Answered step by step

Verified Expert Solution

Question

1 Approved Answer

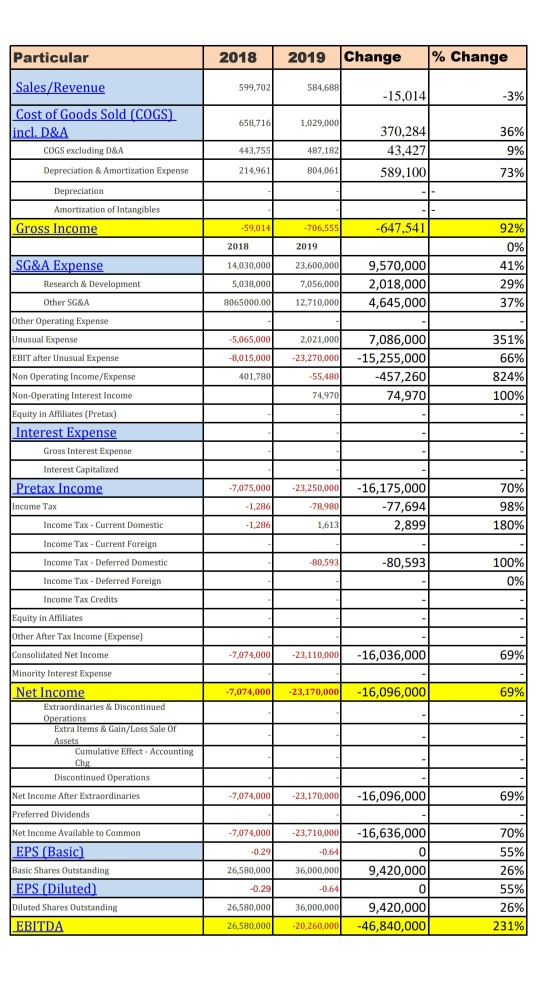

find income statement for year 2019 and do vertical analysis of income statement for year 2019 Particular 2018 2019 Change % Change Sales/Revenue 599,702 584,688

find income statement for year 2019 and do vertical analysis of income statement for year 2019

Particular 2018 2019 Change % Change Sales/Revenue 599,702 584,688 -15,014 -3% 658,716 1,029,000 Cost of Goods Sold (COGS) incl. D&A COGS excluding D&A Depreciation & Amortization Expense 36% 9% 443,755 370,284 43,427 589.100 487.182 214,961 304,061 73% Depreciation Amortization of Intangibles Gross Income -59,014 -647,541 -706,555 2019 2018 14,030,000 5,038,000 8065000.00 23,600,000 7,056,000 12,710,000 SG&A Expense Research & Development Other SGRA Other Operating Expense Unusual Expense EBIT after Unusual Expense 9,570,000 2,018,000 4,645,000 92% 0% 41% 29% 37% -5,065,000 -8.015,000 2,021,000 -23.270,000 -55.480 351% 66% 7,086,000 -15,255,000 -457,260 74,970 401,780 824% 74,970 100% -7,075,000 -23,250,000 -78,980 -1,286 -1,286 -16,175,000 -77,694 2,899 70% 98% 180% 1,613 -80,593 -80,593 100% 0% Non Operating Income/Expense Non-Operating Interest Income Equity in Affiliates (Pretax) Interest Expense Gross Interest Expense Interest Capitalized Pretax Income Income Tax Income Tax - Current Domestic Income Tax - Current Foreign Income Tax Deferred Domestic Income Tax - Deferred Foreign Income Tax Credits Equity in Affiliates Other After Tax Income (Expense) Consolidated Net Income Minority Interest Expense Net Income Extraordinaries & Discontinued Operations Extra Items & Gain/Loss Sale 01 Assets Cumulative Effect - Accounting Chg Discontinued Operations Net Income After Extraordinaries Preferred Dividends Net Income Available to Common EPS (Basic) Basic Shares Outstanding EPS (Diluted) Diluted Shares Outstanding EBITDA -7,074,0001 -23,110,000 -16,036,000 69% -7,074,0001 -23,170,000 - 16,096,000 69% -7,074,000 -23,170,000 - 16,096,000 69% -7,074,000 -23,710,000 -0.29 -0.641 36,000,000 26,580,000 -0.29 - 16,636,000 0 0 9,420,000 0 9,420,000 -46,840,000 70% 55% 26% 55% 26% 231% -0.64 36,000,000 26,580,000 26,580,000 -20,260,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started