Answered step by step

Verified Expert Solution

Question

1 Approved Answer

find similar cases or jurisprudence to this issue? please based to the photo below 28 February 2023 BUREAU OF INTERNAL REVENUE - REVENUE REGION NO.

find similar cases or jurisprudence to this issue?

please based to the photo below

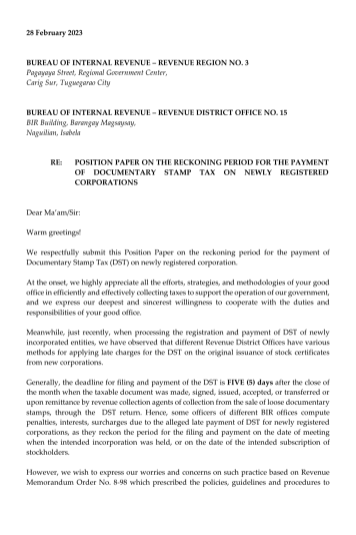

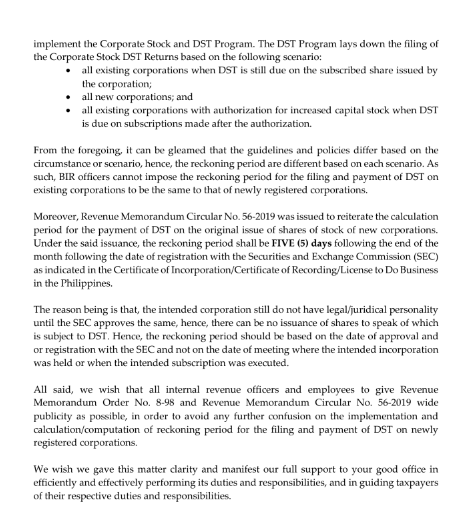

28 February 2023 BUREAU OF INTERNAL REVENUE - REVENUE REGION NO. 3 Pagayaya Street, Regional Government Center, Carig Sur, Tuguegarao City BUREAU OF INTERNAL REVENUE - REVENUE DISTRICT OFFICE NO. 15 BIR Building, Barangay Magsaysay, Naguilia, Isabela RE: POSITION PAPER ON THE RECKONING PERIOD FOR THE PAYMENT OF DOCUMENTARY STAMP TAX ON NEWLY REGISTERED CORPORATIONS Dear Ma'am/Sir: Warm greetings We respectfully submit this Position Paper on the reckoning period for the payment of Documentary Stamp Tax (DST) on newly registered corporation. At the onset, we highly appreciate all the efforts, strategies, and methodologies of your good office in efficiently and effectively collecting taxes to support the operation of our government, and we express our deepest and sincerest willingness to cooperate with the duties and responsibilities of your good office Meanwhile, just recently, when processing the registration and payment of DST of newly incorporated entities, we have observed that different Revenue District Offices have various methods for applying late charges for the DST on the original issuance of stock certificates from new corporations. Generally, the deadline for filing and payment of the DST is FIVE (5) days after the close of the month when the taxable document was made, signed, issued, accepted, or transferred or upon remittance by revenue collection agents of collection from the sale of loose documentary stamps, through the DST retum. Hence, some officers of different BIR offices compute penalties, interests, surcharges due to the alleged late payment of DST for newly registered corporations, as they reckon the period for the filing and payment on the date of meeting when the intended incorporation was held, or on the date of the intended subscription of stockholders However, we wish to express our worries and concerns on such practice based on Revenue Memorandum Order No. 8-98 which prescribed the policies, guidelines and procedures to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided in the position paper it appears that the key issue is the proper ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started