Answered step by step

Verified Expert Solution

Question

1 Approved Answer

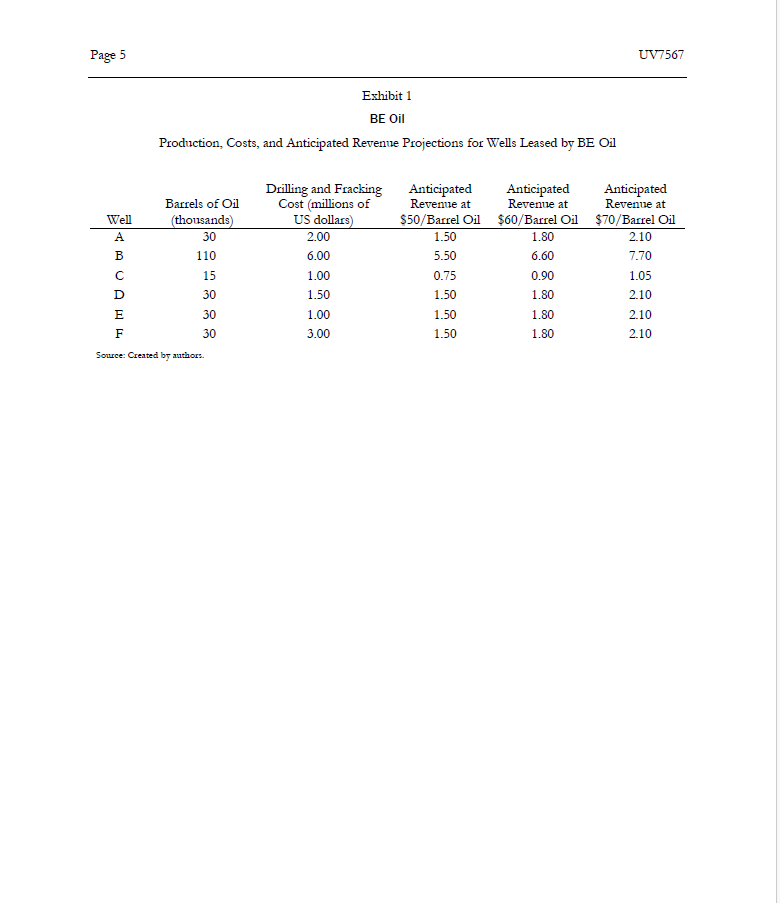

Find out the marginal cost, marginal revenue, average total cost and profit for all the wells. How many wells to drill or which well are

- Find out the marginal cost, marginal revenue, average total cost and profit for all the wells.

- How many wells to drill or which well are we to drill? Analyse and recommend.

- Draw a supply curve based on the data in the case study

- Analyse the case study

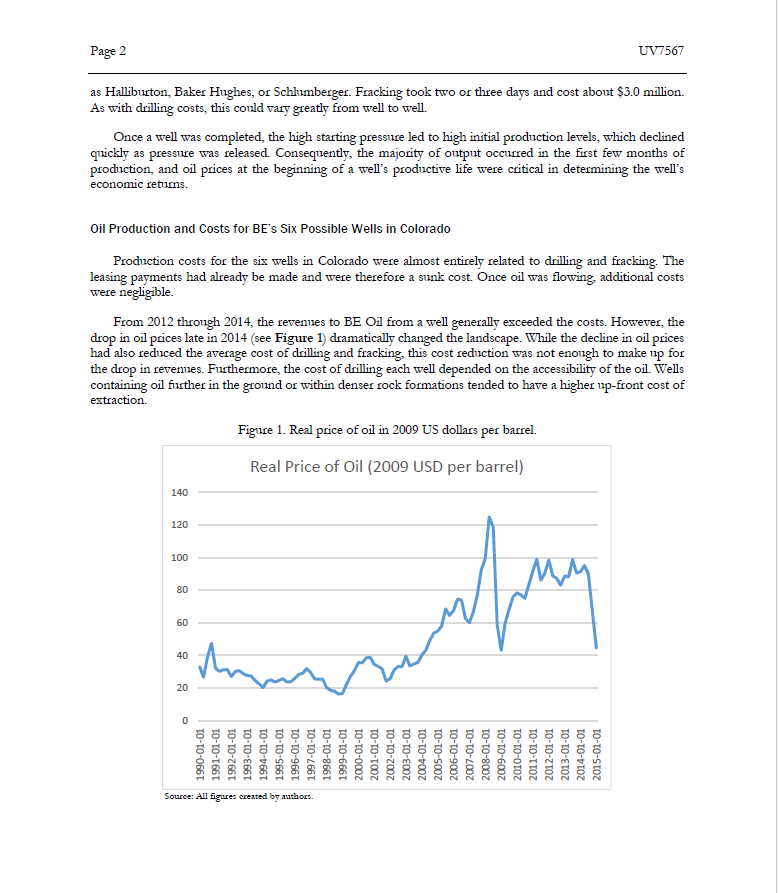

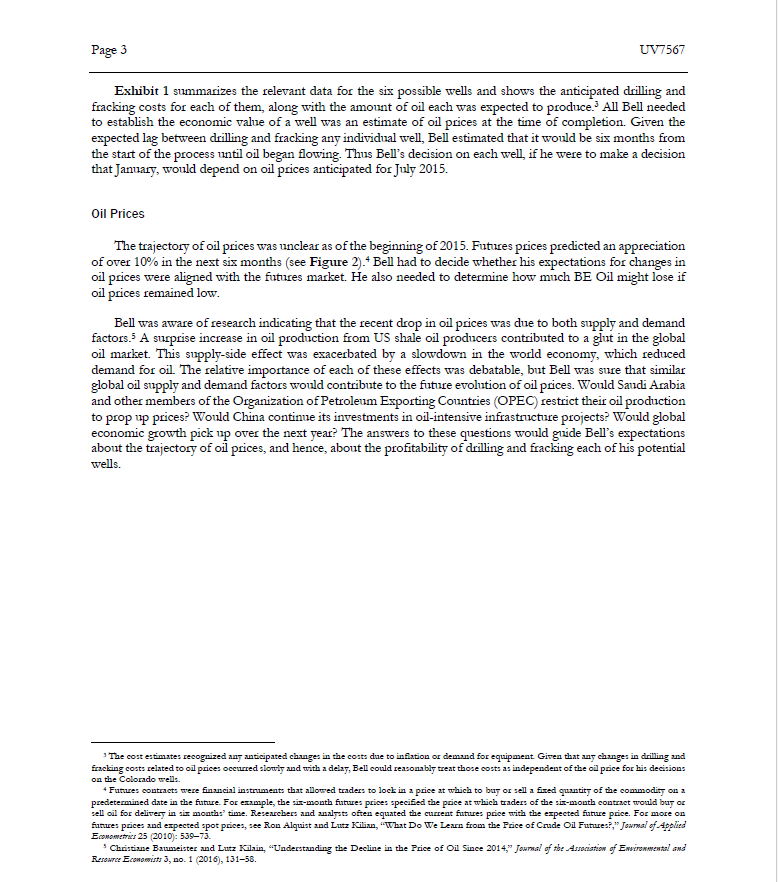

UNIVERSITY VIRGINIA DARDEN Business Publishing BE Oil UV7567 Rev. Dec. 6, 2018 One morning in late January 2015, Quentin Bell was facing some hard truths about the near-term prospects for his four-year-old oil company, BE Oil. The company had leased drilling rights on land in Colorado that would potentially generate six new shale oil wells. Just five months earlier, with oil prices near $100 per barrel, these wells appeared profitable. But in late 2014, oil prices plummeted to under $45 per barrel, dragging Bell's anticipated drilling profits down with them. In fact, on that cold January morning, Bell had to determine if any of the six wells he had planned to drill were even worth starting. The only bit of good news was a slight anticipated increase in oil prices over the next six months. He hoped this would presage a more dramatic rise over time-otherwise, the market forces that drove oil prices might very well drive him out of business! The Economics of Shale Oil Drilling In 2003, a technological breakthrough combined horizontal drilling with hydraulic fracturing ("fracking"), enabling development of natural gas shale. In 2009, the innovation extended into oil development and dramatically reshaped the US oil industry. Before 2009, shale oil production contributed minimally to the global oil supply, but the technological change resulted in an increase of US oil production from 5.4 million barrels per day in 2009 to 9.4 million barrels per day by the end of 2014. This increase represented over half of the overall increase in oil production globally. By early 2014, approximately 70 public oil and gas firms and more than 120 private firms were using fracking technology. In fact, by mid-2014, these companies were producing oil from over 200,000 oil wells across the five states that had shale oil fracking operations: Texas, Oklahoma, North Dakota, Colorado, and New Mexico. Shale oil could be found in geologic formations up to two miles below the earth's surface. To extract these reserves, firms first had to secure mineral rights from respective property owners. These oil leases allowed energy companies to drill and then frack shale formations to free oil from shale rock. Shale oil well drilling was somewhat unique relative to other types of oil extraction in that it required two distinct project steps. A company first drilled the well and then, at a later date, it fracked the well. To drill a well, the majority of firms in the industry rented a drilling rig from specialized service providers. It took between three days and three weeks to drill onshore wells. The average cost was about $3.5 million, but it varied greatly based on geology. Fracking typically occurred months after drilling and was usually performed by a specialized contractor, such This section draws heavily from Erik Gilje, Elena Loutskina, and Daniel Murphy, "Drilling and Debt (working paper, Darden School of Business, 2017). 2 In the parlance of the industry, to drill a well was to "spud" the well, and hydraulic fracturing was referred to as "completing" the well Spudding involved drilling the well into the shale and inserting steel well casings and cement. This fictional case was prepared by Daniel Murphy, Assistant Professor of Business Administration, and Mare L. Lipson, Robert F. Vandall Professor of Business Administration. It was written as a basis for class discussion rather than to illustrate effective or ineffective handling of an administrative situation. Copyright 2018 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved. To order copies, send an email to sales@dardenbusinesspublishing.com No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means-electronic, mechanical, photocopying, recording, or otherwise-without the permission of the Darden School Foundation. Our goal is to publish materials of the highest quality, so please submit any errata to editorial@dardenbusinesspublishing.com

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started