Answered step by step

Verified Expert Solution

Question

1 Approved Answer

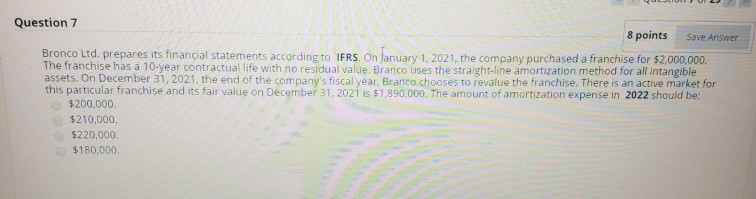

Find answer with solution please. thanks. Save Answer Question 7 8 points Bronco Ltd. prepares its financial statements according to IFRS. on January 1, 2021,

Find answer with solution please. thanks.

Save Answer Question 7 8 points Bronco Ltd. prepares its financial statements according to IFRS. on January 1, 2021, the company purchased a franchise for $2,000,000 The franchise has a 10-year contractual life with no residual value Branco uses the straight-line amortization method for all intangible assets. On December 31, 2021, the end of the company's fiscal year, Branco chooses to revalue the franchise. There is an active market for this particular franchise and its fair value on December 31, 2021 is $1,890,000. The amount of amortization expense in 2022 should be: $200,000 $210,000, $220,000 $180,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started