Answered step by step

Verified Expert Solution

Question

1 Approved Answer

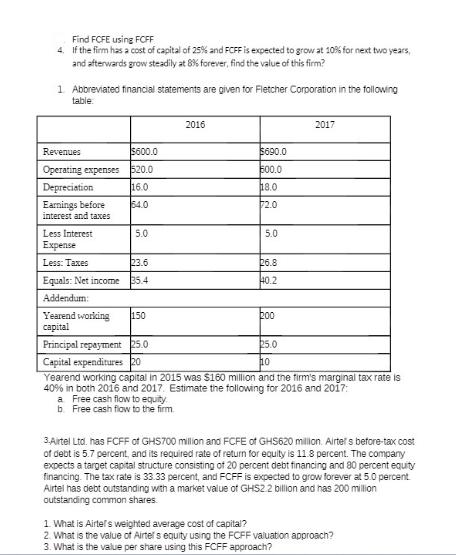

Find FCFE using FCFF 4. If the firm has a cost of capital of 25% and FCFF is expected to grow at 10% for

Find FCFE using FCFF 4. If the firm has a cost of capital of 25% and FCFF is expected to grow at 10% for next two years, and afterwards grow steadily at 8% forever, find the value of this firm? 1 Abbreviated financial statements are given for Fletcher Corporation in the following table Revenues $600.0 Operating expenses $520.0 Depreciation 16.0 Earnings before 64.0 interest and taxes Less Interest Expense Less: Taxes 23.6 Equals: Net income 35.4 Addendum: Yearend working 150 capital 5.0 2016 $690.0 500.0 18.0 72.0 5.0 26.8 40.2 200 2017 Principal repayment 25.0 25.0 Capital expenditures 20 ho Yearend working capital in 2015 was $160 million and the firm's marginal tax rate is 40% in both 2016 and 2017. Estimate the following for 2016 and 2017: a Free cash flow to equity b Free cash flow to the firm 3-Airtel Ltd. has FCFF of GHS700 million and FCFE of GHS620 million. Airtels before-tax cost of debt is 5.7 percent, and its required rate of return for equity is 11.8 percent. The company expects a target capital structure consisting of 20 percent debt financing and 80 percent equity financing. The tax rate is 33.33 percent, and FCFF is expected to grow forever at 5.0 percent. Airtel has debt outstanding with a market value of GHS2.2 billion and has 200 million outstanding common shares 1. What is Airtel's weighted average cost of capital? 2. What is the value of Airtel s equity using the FCFF valuation approach? 3. What is the value per share using this FCFF approach?

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer Lets address each question step by step Question 1 a Free Cash Flow to Equity FCFE and Free Cash Flow to the Firm FCFF for 2016 and 2017 Well u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started