Answered step by step

Verified Expert Solution

Question

1 Approved Answer

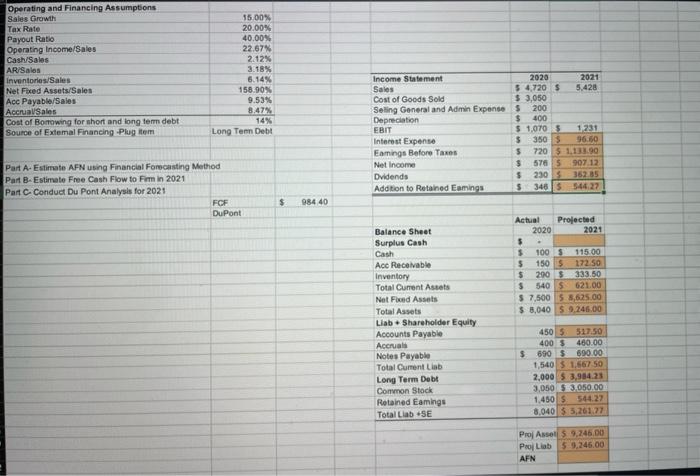

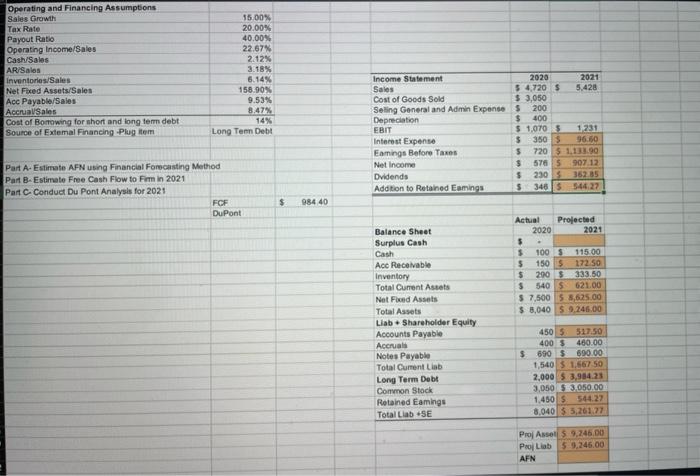

Find abc Operating and Financing Assumptions Sales Growth Tax Rate Payout Ratio Operating Income/Sales Cash/Sales AR/Salos Inventories/Sales Net Fixed Assets/Sales Acc Payable/Sales Accrual Sales Cost

Find abc

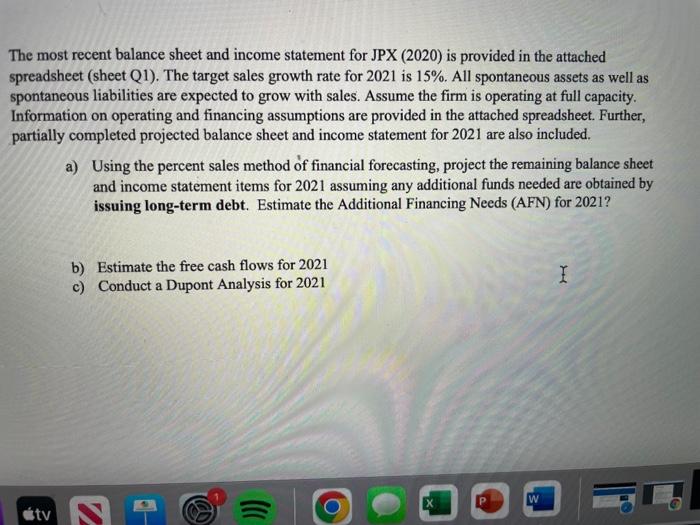

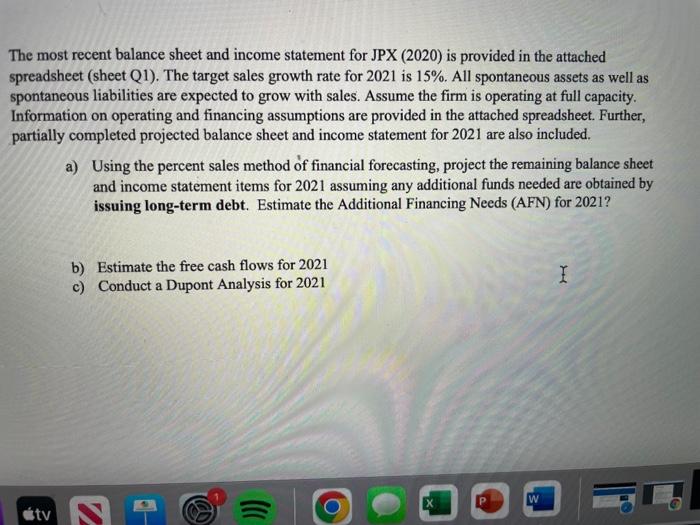

Operating and Financing Assumptions Sales Growth Tax Rate Payout Ratio Operating Income/Sales Cash/Sales AR/Salos Inventories/Sales Net Fixed Assets/Sales Acc Payable/Sales Accrual Sales Cost of Borrowing for short and long term debt Source of Extemal Financing Plug item 15.00% 20.00% 40.00% 22.67% 2.12% 3.18% 6.14% 158.90% 9.53% 8.47% 14% Long Tem Debt Income Statement 2020 2021 Sales 5 4.720 $ 5.428 Cost of Goods Sold $ 3,050 Seling General and Admin Expense S 200 Depreciation $ 400 EBIT $ 1.0705 1231 Interest Expense $350 $ 96.60 Earings Before TRS $ 720 $ 1.133.90 Net Income $ 578 S 907.12 Dvidends $ 230 362 85 Addition to Retained Eamings $ 346 $ 544.27 Part A. Estimate AFN using Financial Forecasting Method Part B. Estimate Free Cash Flow to Firmin 2021 Part C Conduct Du Pont Analysis for 2021 FCF DuPont $ 984 40 Actual Projected 2020 2021 $ $ 100 S 115.00 $ 1505 172.50 $ 2005 333.50 $ 540 5 621.00 $ 7,500 5 8,625.00 $ 8,040 59.246.00 Balance Sheet Surplus Cash Cash Ace Receivable Inventory Total Current Assets Not Fixed Assets Total Assets Liab Shareholder Equity Accounts Payable Accruals Notes Payable Total Current Liab Long Term Debt Common Stock Retained Eamingo Total Llab +SE $ 450 $ 517.50 400 460.00 690 $690.00 1,540 5 1,667 50 2,000$ 3,984.23 3,050 53.050.00 1,450 $ 544.27 8.040 $ 5,261.77 Proj Assels 9,246.00 ProLiab 5 9,246.00 AFN The most recent balance sheet and income statement for JPX (2020) is provided in the attached spreadsheet (sheet Q1). The target sales growth rate for 2021 is 15%. All spontaneous assets as well as spontaneous liabilities are expected to grow with sales. Assume the firm is operating at full capacity. Information on operating and financing assumptions are provided in the attached spreadsheet. Further, partially completed projected balance sheet and income statement for 2021 are also included. a) Using the percent sales method of financial forecasting, project the remaining balance sheet and income statement items for 2021 assuming any additional funds needed are obtained by issuing long-term debt. Estimate the Additional Financing Needs (AFN) for 2021? b) Estimate the free cash flows for 2021 c) Conduct a Dupont Analysis for 2021 I W etv NE ))) O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started