Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find leverage adjusted gap duration. Give management interpretation of duration gap. Suppose interest rates on both assets and liabilities rose from 5% to 9% then,

Find leverage adjusted gap duration. Give management interpretation of duration gap.

Suppose interest rates on both assets and liabilities rose from 5% to 9% then, what will be change in institutions net worth?

Suppose interest rates on both assets and liabilities fall from 15% to 7% then, what will be change in institutions net worth?

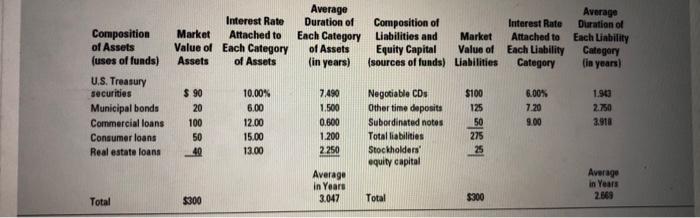

Average Duration of Interest Rate Attached to Value of Each Category Average Duration of Each Liability Category (in years) Composition of Liabilities and Interest Rate Attached to Each Liability Category Composition of Assets Market Each Category of Assets (in years) Market Equity Capital (sources of funds) Liabilities Value of (uses of funds) Assets of Assets U.S. Treasury securities Negotiable CDs Other time deposits $ 90 10.00% 7.490 $100 6.00% 1.943 Municipal bonds 20 6.00 1.500 125 7.20 2.750 Commercial loans 100 12.00 0.600 Subordinated notes 50 9.00 3.910 Consumer loans 50 15.00 1.200 Total liabilities 275 Real estate loans 40 13.00 2.250 Stockholders equity capital Average in Years 3.047 Average in Years Total $300 Total $300 2.869

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Solution Leverage adjusted Duration Gap Duration of Asset Duration of Liabilitiesmarket value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started