Answered step by step

Verified Expert Solution

Question

1 Approved Answer

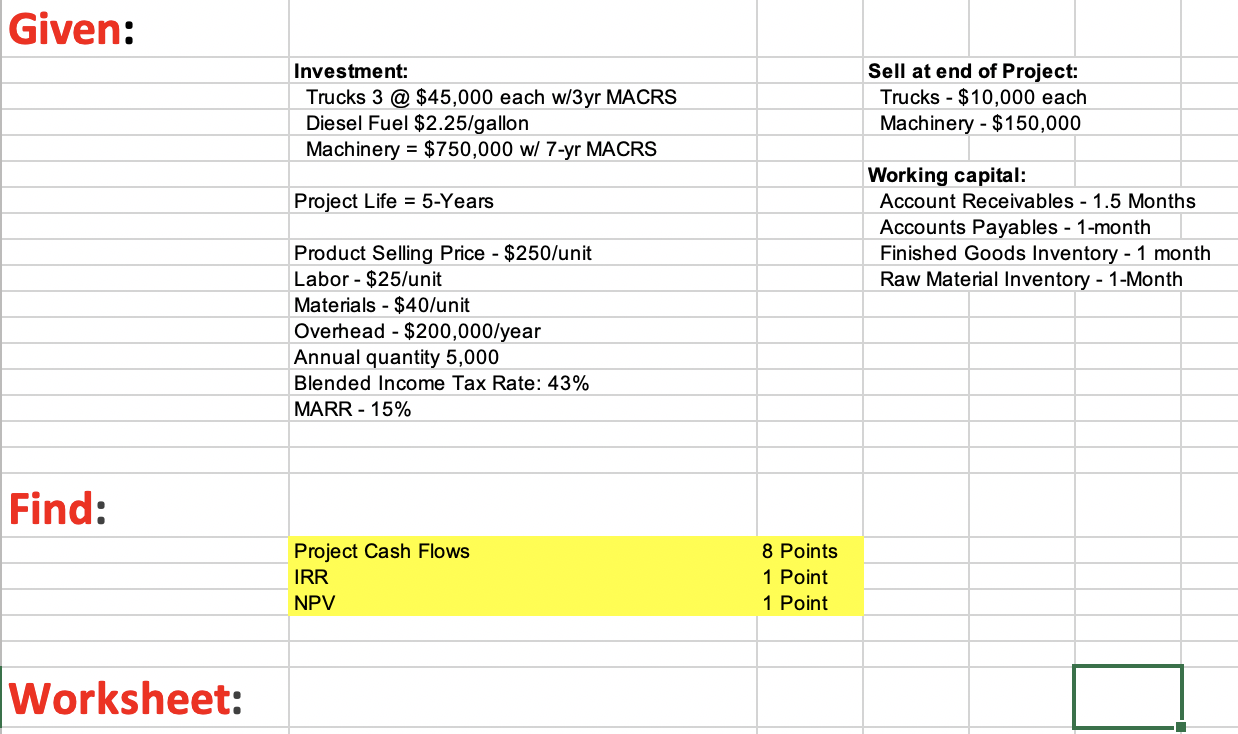

Find Project Cash Flows, IRR, NPV Given: Investment: Trucks 3 @ $45,000 each w/3yr MACRS Diesel Fuel $2.25/gallon Machinery = $750,000 wl 7-yr MACRS Sell

Find Project Cash Flows, IRR, NPV

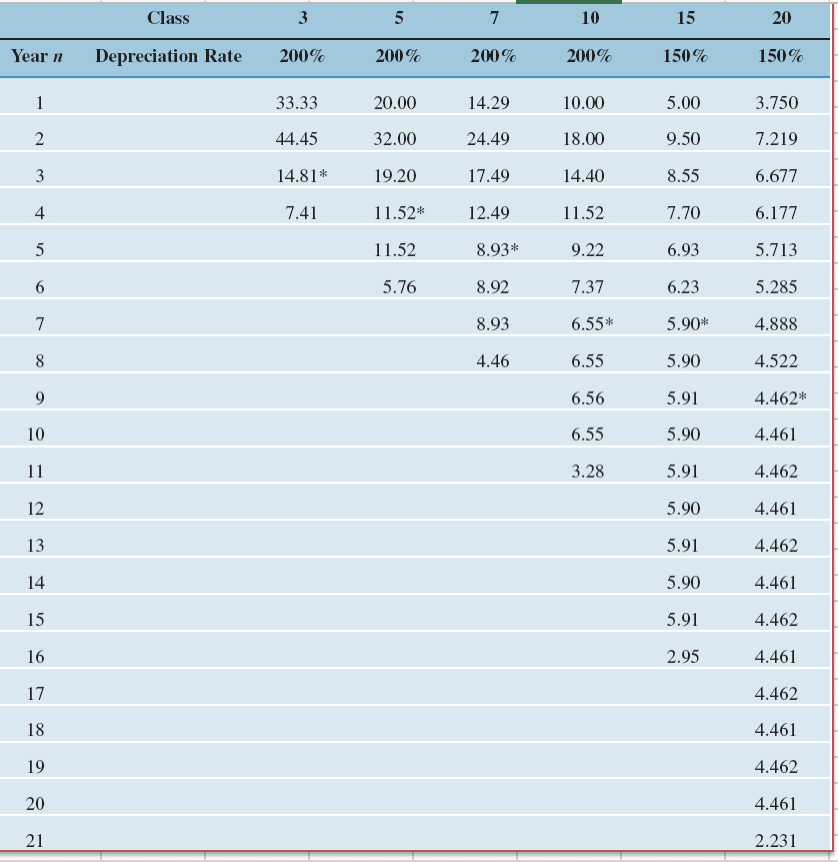

Given: Investment: Trucks 3 @ $45,000 each w/3yr MACRS Diesel Fuel $2.25/gallon Machinery = $750,000 wl 7-yr MACRS Sell at end of Project: Trucks - $10,000 each Machinery - $150,000 Project Life = 5-Years Working capital: Account Receivables - 1.5 Months Accounts Payables - 1-month Finished Goods Inventory - 1 month Raw Material Inventory - 1-Month Product Selling Price - $250/unit Labor - $25/unit Materials - $40/unit Overhead - $200,000/year Annual quantity 5,000 Blended Income Tax Rate: 43% MARR - 15% Find: Project Cash Flows IRR NPV 8 Points 1 Point 1 Point Worksheet: Class 3 5 7 10 15 20 Year n Depreciation Rate 200% 200% 200% 200% 150% 150% 33.33 20.00 14.29 10.00 32.0024.4918.00 5.00 9.50 3.750 7.219 44.45 14.81* 7.41 19.2017.4914.408.556.677 11.52* 12.4911.527.706.177 11.52 8.93* 9.22 6.93 5.713 5.76 8.92 7.37 6.23 5.285 8.936 .55* 5.90* 4.888 5.904.522 4.46 6.55 6.56 6.55 5,914 .462#* 5.904.461 10 3.28 5.914.462 11 12 13 5.90 4.461 5.91 5.90 14 4.461 15 5,91 4.462 16 2.95 4.461 17 4.462 18 4.461 19 4.462 20 4.461 21 2.231 Given: Investment: Trucks 3 @ $45,000 each w/3yr MACRS Diesel Fuel $2.25/gallon Machinery = $750,000 wl 7-yr MACRS Sell at end of Project: Trucks - $10,000 each Machinery - $150,000 Project Life = 5-Years Working capital: Account Receivables - 1.5 Months Accounts Payables - 1-month Finished Goods Inventory - 1 month Raw Material Inventory - 1-Month Product Selling Price - $250/unit Labor - $25/unit Materials - $40/unit Overhead - $200,000/year Annual quantity 5,000 Blended Income Tax Rate: 43% MARR - 15% Find: Project Cash Flows IRR NPV 8 Points 1 Point 1 Point Worksheet: Class 3 5 7 10 15 20 Year n Depreciation Rate 200% 200% 200% 200% 150% 150% 33.33 20.00 14.29 10.00 32.0024.4918.00 5.00 9.50 3.750 7.219 44.45 14.81* 7.41 19.2017.4914.408.556.677 11.52* 12.4911.527.706.177 11.52 8.93* 9.22 6.93 5.713 5.76 8.92 7.37 6.23 5.285 8.936 .55* 5.90* 4.888 5.904.522 4.46 6.55 6.56 6.55 5,914 .462#* 5.904.461 10 3.28 5.914.462 11 12 13 5.90 4.461 5.91 5.90 14 4.461 15 5,91 4.462 16 2.95 4.461 17 4.462 18 4.461 19 4.462 20 4.461 21 2.231Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started