Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find out the RRSP deduction available and CCA that can be claimed Chelsea's personal vehicle is used to perform the work duties, and Chelsea

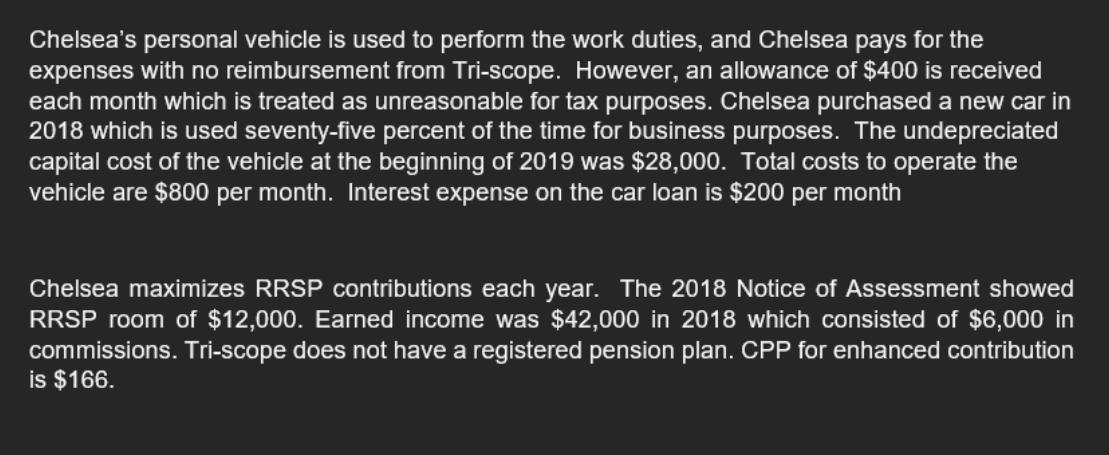

Find out the RRSP deduction available and CCA that can be claimed Chelsea's personal vehicle is used to perform the work duties, and Chelsea pays for the expenses with no reimbursement from Tri-scope. However, an allowance of $400 is received each month which is treated as unreasonable for tax purposes. Chelsea purchased a new car in 2018 which is used seventy-five percent of the time for business purposes. The undepreciated capital cost of the vehicle at the beginning of 2019 was $28,000. Total costs to operate the vehicle are $800 per month. Interest expense on the car loan is $200 per month Chelsea maximizes RRSP contributions each year. The 2018 Notice of Assessment showed RRSP room of $12,000. Earned income was $42,000 in 2018 which consisted of $6,000 in commissions. Tri-scope does not have a registered pension plan. CPP for enhanced contribution is $166.

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To address Chelseas tax situation lets break down the key components Personal Vehicle Expenses Chelseas personal vehicle is used for work duties and s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started