Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find all the deductions asked for, and the final net pay. Social Security is 6.2% of the first $97,500. Medicare is 1.45% of all

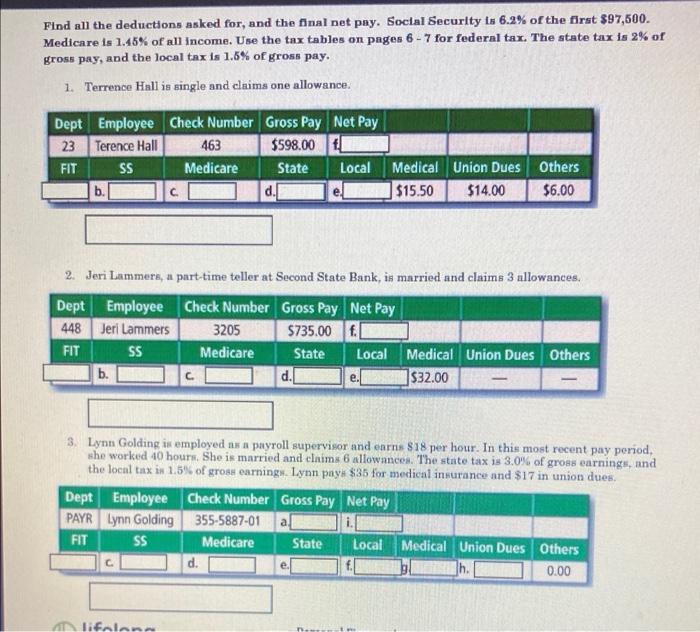

Find all the deductions asked for, and the final net pay. Social Security is 6.2% of the first $97,500. Medicare is 1.45% of all income. Use the tax tables on pages 6-7 for federal tax. The state tax is 2% of gross pay, and the local tax is 1.5% of gross pay. 1. Terrence Hall is single and claims one allowance. Check Number Gross Pay Net Pay Dept Employee 23 Terence Hall 463 $598.00 f FIT SS Medicare State Local Others Medical Union Dues b. $15.50 $14.00 $6.00 2. Jeri Lammers, a part-time teller at Second State Bank, is married and claims 3 allowances. Employee Check Number Gross Pay Net Pay Dept 448 Jeri Lammers 3205 Medicare FIT SS $735.00 f State d. Local Medical Union Dues Others $32.00 b. C. 3. Lynn Golding is employed as a payroll supervisor and earns $18 per hour. In this most recent pay period, she worked 40 hours. She is married and claims 6 allowances. The state tax is 3.0% of gross earnings, and the local tax is 1.5% of gross earnings. Lynn pays $35 for medical insurance and $17 in union dues. Dept Employee PAYR Lynn Golding Check Number Gross Pay Net Pay 355-5887-01 a i.l FIT SS Medicare State Local Medical Union Dues Others C 0.00 lifelong The d. e.

Step by Step Solution

★★★★★

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Q1 Terrence Hall Dept Employee Check Number Gross Pay Net Pay 23 Terence Hall 463 59800 43682 FIT SS Medicare State Local Medical Union d Workings Soc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started