY AVERAGE OF KEY RATIOS \begin{tabular}{|l|l|} \hline Ratio & Sector Average \\ \hline Current ratio & 2.30:1 \\ \hline Acid test ratio (quick ratio) & 1.20:1 \\ \hline Receivable turnover ratio & 7 times \\ \hline Receivable days & 52 days \\ \hline Inventory turnover ratio & 4.85 times \\ \hline Inventory days & 75 days \\ \hline Long-term debt to total debt & 24% \\ \hline Debt-to-equity ratio & 35% \\ \hline Gross profit ratio & 40% \\ \hline Net profit ratio & 18% \\ \hline Return on equity & 22% \\ \hline Return on total assets & 10% \\ \hline Total asset turnover ratio & 1.1 \\ \hline Fixed asset turnover ratio & 2 \\ \hline Current asset turnover ratio & 3 \\ \hline Interest coverage ratio (times interest earned) & 10 \\ \hline Working capital turnover ratio & 8 \\ \hline Return on fixed assets & 24% \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started